Export–Import Bank of the United States facts for kids

|

|

| Agency overview | |

|---|---|

| Formed | February 2, 1934 |

| Headquarters | Lafayette Building Washington, D.C. |

| Employees | 370 (2018) |

| Agency executive |

|

The Export–Import Bank of the United States (EXIM) is the official export credit agency (ECA) of the United States federal government. Operating as a wholly owned federal government corporation, the bank "assists in financing and facilitating U.S. exports of goods and services", particularly when private sector lenders are unable or unwilling to provide financing. Its current chairman and president, Reta Jo Lewis, was confirmed by the Senate on February 9, 2022.

The Export-Import Bank was established in 1934 as the Export-Import Bank of Washington by an executive order of President Franklin D. Roosevelt. Its stated goal was "to aid in financing and to facilitate exports and imports and the exchange of commodities between the United States and other Nations or the agencies or nationals thereof." The bank's first transaction was a $3.8 million loan to Cuba in 1935 for the purchase of U.S. silver ingots. In 1945, it was made an independent agency within the executive branch by Congress.

Under federal law, the EXIM must be reauthorized by Congress every four to five years. Following a brief lapse in Congressional authorization on July 1, 2015, which prevented the bank from engaging in new business, it was reauthorized through September 2019 via the Fixing America's Surface Transportation Act of December 2015. In December 2019, President Donald Trump signed the Export-Import Bank Extension into law as part of the Further Consolidated Appropriations Act, 2020, which authorized the bank until December 31, 2026.

Over its lifetime, the Export-Import Bank has helped finance several historic projects including the Pan-American Highway, the Burma Road, and post-WWII reconstruction. While supporters argue that the bank allows small and medium-sized businesses to participate in the global market, critics allege that it shows favoritism to large corporations and special interests.

Contents

Overview

The Export–Import Bank of the United States (EXIM) is a government agency that provides a variety of tools intended to aid the export of American goods and services. The mission of the Bank is to create and sustain U.S. jobs by financing sales of U.S. exports to international buyers. EXIM equips U.S. exporters and their customers with tools such as buyer financing, export credit insurance, and access to working capital. Second, when U.S. exporters face foreign competition backed by other governments, EXIM provides buyer financing to match or counter the financing offered by almost 96 ECAs around the world. The Bank is chartered as a government corporation by the Congress of the United States; it was last chartered for a three-year term in 2012. The Charter details the Bank's authorities and limitations. Among them is the principle that EXIM does not compete with private sector lenders, but rather provides financing for transactions that would otherwise not occur because commercial lenders are either unable or unwilling to accept the political or commercial risk inherent in the deal.

The EXIM's products are intended to assist export sales for any American export company regardless of size. The bank's charter provides that EXIM makes available "not less than 20%" of its lending authority to small businesses although they have often fallen short of the 20% threshold. In fiscal year 2013 however, 76% of the value of loans and guarantees went to the top 10 recipients.

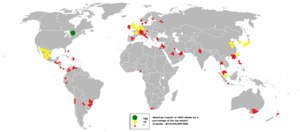

Similar banks, known generally as export credit agencies (ECAs), are operated by 60 foreign countries. As the United States is a member of the Organisation for Economic Co-operation and Development (OECD) they conduct their activities by obeying OECD rules and principles. The goal is to permit exporters in various countries to compete on the basis of the quality of their goods and services, not on preferential financing terms. ECAs of countries which are not participants of the OECD, such as the China Exim Bank are not required by their governments to follow OECD rules.

Personnel

| List of EXIM chairmen and presidents |

|---|

|

| List of EXIM directors |

|---|

|

History

Early history (1934–1944)

EXIM was organized originally as a District of Columbia banking corporation by Executive Order 6581 from Franklin D. Roosevelt on February 2, 1934, under the name Export–Import Bank of Washington. The stated goal was "to aid in financing and to facilitate exports and imports and the exchange of commodities between the United States and other Nations or the agencies or nationals thereof", with the immediate goal of making loans to the USSR and Latin America. Roosevelt created a Second Export–Import Bank of Washington with Executive Order 6638 on March 9, 1934, with the specific goal of aiding trade with Cuba. The Bank's first transaction was a $3.8 million loan to Cuba in 1935 for the purchase of U.S. silver ingots. The First and Second Export–Import Banks were combined in 1936 when Congress transferred the obligations of the Second Export–Import Bank to the first.

Independent agency (1945–present)

Congress made the bank an independent agency on July 31, 1945, with the Export–Import Bank Act of 1945. On March 13, 1968, further legislation changed the name to "Export–Import Bank of the United States". EXIM became a self-sustaining (self-funding) agency in 2007, though the loans remain backed by the government.

The Government Corporation Control Act of 1945 requires the Bank to be reauthorized by Congress every four to five years. Reauthorizations have been approved several times:

| Bill name | Date signed into law | Bank authorized until |

|---|---|---|

| S. 3938 | December 20, 2006 | May 30, 2012 |

| H.R. 2072 | May 30, 2012 | September 30, 2014 |

| H.J.Res. 124 | September 19, 2014 | June 30, 2015 |

| H.R. 22 | December 4, 2015 | September 30, 2019 |

| H.R. 1865 | December 20, 2019 | December 31, 2026 |

It was last chartered for a three-year term in 2012 and in September 2014 was extended through June 30, 2015. Congressional authorization for the bank lapsed as of July 1, 2015. As a result, the bank could not engage in new business, but it continued to manage its existing loan portfolio. Five months later, after the successful employment of the rarely used discharge petition procedure in the House of Representatives, Congress reauthorized the bank until September 2019 via the Fixing America's Surface Transportation Act signed into law on December 4, 2015, by President Barack Obama. In December 2019, President Donald Trump signed the Export-Import Bank Extension into law as part of the Further Consolidated Appropriations Act, 2020 (P.L. 116–94) which authorized the bank until December 31, 2026.

