National Australia Bank facts for kids

|

|

National Australia Bank headquarters in Melbourne

|

|

| Public | |

| Traded as |

|

| Industry | Banking, financial services |

| Founded | 1 October 1981 (as National Commercial Banking Corporation of Australia Limited) |

| Headquarters | 395 Bourke Street Melbourne, Australia |

|

Area served

|

Australia |

|

Key people

|

|

| Products | Business banking Consumer banking Wholesale banking Wealth management Insurance |

| Revenue | |

| Total assets | |

|

Number of employees

|

38,128 (2023) |

| Divisions |

|

| Subsidiaries | Bank of New Zealand |

National Australia Bank (abbreviated NAB, branded nab) is one of the four largest financial institutions in Australia (colloquially referred to as "The Big Four") in terms of market capitalisation, earnings and customers. NAB was ranked the world's 21st-largest bank measured by market capitalisation and 52nd-largest bank in the world as measured by total assets in 2019.

As of January 2019[update], NAB operated 3,500 Bank@Post locations—including 7,000+ ATMs across Australia, New Zealand, and Asia—and served 9 million customers.

NAB has an "AA−" long-term issuer rating by Standard & Poor's.

Contents

History

1982–1999

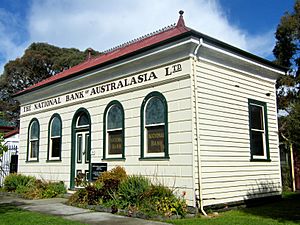

National Australia Bank was formed as National Commercial Banking Corporation of Australia Limited in 1982 by the merger of National Bank of Australasia and the Commercial Banking Company of Sydney. The resulting company was subsequently renamed National Australia Bank Limited.

The expanded financial base of the merged entity triggered significant offshore expansion over ensuing years. Representative offices were established in Beijing (1982), Chicago (1982), Dallas (1983), Seoul (1983, upgraded to a branch in 1990), San Francisco (1984), Kuala Lumpur (1984), Athens (1984, closed 1989), Frankfurt (1985, closed 1992), Atlanta (1986), Bangkok (1986), Taipei (1986 upgraded to branch 1990), Shanghai (1988, closed 1990), Houston (1989) and New Delhi (1989).

In 1987, NAB bought Clydesdale Bank (Scotland) and Northern Bank (Northern Ireland and Republic of Ireland) from Midland Bank. It rebranded Northern Bank branches in the Republic of Ireland to National Irish Bank and changed both banks' logos from that of the Midland Bank. In 1990, NAB bought Yorkshire Bank (England and Wales).

In 1992, NAB purchased the Bank of New Zealand, which became a subsidiary of the Australian bank, but retained local governance, with a New Zealand board of directors. At some point, a business entity known as Bank of New Zealand in Australia (BNZA) was absorbed by NAB.

Further acquisitions followed – which at the time had about a 26% market share in the market, and Michigan National Bank (MNB) in 1995. NAB had earlier rationalised its operations in the US and closed its offices in Atlanta, Chicago, Dallas, Houston, and San Francisco in 1991.

This period of rapid expansion through acquisition concluded with the purchases in 1997 of HomeSide Lending, a leading US mortgage originator and servicer based in Florida, and most significantly, the acquisition in 2000 of MLC Limited (and related entities) for $4.56bn, one of the biggest mergers in Australian corporate history.

2000s

NAB encountered a difficult period in the period 2000–2005. In 2000, NAB sold Michigan National Bank to ABN AMRO , then in 2001 sold HomeSide's operating assets for US$1.9b to Washington Mutual, the largest US savings and loan company, as well as the mortgage unit's loan-servicing technology and operating platform.

The foreign currency trader fraud was the catalyst for the resignations of CEO Frank Cicutto and Chairman Charles Allen. The resignations were preceded by a Board revolt where Catherine Walters emerged as a whistle blower citing serious culture issues at the company having led to the string of failures.

Frank Cicutto was CEO of NAB from 1999 to 2004. The Australian economic environment during his leadership was stable and productive after 17 consecutive years of economic growth since 1992, averaging 3.3 per cent per annum.

In February 2004, John Stewart was appointed CEO of NAB following the sacking of Cicutto. Stewart proceeded with a far reaching re-organisation of the company along regional lines leading to the appointment of Ahmed Fahour as the CEO of Australia in September 2004. On 20 February 2009 Fahour stepped down from the principal board and group executive committee.

In 2005, NAB announced a cut of 2,000 Australian jobs as part of a global cost-cutting program with the intention of cutting around 4,200 positions – about 10.5% of its total workforce globally.

It began to outsource back office positions offshore, beginning with a pilot with 23 jobs from the accounts payable department in Melbourne going to Bangalore, India in an agreement with Accenture. Later that year, it sold Northern Bank and National Irish Bank to the Danish Danske Bank. Over 200 additional jobs had been sent offshore by 2006.

As part of the culture change program, a new Australian head office was purpose built at Docklands in Melbourne. This building is characterised by its open plan layout and was officially opened in October 2004. After Cameron Clyne became CEO in 2009, the Docklands building became the global headquarters replacing 500 Bourke Street.

