Export–Import Bank of the United States facts for kids

|

|

| Agency overview | |

|---|---|

| Formed | February 2, 1934 |

| Headquarters | Lafayette Building Washington, D.C. |

| Employees | 370 (2018) |

| Agency executive |

|

The Export–Import Bank of the United States (EXIM) is a special bank run by the United States federal government. It helps American businesses sell their products and services to other countries. EXIM is like a government-owned company. It helps pay for and make it easier for U.S. companies to export goods and services. This is especially helpful when regular banks cannot or will not provide the money needed. James C. Cruse became the acting president and chairman on February 28, 2025.

The Export–Import Bank started in 1934. It was created by President Franklin D. Roosevelt through a special order called an executive order. Its main goal was to help finance and make trade easier between the United States and other countries. The bank's first deal was a $3.8 million loan to Cuba in 1935. This loan helped Cuba buy U.S. silver. In 1945, the United States Congress made EXIM an independent agency. This means it works separately within the U.S. government.

Under U.S. law, Congress must approve EXIM's work every four to five years. In 2015, Congress approved the bank again through September 2019. Then, in December 2019, President Donald Trump signed a law that allowed the bank to continue until December 31, 2026.

Over the years, EXIM has helped pay for many important projects. These include parts of the Pan-American Highway and the Burma Road. It also helped countries rebuild after World War II. People who support EXIM say it helps small and medium-sized businesses sell their products around the world. However, some critics say it mostly helps large companies.

Contents

What EXIM Does

The Export–Import Bank of the United States (EXIM) is a government agency. It offers different ways to help American companies export their goods and services. EXIM's main goal is to create and keep jobs in the U.S. It does this by helping American companies sell their products to buyers in other countries.

EXIM gives U.S. exporters and their customers tools to help with sales. These tools include financing for buyers, insurance for export credit, and access to money for daily operations. Also, when U.S. exporters compete with foreign companies that get help from their own governments, EXIM can offer similar financing. This helps American companies compete fairly.

The U.S. Congress created EXIM as a government company. Its rules say that EXIM should not compete with private banks. Instead, it helps with deals that private banks cannot or will not support. This is often because the deals involve too much political or business risk.

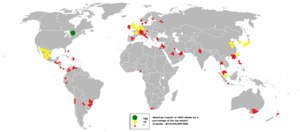

EXIM's services are meant to help any American export company, no matter its size. The bank's rules state that at least 20% of its lending should go to small businesses. While they have sometimes missed this goal, EXIM aims to support smaller companies. Many other countries, about 60 of them, have similar banks called export credit agencies (ECAs). The U.S. is part of a group called the Organisation for Economic Co-operation and Development (OECD). This means EXIM follows OECD rules. These rules help make sure that companies from different countries compete based on their product quality, not just on special financing deals.

Who Leads EXIM

The Export–Import Bank is led by a Board of Directors. This board includes the President of the bank, who is also the Chairman. There is also a First Vice President, who is the Vice Chairman. Three other directors are chosen by the President of the United States and approved by the Senate.

No more than three of these five board members can be from the same political party. Also, at least one member must have experience with small businesses. Board members serve for four years. They can stay on the board for up to six months after their term ends, until a new person takes their place. The United States Trade Representative and the Secretary of Commerce also serve on the board, but they do not vote.

Current Board Members

Here are the current board members as of February 24, 2025:

| Name | Position | Party | Took office | Term expiration |

|---|---|---|---|---|

| James C. Cruse | Interim President and Chair | N/A | February 28, 2025 | — |

| James G. Burrows, Jr. | Vice President and Vice Chair | N/A | February 28, 2025 | — |

| Spencer Bachus | Member | Republican | May 8, 2019 | January 20, 2027 |

| Vacant | Member | — | — | January 20, 2027 |

| Vacant | Member | — | — | January 20, 2029 |

| Howard Lutnick | Secretary of Commerce ex officio (non-voting) |

Republican | February 21, 2025 | — |

| Jamieson Greer | U.S. Trade Representative ex officio (non-voting) |

Republican | February 26, 2025 | — |

| Past EXIM Chairmen and Presidents |

|---|

|

| Past EXIM Directors |

|---|

|

EXIM's History

Early Years (1934–1944)

EXIM first started as a banking company in Washington, D.C. on February 2, 1934. President Franklin D. Roosevelt created it with a special order. It was first called the Export–Import Bank of Washington. Its goal was to help finance and make trade easier between the U.S. and other countries. At first, it focused on loans to the USSR and Latin America.

Roosevelt created a second Export–Import Bank in March 1934. This one was specifically to help trade with Cuba. The bank's first deal was a $3.8 million loan to Cuba in 1935. This helped Cuba buy U.S. silver ingots. In 1936, the two banks were combined into one.