Projects assisted

Pan-American Highway

The Pan-American Highway runs from Alaska to Chile through 14 countries with important transportation links to nearly all of continental Latin America. The highway was constructed beginning in 1936 with the last phase complete in 1980.

EXIM Bank credits and loans supported construction of the Pan-American Highway in Mexico, Honduras, Guatemala, Nicaragua, El Salvador, Costa Rica, Panama, Colombia, Ecuador, Peru and Chile. In Paraguay, Argentina, and Bolivia EXIM supported construction of highway spurs connected to the Pan-American Highway. EXIM approved twenty credits to U.S. companies including Caterpillar, Koehring Co., Allis-Chalmers Manufacturing, The Galion Iron Works, and Thew Shovel to help build the highway.

Burma Road

Constructed between 1937 and 1938, the 717-mile Burma Road links Lashio in present-day Myanmar (previously Burma) to Kunming in Yunnan Province, China.

The $25 million credit approved by EXIM in December 1938 was crucial in ensuring that the supply route remained open by providing the transportation vehicles and support material to operate the new road and by providing China with purchasing power during WWII. An additional $20 million to the Universal Trading Corporation was approved in 1940. A 1939 journal article in Foreign Affairs noted that China used part of the $25 million to purchase 2,000 three-ton trucks from Ford, Chrysler, and General Motors.

Post-WWII reconstruction and the Marshall Plan

EXIM played a critical role during the years between the end of Lend-Lease (September 1945) and the beginning of the Marshall Plan and the World Bank's first authorizations (May 1947 – 1948). At the end of WWII, it was recognized that the U.S. did not have a credit facility capable of handling the demand that would result from the cessation of hostilities. One of the major rationales behind the Export–Import Bank Act of 1945, the basis of EXIM's current charter document, was the necessity to dramatically increase EXIM's lending capacity to adequately respond to Europe's post-war reconstruction needs. The 1945 EXIM Annual Report predicated EXIM's role in the immediate post-WWII period: "the Export–Import Bank was to be the principal source of long-term dollar loans for an extended period of time." This assertion was based on the lack of interest by private capital in lending to foreign government buyers and delays in ratification of the Articles of Agreement for the International Monetary Fund and the International Bank for Reconstruction and Development. The Export–Import Bank Act of 1945 increased lending authority from $750 million to $3.5 billion, almost a fourfold increase to help address these shortfalls.

In 1945 and 1946 credit was offered to France, Denmark, Norway, Belgium, the Netherlands, Turkey, Czechoslovakia, Finland, Italy, Ethiopia, Greece, Poland and Austria to purchase equipment, facilities, and services from the United States. The financing was designed to aid reconstruction of the nations and to repair their import and export capability through the purchase of new machinery, currency exchange, and improvements and repairs to infrastructure and transportation systems.

When the Marshall Plan was initiated in 1948, EXIM concentrated its lending on non-Economic Recovery Act nations in North and South America.

First credits to post-Soviet nations

When the Berlin Wall fell in 1989 and the USSR was dissolved in 1991, U.S. companies were able to conduct business freely with Eastern Europe for the first time since the end of WWII. EXIM was one of the first financial institutions to provide financing for exports to the former Soviet Union, Poland, Czechoslovakia and the newly independent nations that emerged after 1991. In 1990, President George H.W. Bush waived the Jackson–Vanik amendment, which had officially blocked normal trade relations with communist countries since 1975. This waiver permitted all E guarantee and insurance programs to U.S. companies wanting to do business with the USSR and several former communist countries.

EXIM resumed business with Czechoslovakia in March 1990. On January 25, 1991, EXIM approved the first transaction to Czechoslovakia since 1947. Financed by First Interstate Bank of Los Angeles, CA, the guarantee allowed Tonak Hat Company to purchase computers from a U.S. company, Digital Equipment Corporation of Massachusetts. Since 1991, EXIM has supported exports to 25 of the nations that emerged after the fall of the Iron Curtain.

First credit to India

After a visit to India in January 2015, President Obama announced that the EXIM will finance $1 billion of exports of 'Made-in-America' products, the U.S. Overseas Private Investment Corporation will lend $1 billion to small- and medium-sized rural enterprises and the U.S. Trade and Development Agency will commit $2 billion for renewable energy. Obama and Modi agreed on issues that had previously stopped U.S. companies from establishing nuclear reactors in India.

Support

Supporters say that the bank emphasizes trying to help small and medium size businesses expand their exporting capabilities. CEO and president of the National Association of Manufacturers Jay Timmons stated: "The EXIM plays a critical role in manufacturer's ability to export to new markets and keep up with growing global competition. The Bank assists nearly 290,000 export related jobs and each year is helping more and more small and medium-sized manufacturers grow their businesses and hire new workers. More than 85% of all EXIM transactions directly benefit small business exporters—the economic engine that powers our economy and job creation."

When Obama was campaigning for president in 2008, he stated that the Export–Import Bank had "become little more than a fund for corporate welfare." During the Bank's reauthorization struggle, May 2012, he said that the Export–Import Bank plays a very important role in reaching his goal of doubling exports over 5 years. At the reauthorization ceremony Obama stated: "We're helping thousands of businesses sell more of their products and services overseas, in the process, we're helping them create jobs here at home. And we're doing it at no extra cost to the taxpayer."

See also

In Spanish: Eximbank para niños

In Spanish: Eximbank para niños

- CoBank

- List of export credit agencies

- Independent agencies of the United States government

- List of federal agencies in the United States

- Title 12 of the Code of Federal Regulations