Venture capital facts for kids

Venture capital is a special kind of money that investors give to new businesses. These businesses usually have big ideas and promise to grow very fast. Think of it as a way to help exciting new companies get started and become successful.

When people invest venture capital, they know it can be risky. Not every new business succeeds. But if a business does well, the investors can earn a lot of money back, much more than they might from other types of investments.

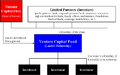

A venture capitalist (often called a VC) is a person or a company that provides this money. They look for new businesses with great potential. A venture capital fund is like a big pot of money where many investors put their money together. This fund then invests in different new companies. These companies might be too new or too risky for regular banks to lend money to.

Venture capitalists often do more than just give money. They can also share their knowledge, advice, and technical skills to help the new business grow. Most venture capital comes from groups of wealthy investors, big investment banks, or other financial organizations that combine their money. This way of getting money is very popular for new companies, especially those that want to innovate and expand quickly.

Contents

What is Venture Capital?

Venture capital is money given to start-up companies or small businesses that are expected to grow rapidly. It's different from a regular bank loan because the investors become part-owners of the company. They share in the company's success, but also its risks.

Why Companies Need Venture Capital

New companies often have great ideas but not enough money to make them happen. They might need funds to:

- Develop new products.

- Hire talented people.

- Build factories or offices.

- Market their products or services.

Traditional banks might not lend money to these new businesses because they don't have a long history or a lot of assets. Venture capitalists are willing to take that risk because they believe in the company's future.

Who are Venture Capitalists?

Venture capitalists are expert investors. They don't just hand out money. They carefully research many new businesses to find the ones with the best chance of success. They look for strong business plans, unique ideas, and talented teams.

Many venture capitalists have experience in building businesses themselves. This means they can offer valuable advice and connections to the companies they invest in. They want to help the businesses grow because that's how their investment becomes successful.

How Venture Capital Works

When a venture capitalist invests in a company, they usually get a share of the company's ownership. This means they own a small part of the business. If the company becomes very successful, the value of their share goes up.

Stages of Funding

Venture capital funding often happens in different stages as a company grows:

- Seed Stage: This is the very first money a company gets to start developing its idea.

- Early Stage: After the idea is developed, more money is needed to build the first products and find customers.

- Growth Stage: Once the company is growing, it needs more money to expand, hire more people, and reach new markets.

Each stage involves more money as the company becomes bigger and more established.

The Goal of Venture Capital

The main goal for venture capitalists is to help a company grow big enough to either:

- Be sold to a larger company.

- Offer its shares to the public on a stock exchange (this is called an Initial Public Offering or IPO).

When one of these things happens, the venture capitalists can sell their shares and make a profit. This profit is how they earn money from their risky investments.

Images for kids

-

A highway exit for Sand Hill Road in Menlo Park, California, where many Bay Area venture capital firms are based

See also

In Spanish: Capital riesgo para niños

In Spanish: Capital riesgo para niños

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |