Image: Wall Street guide - (1902) (14597790599)

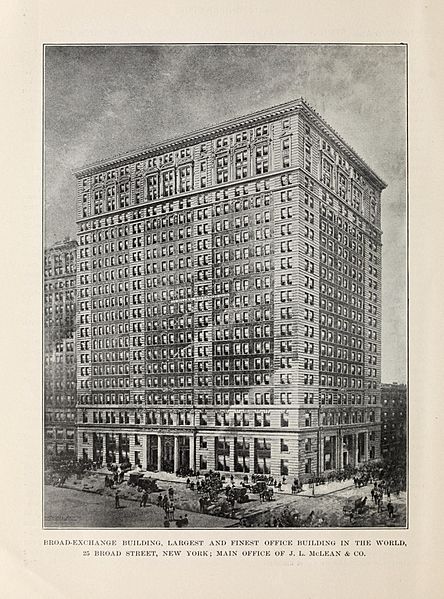

Description: Identifier: wallstreetguide00jlmc (find matches) Title: Wall Street guide / Year: 1902 (1900s) Authors: J.L. McLean & Co. Subjects: Stock exchanges Publisher: New York: J.L. McLean Contributing Library: Columbia University Libraries Digitizing Sponsor: The Durst Organization View Book Page: Book Viewer About This Book: Catalog Entry View All Images: All Images From Book Click here to view book online to see this illustration in context in a browseable online version of this book. Text Appearing Before Image: e $500 on the transaction. Onthe other hand, one could deposit an additional $500,or as much more as might be required to protect thetrade, and if later the price rallied to 40Vs one couldclose out and withdraw the entire deposit withoutloss, while if it went to, say 50, one could close outand withdraw the original deposit, together with alladditional margins deposited from time to time, andthe trader would also have a net profit on the in-vestment of $1,000, less commission charges andinterest at the rate of 5 per cent, per annum for theperiod we had been carrying the trade on the bal-ance required to purchase and pay for the certifi-cate. Thus it will be seen that in the marginaltransaction the stock is actually bought and sold anddelivery is made between brokers, in just exactly thesame manner as in the cash transaction above illus-trated, the only difference being that the customer canbuy a much larger quantity of stock with the sameamount of capital; and in case of a profit being Text Appearing After Image: BROAD-EXCHANGE BUILDING, LARGEST AND FINEST OFFICE BUILDING IN THE WORLD,:..-> BROAD STREET, NEW YORK; MAIN OFFICE OF J. L. MoLEAN & CO. WALL STREET GUIDE. made, the profit is just so many times greater inproportion to ones investment. There are often op-portunities where such investments can be made bythe operator with but little risk, and the returnreceived from the investment is enormous. Take, for example, the case of Missouri Pacific,which, early in the year 1901, sold on the New YorkStock Exchange at $51 per share. In less than threemonths it advanced to the price of $117 per share, anet gain of 66 points. When the stock was quoted at 51, let us say thatyou concluded it was destined to advance, becauseyou saw all around you the evidence of great pros-perity, and you knew that this railroad was makinglarge earnings. You invested $5,000, and bought1,000 shares on a 5 per cent, margin. At 117 yousold your stock, pocketing a net gain of $66,000, orover 1,300 per cent, on the Note About Images Please note that these images are extracted from scanned page images that may have been digitally enhanced for readability - coloration and appearance of these illustrations may not perfectly resemble the original work.

Title: Wall Street guide - (1902) (14597790599)

Credit: https://www.flickr.com/photos/internetarchivebookimages/14597790599/ Source book page: https://archive.org/stream/wallstreetguide00jlmc/wallstreetguide00jlmc#page/n9/mode/1up

Author: J.L. McLean & Co.

Permission: At the time of upload, the image license was automatically confirmed using the Flickr API. For more information see Flickr API detail.

Usage Terms: No known copyright restrictions

License: No restrictions

License Link: https://www.flickr.com/commons/usage/

Attribution Required?: No

Image usage

The following page links to this image: