Federal Insurance Contributions Act facts for kids

The Federal Insurance Contributions Act (often called FICA) is a special tax in the United States. It's a tax taken from your paycheck (or paid by your employer) that helps fund two important government programs: Social Security and Medicare.

These programs provide benefits to different groups of people:

- Social Security helps people who are retired, people with disabilities, and children whose parents have passed away.

- Medicare helps older people with their hospital bills.

So, FICA is a way for workers and their employers to contribute to these programs that help many Americans.

Contents

- How FICA Taxes Are Calculated

- Who Doesn't Pay FICA Taxes?

- Some Students

- Employees of Some State and Local Governments

- Certain Native Americans

- Some People from Other Countries

- Members of Some Religious Groups

- Some People on Temporary Work Assignments from Other Countries

- Some Family Employees

- Foreign Governments and Some International Organizations

- Certain Emergency Workers

- Certain Newspaper Carriers

- History of FICA

- See also

- Images for kids

How FICA Taxes Are Calculated

Understanding FICA Taxes

FICA taxes are collected to support Social Security and Medicare. While the money you pay into FICA is linked to the benefits you might receive later, the United States Supreme Court has said that Social Security is not like a regular insurance plan or a personal savings account. This means the government can change the rules for these benefits. So, FICA acts like a tax that is set aside for specific uses.

This tax only applies to money you earn from working, like your salary or wages. It does not apply to other types of income, such as money you earn from investments (like rent, interest, or dividends).

There are two parts to the FICA tax:

- The Medicare part (called Hospital Insurance or HI) applies to all the money you earn from working. There's no limit.

- The Social Security part (called OASDI) only applies up to a certain amount of earned income each year. For example, in 2023, this limit was $160,200. If you earn more than that, you don't pay Social Security tax on the amount over the limit.

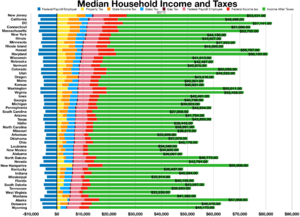

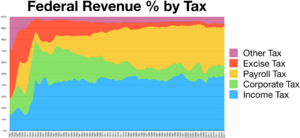

Many people actually pay more in FICA taxes than they do in regular income taxes.

For People Who Work for an Employer

If you work for a company, both you and your employer pay FICA taxes.

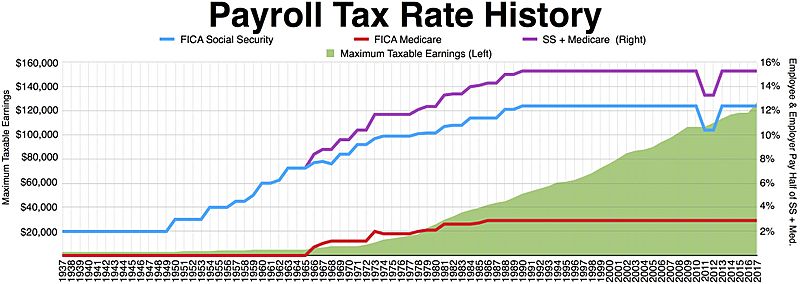

- Your share: Since 1990, the Social Security part you pay is 6.2% of your wages, up to the yearly limit (which was $137,700 in 2020). The Medicare part you pay is 1.45% of your wages, and there's no limit on this.

- Your employer's share: Your employer also pays 6.2% for Social Security and 1.45% for Medicare.

This means that for every dollar you earn (up to the Social Security limit), a total of 12.4% goes to Social Security (6.2% from you, 6.2% from your employer) and 2.9% goes to Medicare (1.45% from you, 1.45% from your employer).

If you have more than one job in a year, it's possible to pay too much Social Security tax. If this happens, you can get the extra money back when you file your federal income tax return.

For Self-Employed People

If you work for yourself, like an independent contractor or someone who owns their own business, you pay a similar tax called the Self-Employment Contributions Act (SECA) tax.

