Baltimore Equitable Society facts for kids

Quick facts for kids |

|

|

Baltimore Equitable Insurance

|

|

Previous location of Baltimore Equitable Insurance, relocated 2003

|

|

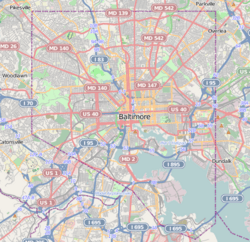

| Location | 100 N Charles St, Suite 640., Baltimore, Maryland |

|---|---|

| Area | 0.5 acres (0.20 ha) |

| Built | 1962 |

| Architect | Ludwig Mies Van Der Rohe |

| Architectural style | Modernistic |

| NRHP reference No. | 77001528 |

Baltimore Equitable Insurance is a very old company. It was founded in 1794. This makes it one of the oldest businesses in Baltimore. It is also the third-oldest fire insurance company in the United States.

Until 2003, the company was located in a historic building. This building was originally the Eutaw Savings Bank. It was built in 1857. The building has a brownstone front and brick sides. It was designed in the Italian Renaissance style.

The Eutaw Savings Bank moved out in 1887. Then, Baltimore Equitable Society bought the building in 1889. The building was added to the National Register of Historic Places in 1977. Today, a restaurant is in that old building.

In 2003, Baltimore Equitable Insurance moved. The old building needed many repairs. Also, Hurricane Isabelle hit that year. The company decided to move to a newer building. Their new office is at One Charles Center in Baltimore. This building was part of a city improvement project in the 1960s.

Contents

What is a Fire Mark?

Have you ever seen a sign with clasped hands on an old house? This sign is called a "fire mark." It means the home is, or was, insured by Baltimore Equitable Insurance.

The company chose clasped hands to show an agreement. It symbolizes the company and the policyholder shaking hands. This shows they both agree to the insurance contract. Long ago, these fire marks were as important as the paper insurance policy.

Fire Marks in History

In Europe, insurance companies often owned the fire departments. Firefighters would only put out fires if a home had the correct fire mark. This showed the home was insured by their company.

However, this was different in the United States. Benjamin Franklin helped start public fire departments here. These volunteer firefighters would put out any fire. They did not care if the home had insurance or a fire mark.

Even so, fire marks were still very important. Many early insurance companies used them. Baltimore Equitable still gives a fire mark to its customers today. It is numbered and painted black with gold leaf.

The Story of Baltimore Equitable

On January 21, 1794, some important citizens met. They wanted to start a fire insurance company. They wanted it to be like the one Benjamin Franklin started in Philadelphia. This meeting led to the Baltimore Equitable Society.

By February 10, 1794, they had a plan for the new company. It was called the Baltimore Equitable Society for Insuring of Houses From Loss By Fire. The first insurance policy was given on April 10, 1794. It went to Humphrey Pierce for his brick house.

The company became official on December 27, 1794. This means it was formed even before Baltimore City itself. The city became official three years later.

Early Days and First Fire

In its first year, the Society wrote 104 policies. These policies covered homes worth over $129,000. The company's costs for that first year were low. They paid for things like salaries and rent.

The Society had its first fire claim on December 4, 1796. William Hawkins' two brick houses were destroyed. This fire also burned other businesses and homes. It was called the city's "Great Fire" at that time. After this fire, the Society started its tradition. They always paid their policyholders quickly and fully.

Famous Policyholders

Baltimore Equitable insured homes for many important people. In 1803, Charles Carroll of Carrollton insured four buildings. He was a signer of the Declaration of Independence.

In 1838, Homewood was first insured. This was the home of Charles Carroll Jr. Today, it is on the Johns Hopkins University campus. When the owner canceled the policy in 1866, the company gave back all the money paid. Later, in 1903, Johns Hopkins University bought the mansion. They insured it again with Baltimore Equitable.

Witnessing History

The Society saw many big events in the 1800s. In 1814, the British burned Washington, D.C. Then they planned to attack Baltimore. Francis Scott Key watched the battle from the harbor. He wrote the poem that became our national anthem.

The British failed to capture Baltimore. Six months later, the Society recorded their relief. They noted that "there was no loss sustained." If the British had won, the story would have been very different.

In 1865, the Society made a big change. They started offering "perpetual policies." This meant policies that lasted forever. The company had enough money from good investments to do this. The first perpetual policy was for a home on Lombard Street. Another was for "Mondawmin," a large home. Today, the Mondawmin Shopping Center stands where that home once was.

The Great Baltimore Fire

The early 1900s were good for the Society. But then disaster struck in 1904. On February 7, a large fire started in downtown Baltimore. This was called the Great Baltimore Fire.

The fire destroyed 150 acres of the city. About 2,500 businesses were burned. Luckily, no lives were lost. But the damage cost about $150 million. Baltimore Equitable had 455 policyholders affected. The company paid out nearly $2 million. All policyholders were paid in full and quickly.

Tough Times and World War II

After the 1904 fire, the Great Depression hit the nation. This was from 1929 to 1939. Many people lost money and jobs. But Baltimore Equitable stayed strong. Their money grew by 23%. They even created a Fire Museum during this time.

During World War II (1941-1945), many Baltimoreans went to fight. Those insured by the Society did not worry about yearly payments. They knew their families would be taken care of if something happened.

In 1968, there was unrest in Baltimore. Some insurance companies stopped covering homes in the city. But Baltimore Equitable kept writing policies. They continued to help people in the city.

Baltimore Equitable Today

Baltimore Equitable has continued to be successful. They offer a special "perpetual homeowner's policy." This is a unique type of insurance.

A company called A.M. Best Company checks insurance companies. They rated Baltimore Equitable Society as "A - Excellent." This means the company is very good at meeting its promises.

In 2016, Baltimore Equitable started new advertising. They focused on their perpetual homeowners insurance. They also offer insurance for renters and condo owners.

- Baltimore Equitable Society, Baltimore City, including photo from 1976, at Maryland Historical Trust

| Ernest Everett Just |

| Mary Jackson |

| Emmett Chappelle |

| Marie Maynard Daly |