By 2006, NAB had turned its fortunes around, reporting an industry record $4.3 billion profit and winning two local Bank of the Year awards. It also had a major reform which included the refurbishment of all of its branches, and the replacement of signage in and around National branches and buildings, being changed from 'National' to 'nab'.

In May 2007, NAB announced that it would delist from the New York Stock Exchange, and this took place in August 2007. NAB delisted from the London and Tokyo exchanges in 2006.

In March 2008, NAB announced that it would send maintenance and support for some core banking applications to India through an offshoring arrangement with Infosys and Satyam, affecting another 260 employees.

On 25 July 2008, NAB's announcement of an additional A$830 million provision associated with deterioration in US real estate markets triggered the biggest single-day fall in its share price in 21 years, wiping over A$7 billion from the stock's value.

In October 2008, NAB launched a branchless direct bank trading separately as UBank under the leadership of Greg Sutherland and Gerd Schenkel.

In January 2009, Cameron Clyne became CEO, and began a strategy of reputation change, wealth management and a focus on domestic markets.

As part of this strategy, NAB's underweight retail bank – under the leadership of Lisa Gray – attempted to increase market share by competing on price and cutting fees. Initially denting earnings in the division, the strategy produced mixed results over the medium term, with cash earnings, market share and customer satisfaction rising, but operating margin and cost to income ratio worsening since it began in 2009. In line with the strategy, NAB attempted to differentiate itself from the other "Big 4" Australian banks in a large, national public relations campaign centred around a theme of "breaking up" with the other banks on Valentine's Day 2011. The campaign received both a positive and negative reception. It also attracted swift competitive responses from other major banks. The campaign won an advertising award at Cannes.

In 2009, NAB acquired the mortgage business of Challenger Financial Services for $385 million, in order to boost its market share in the broker channel. The purchase also included the PLAN, Choice, and FAST mortgage aggregation businesses and approximately 17.5% in Homeloans Ltd. In June that year it paid A$825m ($660m:£401m) for UK insurer Aviva's Australian wealth management businesses, including their Navigator platform. NAB beat off competition from AMP for Navigator. news In July 2009 NAB acquired an 80% stake in the private wealth management division of Goldman Sachs JBWere, for A$99m.

In December 2009 NAB began a nine month attempt to purchase Axa Asia Pacific. This attempt was blocked twice by the Australian Competition & Consumer Commission. The first time, in April 2010, was because the regulator believed that the merger would cause a substantial lessening of competition in the retail investment platform market. NAB subsequently lodged a revised bid which aimed to address these concerns but was rejected a second time in September of that year. The Axa deal's drawn out process drew criticism for the bank's underperformance.

2010s

NAB's poor 2012 financial results called its strategy into question: net profit dropped by 22% compared to the previous year. In 2014, the NAB Melbourne Government announced that Cameron Clyne would be succeeded as CEO by Andrew Thorburn, NAB's New Zealand head. In August 2014, Lisa Gray left NAB as part of a broader set of executive changes.

As part of a strategy to focus NAB on its domestic markets, the bank listed its US subsidiary, Great Western Bank, on the New York Stock Exchange in October 2014 as part of an initial public offering. NAB sold its final 28.5% holding in Great Western in July 2015.

In May 2015, NAB also confirmed it would demerge its Clydesdale and Yorkshire Bank business in the UK, through an initial public offering. The business was partially floated on the London Stock Exchange and Australian Securities Exchange under a new holding company, The CYBG plc, in February 2016, with the remaining shares distributed to NAB's shareholders.

In July 2019, Ross McEwan was appointed group chief executive officer and managing director, after resigning from the Royal Bank of Scotland in April of that year.

2020s

In January 2021, NAB announced plans to acquire the neobank 86 400 for $220 million and subsequently merge it with UBank.

In May 2021, NAB completed its sale of its advice, platforms, superannuation and investments and asset management businesses to IOOF Holdings. As part of the MLC Wealth Transaction, NAB retained the companies that operated the advice businesses.

In September 2021, NAB temporarily rebranded their logo to JAB to promote vaccines for COVID-19.

In the first half of 2022, NAB relocated its global headquarters from 800 Bourke Street Docklands to a new natural light and greenery purpose built 39 storey building at 395 Bourke Street. The move also replaced National Bank House at 500 Bourke Street. The bank currently has 2 main buildings for employees at 700 Bourke Street Docklands and the new 395 NAB Place.

On 1 June 2022, National Australia Bank Limited (NAB) acquired the consumer banking business from Citigroup Pty Ltd (Citi), an Australian branch of Citibank.

On 19 January 2023, NAB announced that it would create a stablecoin called the AUDN that would be pegged to the Australian Dollar, and that the digital asset would be on the Ethereum network. The objective is to streamline cross-border banking transactions, and will also be used for trading carbon credits. AUDN is expected to be live in mid-2023.

