National Australia Bank facts for kids

|

|

Headquarters at 395 Bourke Street in Melbourne

|

|

| Public | |

| Traded as |

|

| Industry | Banking, financial services |

| Founded | October 1, 1981 (as National Commercial Banking Corporation of Australia Limited) |

| Headquarters | 395 Bourke Street Melbourne, Australia |

|

Area served

|

Australia |

|

Key people

|

|

| Products | Business banking Consumer banking Wholesale banking Wealth management Insurance |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

38,996 (2024) |

| Divisions |

|

| Subsidiaries | Bank of New Zealand |

National Australia Bank Limited (often called NAB) is one of the four biggest banks in Australia. These four banks are sometimes called "The Big Four." NAB is known for its large size, earnings, and many customers. In 2019, it was one of the world's largest banks based on its total value and assets.

As of January 2019, NAB had 3,500 Bank@Post locations and over 7,000 ATMs. These were spread across Australia, New Zealand, and Asia. NAB served about 9 million customers.

Contents

History of NAB

How NAB Started: 1982–1999

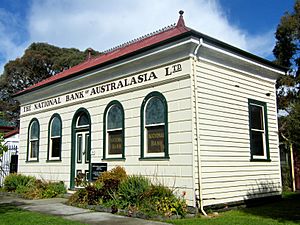

National Australia Bank was created in 1982. It was formed when two banks, the National Bank of Australasia and the Commercial Banking Company of Sydney, joined together. The new company was first called National Commercial Banking Corporation of Australia Limited, but soon changed its name to National Australia Bank Limited.

After this merger, NAB grew a lot and started expanding outside Australia. It opened offices in many cities around the world, including Beijing, Chicago, and Seoul.

In 1987, NAB bought two banks in the UK: Clydesdale Bank in Scotland and Northern Bank in Northern Ireland. It also bought Yorkshire Bank in England and Wales in 1990.

NAB continued to grow by buying other banks. In 1992, it bought the Bank of New Zealand. This bank became a part of NAB but kept its own local board of directors in New Zealand. NAB also bought Michigan National Bank in the US in 1995.

This period of fast growth ended with a big purchase in 1997. NAB bought HomeSide Lending, a US company that helped people get home loans. Then, in 2000, it bought MLC Limited, a large financial company in Australia. This was one of the biggest mergers in Australian history at the time.

Changes in the 2000s

The early 2000s were a challenging time for NAB. In 2000, NAB sold Michigan National Bank. In 2001, it sold HomeSide's main business parts.

In 2004, there was a problem with currency trading at NAB. This led to changes in the bank's leadership. John Stewart became the new CEO in February 2004. He started a big reorganization of the company.

In 2005, NAB announced it would reduce about 2,000 jobs in Australia. This was part of a plan to cut costs globally. The bank also started sending some of its back-office work to other countries, like India. Later that year, it sold Northern Bank and National Irish Bank.

NAB also moved its main Australian office to a new building in Melbourne in 2004. This building had an open design. By 2006, NAB's situation had improved. It reported a record profit and won awards. The bank also updated all its branches and changed its branding from 'National' to 'nab'.

In 2007, NAB decided to stop listing its shares on the New York Stock Exchange. It had already stopped listing on the London and Tokyo exchanges in 2006.

In 2008, NAB launched a new online-only bank called UBank. This bank had no physical branches. In January 2009, Cameron Clyne became the new CEO. He focused on improving NAB's reputation and growing its business in Australia.

NAB tried to attract more customers by offering lower prices and fewer fees. This strategy had mixed results. In 2011, NAB launched a big advertising campaign. It tried to show itself as different from the other "Big 4" banks.

NAB also made more purchases in 2009. It bought the mortgage business of Challenger Financial Services. It also bought Aviva's Australian wealth management businesses and a large part of Goldman Sachs JBWere's private wealth division.

In December 2009, NAB tried to buy Axa Asia Pacific. However, the Australian Competition & Consumer Commission blocked this attempt twice. They believed the merger would reduce competition in the investment market.

NAB in the 2010s

In 2012, NAB's financial results were not as good as expected. In 2014, Andrew Thorburn became the new CEO, replacing Cameron Clyne.

As part of a plan to focus on its main markets, NAB sold its US bank, Great Western Bank, in 2014 and 2015. In May 2015, NAB also decided to separate its Clydesdale Bank and Yorkshire Bank businesses in the UK. These banks became a new company called The CYBG plc in February 2016.

In July 2019, Ross McEwan was appointed as the new group chief executive officer.

NAB in the 2020s

In January 2021, NAB announced plans to buy the online bank 86 400. The goal was to combine it with UBank.