Becoming Independent (1945–Present)

On July 31, 1945, Congress made the bank an independent agency. This meant it could operate more freely. On March 13, 1968, its name was changed to "Export–Import Bank of the United States." Since 2007, EXIM has been able to fund itself. However, its loans are still backed by the U.S. government.

A law from 1945 says that Congress must approve the bank's operations every four to five years. This approval process is called reauthorization. Here are some times the bank was reauthorized:

| Bill name | Date signed into law | Bank authorized until |

|---|---|---|

| S. 3938 | December 20, 2006 | May 30, 2012 |

| H.R. 2072 | May 30, 2012 | September 30, 2014 |

| H.J.Res. 124 | September 19, 2014 | June 30, 2015 |

| H.R. 22 | December 4, 2015 | September 30, 2019 |

| H.R. 1865 | December 20, 2019 | December 31, 2026 |

The bank's authorization ended on July 1, 2015. This meant it could not make new deals. But it continued to manage its existing loans. Five months later, Congress approved the bank again. This happened on December 4, 2015, when President Barack Obama signed a new law. This law allowed the bank to operate until September 2019. In December 2019, President Donald Trump signed another law. This law authorized the bank until December 31, 2026.

EXIM also started the China and Transformational Exports program. This program helps American companies compete with Chinese businesses. It also aims to keep America strong in certain important industries.

Projects EXIM Has Helped With

Pan-American Highway

The Pan-American Highway is a very long road system. It stretches from Alaska all the way to Chile. It passes through 14 countries and connects to almost all of Latin America. Construction on the highway began in 1936 and finished in 1980.

EXIM Bank helped pay for parts of the Pan-American Highway. This included sections in Mexico, Honduras, Guatemala, Nicaragua, El Salvador, Costa Rica, Panama, Colombia, Ecuador, Peru, and Chile. EXIM also supported building connecting roads in Paraguay, Argentina, and Bolivia. EXIM approved loans to U.S. companies like Caterpillar and General Motors. These loans helped buy equipment to build the highway.

Burma Road

The Burma Road is a 717-mile road built between 1937 and 1938. It connects Lashio in Myanmar (formerly Burma) to Kunming in China.

In December 1938, EXIM approved a $25 million loan. This money was very important for keeping the supply route open. It helped China buy trucks and other supplies to use the new road during World War II. Another $20 million was approved in 1940. A 1939 article noted that China used some of the money to buy 2,000 trucks from U.S. companies like Ford and Chrysler.

Rebuilding After World War II

EXIM played a key role after World War II. It helped countries rebuild when other aid programs had ended or not yet started. After the war, it was clear that the U.S. needed a way to help with the huge demand for money. The Export–Import Bank Act of 1945 greatly increased EXIM's ability to lend money. This was to help Europe rebuild after the war.

In 1945 and 1946, EXIM offered loans to many European countries. These included France, Denmark, Norway, and Italy. The money helped them buy equipment and services from the United States. The goal was to help these nations rebuild and restart their trade. This included buying new machines and fixing transportation systems.

When the Marshall Plan started in 1948, EXIM focused its loans on countries in North and South America. These were countries not covered by the Marshall Plan.

Helping Post-Soviet Nations

When the Berlin Wall fell in 1989 and the Soviet Union broke apart in 1991, U.S. companies could trade with Eastern Europe again. EXIM was one of the first banks to help finance exports to the former Soviet Union and other new countries. In 1990, President George H.W. Bush removed a trade barrier. This allowed EXIM to offer its programs to U.S. companies wanting to do business there.

EXIM started working with Czechoslovakia again in March 1990. In January 1991, EXIM approved its first deal with Czechoslovakia since 1947. This deal helped a hat company buy computers from a U.S. company. Since 1991, EXIM has supported exports to 25 of the countries that formed after the fall of the Iron Curtain.

First Loan to India

In January 2015, President Obama visited India. He announced that EXIM would finance $1 billion in "Made-in-America" products for India. This helped U.S. companies sell their goods there.

Why EXIM is Supported

Supporters say that EXIM helps small and medium-sized businesses grow their ability to export. Jay Timmons, who leads the National Association of Manufacturers, said that EXIM is very important. He stated that it helps manufacturers export to new markets and compete globally. He also mentioned that EXIM helps almost 290,000 jobs related to exports. He added that over 85% of EXIM's deals directly help small businesses.

When Barack Obama was running for president in 2008, he said EXIM had become "little more than a fund for corporate welfare." However, when the bank was being reauthorized in May 2012, he said it was very important. He stated that it helped him reach his goal of doubling U.S. exports. At the reauthorization ceremony, Obama said: "We're helping thousands of businesses sell more of their products and services overseas. In the process, we're helping them create jobs here at home. And we're doing it at no extra cost to the taxpayer."

See also

In Spanish: Eximbank para niños

In Spanish: Eximbank para niños

- CoBank

- List of export credit agencies

- Independent agencies of the United States government

- List of federal agencies in the United States

- Title 12 of the Code of Federal Regulations