Corporate affairs

Chief Executives

The following individuals have been appointed to serve as chief executive:

| # | Name | Term start | Term end | Ref |

|---|---|---|---|---|

| 1 | Jack Booth | 1 January 1983 | 1985 | |

| Vic Martin | 1 January 1983 | 1983 | ||

| 2 | Nobby Clark | 1985 | 1990 | |

| 3 | Don Argus AO | 1991 | 1999 | |

| 4 | Frank Cicutto | 1999 | September 2004 | |

| 5 | John Stewart | September 2004 | 31 December 2008 | |

| 6 | Cameron Clyne | 1 January 2009 | August 2014 | |

| 7 | Andrew Thorburn | August 2014 | February 2019 | |

| 8 | Ross McEwan | December 2019 | April 2024 | |

| 9 | Andrew Irvine | April 2024 | incumbent |

Chairs

The following individuals have been appointed to serve as chairman of the board:

| # | Name | Term start | Term end | Ref |

|---|---|---|---|---|

| 1 | Sir Robert Law-Smith CBE AFC | 1 January 1983 | 1986 | |

| 2 | Sir Rupert Clarke | 1986 | January 1992 | |

| 3 | Bill Irvine OAM | January 1992 | September 1997 | |

| 4 | Mark Rayner | September 1997 | 2001 | |

| 5 | Charles Allen AO | 2001 | February 2004 | |

| 6 | Graham Kraehe AO | February 2004 | September 2005 | |

| 7 | Michael Chaney AO | September 2005 | December 2015 | |

| 8 | Ken Henry AC | December 2015 | July 2019 | |

| 9 | Phil Chronican | December 2019 | Incumbent |

Overview

The National Australia Bank Group is organised into eight divisions, spread across two geographic regions.

| Region | Division | Description |

|---|---|---|

| Australia | Business and Private Banking |

|

| Personal Banking |

|

|

| UBank & 86 400 |

|

|

| MLC & NAB Private Wealth |

|

|

| New Zealand | NZ Banking |

|

| Global | Corporate and Institutional Banking |

|

| Specialised Group Assets |

|

|

| Corporate Functions and Other |

|

Technology

NAB is a large user of the Siebel and Teradata CRM systems. While NAB has received recognition as an early adopter and leader in CRM (Customer Relationship Management) the system was reinvigorated in 2004–5 as part of the broader turnaround to support the new focus on cross-selling.

In 2006, NAB was named the winner of the IFS/Cap Gemini Financial Innovation awards for its CRM system, internally called "National Leads".

On 25 November 2010, NAB suffered a system malfunction resulting in the failure of accounts processing. As a result, around 60,000 banking transactions were lost, and had to be manually recovered. The malfunction was caused by a corruption of an irreplaceable system file. This issue has been dubbed by some commentators as one of the biggest failures in the history of the Australian banking system.

Under Cameron Clyne's leadership, NAB began to upgrade its core banking platform in a project dubbed "NextGen". The project involves the replacement of its legacy systems which are up to 40 years old with an Oracle-based solution. UBank was reported to be the first beneficiary of this project. In total, the project was expected to be completed in 2014 and cost $1 billion.

As of April 2014, NAB's "NextGen" program was said to suffer from "growing problems".

In July 2020, NAB signed an agreement with Microsoft to further develop its multi-cloud computing strategy including the migration of key applications to the cloud while accelerating development and innovation.

In September 2020, The National Australia Bank partnered with crowdsource security firm Bugcrowd to launch a bug bounty program, which offers a reward to security researchers who can find previously unknown vulnerabilities in the bank's system. Would be participants must have an "Elite Trust Score" on Bugcrowd.

Corporate responsibility

In 2008, NAB invested $33.5 million in corporate responsibility initiatives. Its target is to spend 1% of cash earnings before tax in this area. In 2009, NAB became the largest Fairtrade accredited workplace in Australia through purchasing Fairtrade tea, coffee and hot chocolate for their offices and retail branches. In March 2010 NAB stated it expected to save nearly $1 million in annual power costs from a $6.5 million tri-generation plant at its main data centre. NAB became one of Australia's largest carbon neutral companies in September 2010. NAB ranked equal first among financial service companies in the Global 500 companies in the 2010 Carbon Disclosure Leadership Index.

Sponsorship and scholarships

In 2013 NAB emerged as a sponsor of Australian rules football, both at grassroots and elite level. It supports Auskick, an initiative to improve young footballers, as well as the NAB Cup (an Australian Football League pre-season competition), the NAB AFL Rising Star award; and the AFL National Draft. Other significant sporting sponsorships included the Socceroos, the 2006 Commonwealth Games, and was the main shirt sponsor of the South Sydney Rabbitohs between 2008 and 2010.

Support is also given towards community group volunteers around Australia. In recent years, NAB has provided financial support and relief to drought affected farmers and helped in the clean-up of flood affected in Queensland and Victoria. NAB has also sponsored the Sheikh Fehmi El-Imam Scholarship, designed to help strengthen the links between NAB and the Muslim community and enables an undergraduate student to continue post-graduate studies in finance and economics.

The National Australia Bank is the AFL Women's current and inaugural naming rights partner.

See also

- Banking in Australia

- List of banks

- List of banks in Australia

- List of banks in Oceania