In May 2021, NAB finished selling its advice, platforms, superannuation, and investment businesses to IOOF Holdings.

In September 2021, NAB temporarily changed its logo to "JAB" to encourage people to get COVID-19 vaccines.

In the first half of 2022, NAB moved its global headquarters to a new building at 395 Bourke Street in Melbourne. This new building has lots of natural light and greenery.

On June 1, 2022, NAB bought the consumer banking business from Citigroup in Australia.

In January 2023, NAB announced it would create a stablecoin called AUDN. This digital currency would be linked to the Australian Dollar. It would run on the Ethereum network. The idea is to make international banking easier and to use it for trading carbon credits. AUDN was expected to be ready by mid-2023.

NAB's Leaders

Chief Executive Officers

Here are the people who have been the chief executive (CEO) of NAB:

| # | Name | Term start | Term end |

|---|---|---|---|

| 1 | Jack Booth | January 1, 1983 | 1985 |

| Vic Martin | January 1, 1983 | 1983 | |

| 2 | Nobby Clark | 1985 | 1990 |

| 3 | Don Argus | 1991 | 1999 |

| 4 | Frank Cicutto | 1999 | September 2004 |

| 5 | John Stewart | September 2004 | December 31, 2008 |

| 6 | Cameron Clyne | January 1, 2009 | August 2014 |

| 7 | Andrew Thorburn | August 2014 | February 2019 |

| 8 | Ross McEwan | December 2019 | April 2024 |

| 9 | Andrew Irvine | April 2024 | incumbent |

Chairs of the Board

These people have been the chairman of NAB's board of directors:

| # | Name | Term start | Term end |

|---|---|---|---|

| 1 | Sir Robert Law-Smith | January 1, 1983 | 1986 |

| 2 | Sir Rupert Clarke | 1986 | January 1992 |

| 3 | Bill Irvine | January 1992 | September 1997 |

| 4 | Mark Rayner | September 1997 | 2001 |

| 5 | Charles Allen | 2001 | February 2004 |

| 6 | Graham Kraehe | February 2004 | September 2005 |

| 7 | Michael Chaney | September 2005 | December 2015 |

| 8 | Ken Henry | December 2015 | July 2019 |

| 9 | Phil Chronican | December 2019 | Incumbent |

How NAB Works

The National Australia Bank Group is organized into different parts. These parts work across Australia, New Zealand, and globally.

| Region | Division | What it Does |

|---|---|---|

| Australia | Business and Private Banking |

|

| Personal Banking |

|

|

| UBank & 86 400 |

|

|

| MLC & NAB Private Wealth |

|

|

| New Zealand | NZ Banking |

|

| Global | Corporate and Institutional Banking |

|

| Specialised Group Assets |

|

|

| Corporate Functions and Other |

|

Technology at NAB

NAB uses advanced computer systems to manage customer information. In 2006, NAB won an award for its customer relationship management (CRM) system.

In 2010, NAB had a system problem that caused about 60,000 banking transactions to be lost. They had to be recovered manually.

NAB has been working to update its main banking computer systems. This project is called "NextGen." It involves replacing older systems with new technology. UBank was one of the first parts of NAB to use these new systems.

In 2020, NAB partnered with Microsoft to move more of its important computer programs to the cloud. This helps them develop new things faster. Also in 2020, NAB started a program with Bugcrowd. This program pays security experts to find weaknesses in the bank's computer systems.

Being a Responsible Company

NAB tries to be a responsible company. In 2008, it invested $33.5 million in projects that help the community. NAB aims to spend 1% of its earnings on these types of initiatives.

In 2009, NAB became the largest Fairtrade-certified workplace in Australia. This means they buy Fairtrade tea, coffee, and hot chocolate for their offices. In 2010, NAB became one of Australia's largest carbon-neutral companies. This means they balance out the carbon dioxide they produce.

Sponsorships and Support

NAB supports many sports and community groups. Since 2013, NAB has been a big sponsor of Australian rules football. They support programs for young players like Auskick. They also sponsor the NAB Cup (a pre-season competition), the NAB AFL Rising Star award, and the AFL National Draft.

NAB also supports community volunteers across Australia. They have provided financial help to farmers affected by drought and helped with flood clean-up in Queensland and Victoria. NAB also sponsors the Sheikh Fehmi El-Imam Scholarship, which helps students study finance and economics.

NAB is also the main sponsor for the AFL Women's league.

See also

In Spanish: National Australia Bank para niños

In Spanish: National Australia Bank para niños

- Banking in Australia

- List of banks

- List of banks in Australia

- List of banks in Oceania

| Shirley Ann Jackson |

| Garett Morgan |

| J. Ernest Wilkins Jr. |

| Elijah McCoy |