Capital asset pricing model facts for kids

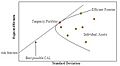

The Capital Asset Pricing Model (CAPM) is a way for people to figure out how much money they might expect to earn from investing in a stock. It helps them understand if a stock's price is fair, based on how risky it is.

Imagine you're investing your money. You'd want to earn more if you take a bigger risk, right? CAPM helps explain this idea. It suggests that the money you get back from a stock can be split into two parts: a "safe" amount and an "extra" amount for taking a risk.

Contents

How Investors Think About Stocks

When people invest, they usually think about two main things for a stock:

- How much money it might make: This is the average return they expect over time.

- How much its value might change: This is called volatility. It means how much the stock's price goes up and down. A stock that changes a lot is more volatile, or riskier.

Investors want to get the best possible return without taking on too much risk. CAPM helps them balance these two ideas.

Understanding Risk and Reward

The CAPM says that the return you get from a stock is made up of two parts:

- The Risk-Free Rate: This is like the money you'd earn from a super safe investment, such as a government bond. It's the return you get without taking almost any risk. Think of it as the basic reward for lending your money.

- The Risk Premium: This is the extra money you expect to earn for taking on more risk. If you invest in a stock that could go up or down a lot, you'd want a higher potential reward for that extra uncertainty.

What is Beta?

A key part of the risk premium is something called "beta." Beta measures how much a stock's price tends to move compared to the entire stock market.

- If a stock has a beta of 1, it means it moves about the same as the market.

- If a stock has a beta greater than 1 (like 1.5), it means it tends to move more than the market. It's riskier, but could also offer higher returns.

- If a stock has a beta less than 1 (like 0.5), it means it tends to move less than the market. It's less risky.

So, beta helps investors understand how much extra risk they are taking by owning a specific stock compared to just owning the whole market.

The Market Risk Premium

The "market risk premium" is the average extra return that investors expect from the entire stock market compared to a risk-free investment. It's the reward for taking on the general risk of investing in stocks.

The CAPM puts all these ideas together to give investors a way to estimate what a stock's return should be, based on its risk.

Why is CAPM Important?

The Capital Asset Pricing Model is important because it helps:

- Investors decide if a stock is a good buy. If a stock's expected return is higher than what CAPM suggests, it might be a good deal.

- Companies understand how much their projects need to earn to be worthwhile.

- Financial experts value different investments.

Even though it's a model and makes some simple assumptions, CAPM is a widely used tool in finance to think about risk and return.

Images for kids

See also

In Spanish: Modelo de valoración de activos financieros para niños

In Spanish: Modelo de valoración de activos financieros para niños

| Shirley Ann Jackson |

| Garett Morgan |

| J. Ernest Wilkins Jr. |

| Elijah McCoy |