Banca Monte dei Paschi di Siena facts for kids

|

|

Monte dei Paschi di Siena Headquarter's Main Entrance, Palazzo Salimbeni, Siena

|

|

| Public (Società per azioni) | |

| Traded as | BIT: BMPS |

| ISIN | [https://isin.toolforge.org/?language=en&isin=IT0005218752 IT0005218752] |

| Industry | Financial services |

| Founded | 4 March 1472 (as a mount of piety) |

| Headquarters |

,

Italy

|

|

Number of locations

|

|

|

Key people

|

Nicola Maione (chairman) Luigi Lovaglio (CEO) |

| Services |

|

| Revenue | |

|

Operating income

|

|

| Total assets | €124,579 billion (Q1 2025) |

| Total equity | |

| Owner | Ministry of Economy and Finance (11.7%) |

|

Number of employees

|

|

| Subsidiaries |

|

| Capital ratio | |

| Footnotes / references in consolidated financial statement |

|

Banca Monte dei Paschi di Siena S.p.A. (often called BMPS or just MPS) is a very old Italian bank. It started way back in 1472 as a "mount of piety," which was a type of charity that offered small loans to people in need. Today, it is known as the oldest bank in the world that is still running. It is also one of the largest banks in Italy.

In 1995, the bank changed from a public body into a company called Banca Monte dei Paschi di Siena. A separate group, the Fondazione Monte dei Paschi di Siena, was created to continue the bank's original charity work. For a long time, this foundation was the bank's biggest owner.

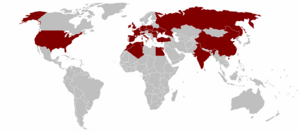

Around 2016 and 2017, the bank faced some big challenges and needed help from the Italian government to stay strong. By 2020, BMPS had about 1,400 branches, 21,000 employees, and 3.9 million customers in Italy. It also had branches in other countries. A special part of the bank, MPS Capital Services, helps big companies with their banking and investments.

Contents

The Bank's Long History

Banca Monte dei Paschi di Siena began on March 4, 1472, in the Republic of Siena. It was set up as a "mount of piety" to help poor people by giving them small loans without interest. This is why it is considered the oldest bank that has been open continuously. The bank's name, "Paschi," comes from the word for pastures. In 1624, when Siena became part of the Grand Duchy of Tuscany, the Grand Duke promised the bank's depositors income from state-owned pastures as a guarantee.

As Italy became one united country, the bank grew and started offering new services, like home loans. In 1995, the bank officially split into two parts: the banking company (Banca Monte dei Paschi di Siena S.p.A.) and the Fondazione Monte dei Paschi di Siena. The Fondazione is a non-profit group that uses its money to support education, science, health, and art, especially in the Siena area. In 1999, Banca Monte dei Paschi di Siena became a public company and its shares were listed on the Italian Stock Exchange.

Growing Bigger (2000–2006)

After joining the stock exchange, the bank started to grow a lot. It bought other banks, like Banca Agricola Mantovana and Banca del Salento. It also created special companies to focus on different types of banking, such as:

- Consum.it for loans to individuals.

- MPS Leasing and Factoring for equipment leasing and other financial services.

- MPS Finance for investment banking.

- MP Asset Management SGR for managing savings.

- MPS Personale for financial advice.

- MPS Banca per l'Impresa for business loans.

The bank also opened many new branches, reaching over 2,000. To help pay for this growth, the bank made some complicated financial deals that were later found to have hidden problems.

Buying Antonveneta (2006–2008)

In 2007, Monte dei Paschi di Siena agreed to buy another bank called Banca Antonveneta from Banco Santander for €9 billion. This was a very large purchase for the bank. During this time, Banca MPS also sold its shares in Finsoe and bought another regional bank, Cassa di Risparmio di Biella e Vercelli.

After the 2008 Financial Crisis

After the big financial crisis in 2008, and with problems in Italy's economy, MPS faced difficulties. The bank lost a lot of money in 2012 and needed more funds to keep going. Its main owner, the Fondazione Monte dei Paschi di Siena, was hesitant to put in more money because it would mean owning a smaller part of the bank.