Since you are both the "employee" and the "employer," you are responsible for paying both parts of the tax. This means self-employed people pay the full 15.3% (12.4% for Social Security + 2.9% for Medicare). However, this 15.3% is applied to 92.35% of your business's net earnings, which makes it fair compared to what regular employees and their employers pay.

Generally, if a self-employed person earns $400 or more in a year, they need to pay SECA taxes.

Who Doesn't Pay FICA Taxes?

While most workers pay FICA taxes, some groups are exempt (don't have to pay) under certain conditions.

Some Students

Some students who work part-time for their university are exempt from FICA taxes. This usually applies if their work is mainly related to their studies. However, if a full-time college student works off-campus, they still have to pay FICA taxes.

Also, students working in college clubs, fraternities, or sororities doing jobs like cooking or cleaning might be exempt, unless the place mainly provides housing.

Employees of Some State and Local Governments

In some states, like Alaska, California, and Texas, certain state and local government employees and their employers don't pay the Social Security part of FICA taxes. This is because they have their own retirement plans that offer similar benefits.

Certain Native Americans

Some payments to members of federally recognized Native American tribes for council services are not subject to FICA. Also, if a member of a tribe with fishing rights hires another member of the same tribe for fishing-related work, those wages can be exempt.

Some People from Other Countries

Some people who are not U.S. citizens and are temporarily working in the United States might be exempt from FICA tax. This often applies to:

- Employees of foreign governments.

- Crew members on foreign ships or aircraft.

- Students, scholars, teachers, or researchers visiting the U.S. on certain visas (like F-1 or J-1).

- Employees of international organizations.

Members of Some Religious Groups

Members of certain religious groups, like the Mennonites and the Amish, can apply to be exempt from FICA tax. These groups believe it's their religious duty to care for their sick, disabled, or elderly members, rather than relying on government insurance.

To get this exemption, a person must:

- Give up their right to Social Security benefits.

- Be part of a recognized religious group that opposes accepting such benefits.

- Be part of a group that has continuously provided for its members' food, shelter, and medical care since 1950.

- Have never received Social Security benefits before.

Some People on Temporary Work Assignments from Other Countries

Sometimes, people work temporarily in a country different from their home country. To avoid paying social security taxes in both countries, the U.S. has special agreements called "totalization agreements" with many countries (like Canada, Germany, Japan, and the United Kingdom).

If a worker from one of these countries is in the U.S. for a temporary assignment (usually no more than five years) and is still covered by their home country's social security system, they might not have to pay FICA tax in the U.S.

Some Family Employees

If a parent hires their child, the child's wages might be exempt from FICA tax. This applies if the child is under 18 (or under 21 for household work). However, this exemption doesn't apply if the child works for a large company or a partnership where not all partners are the child's parents.

Foreign Governments and Some International Organizations

Foreign governments and certain international organizations are exempt from paying FICA tax on wages paid to their employees.

Certain Emergency Workers

People hired temporarily by state or local governments to help during emergencies like fires, storms, or floods might be exempt from FICA tax, as long as they are not meant to be permanent employees.

Certain Newspaper Carriers

Newspaper carriers who are under 18 years old are exempt from FICA tax.

History of FICA

Before the 1930s, the United States didn't have nationwide programs to help people with retirement, disabilities, or health care for the elderly. This meant that if people didn't save enough money, they could be left without income when they retired or became disabled.

- In the 1930s, during a time called the New Deal, the government created Social Security. This program was designed to help with retirement, and support people with disabilities. The FICA tax was introduced to pay for Social Security.

- In the 1960s, Medicare was created to help older people with their health care costs. The FICA tax was then increased to help pay for Medicare as well.

In 2010 and 2012, there were temporary reductions in the FICA payroll tax as part of government efforts to help the economy. In 2020, President Donald Trump temporarily paused the collection of this tax for a few months.

See also

Images for kids

| George Robert Carruthers |

| Patricia Bath |

| Jan Ernst Matzeliger |

| Alexander Miles |