Hidden Problems and Government Help (2013)

Around 2009, some of the complicated financial deals the bank made earlier started causing big losses. To hide these losses, some top managers at the bank made more complex deals with other banks. These actions later led to legal issues for some of the bank's former leaders.

The problems were discovered in late 2012 and early 2013. The bank's shares dropped a lot, and its president resigned. In January 2013, the bank asked the Italian government for €3.9 billion in help. The government agreed to this bailout.

In 2019, after a long trial, some former bank executives and bankers from other companies were found responsible for hiding the bank's losses. However, in 2022 and 2023, higher courts overturned these convictions, meaning the former executives and banks were found not guilty.

A Slow Recovery (2014–2022)

The bank continued to face challenges after 2013. In 2014, it failed a "stress test" by the European Central Bank, which checks if banks can handle tough financial times. This meant the bank needed to raise even more money. It ended 2014 with a big loss.

In 2015, the bank made a profit, but it still had a lot of "non-performing loans" (loans that customers were not paying back). This was a bigger problem for MPS than for many other Italian banks.

In 2016, another stress test showed that MPS was the only bank that would have negative capital in a bad economic situation. This meant it needed a huge amount of money, about €8.8 billion. The bank planned to raise €5 billion and sell off its bad loans. However, it struggled to find investors.

In December 2016, the bank asked the Italian government for "precautionary recapitalisation." This meant the government would step in to help the bank. The government set up a fund to help several Italian banks, including MPS.

In 2017, the European Union agreed to the Italian government's plan to help MPS. The bank was recapitalized with €8.1 billion. The Italian Ministry of Economy and Finance provided €3.9 billion, and bondholders (people who had lent money to the bank) had their bonds converted into shares.

Returning to Profit and Privatization (Since 2023)

After a loss in 2022, MPS made a big profit of over €2 billion in 2023. In February 2024, the bank paid its first dividend (a payment to shareholders) since 2010.

The Italian government, which had become the main owner after the 2017 bailout, started selling its shares to private investors.

- On November 20, 2023, the government sold 25% of its shares, reducing its ownership from 64% to 39%.

- On March 27, 2024, it sold another 12.5% stake.

- On November 14, 2024, the government sold a 15% stake for €1.1 billion. This reduced its ownership to 11.7%. Other companies, like Banco BPM and Anima Holding, bought parts of these shares. This sale helped the Italian government meet its promise to the EU to reduce its ownership below 20% by the end of 2024.

In January 2025, MPS announced a plan to buy a larger rival bank, Mediobanca. In April 2025, a group that advises shareholders recommended approving this plan, seeing it as a good strategic move for MPS.

Culture and Community Support

The main office of MPS is in the Palazzo Salimbeni in Siena. This building holds a valuable art collection and many old historical documents from the bank's long history. These are not usually open to the public.

The bank is also well-known for being the main sponsor of the Italian basketball team Mens Sana Basket from Siena.

For many years, the bank's profits helped fund important local projects, like the famous Palio di Siena horse race, renovations of historic buildings in Siena, and science programs. However, after 2010, the money available for these projects greatly decreased due to the bank's financial problems.

The Fondazione Monte dei Paschi di Siena, the charity group connected to the bank, also saw its income drop sharply. This meant the foundation had to stop giving money to other organizations for a while.

Who Owns the Bank?

As of May 19, 2025, the main owners of Monte dei Paschi are:

| Shareholder | % of Capital |

|---|---|

| Ministry of Economy and Finance (Italian Government) | 11.731% |

| Gruppo Francesco Gaetano Caltagirone | 9.963% |

| Delfin S.à.r.l. | 9.866% |

| Banco BPM S.p.A. | 8.996% |

| Other Shareholders | 59.444% |

Images for kids

See also

In Spanish: Monte dei Paschi di Siena para niños

In Spanish: Monte dei Paschi di Siena para niños