Credit default swap facts for kids

A credit default swap (or CDS for short) is like a special agreement. Imagine you want to protect yourself if a company can't pay back its loans. With a CDS, you pay someone regularly, and if that company fails to pay its loans (this is called a default), the other person pays you a large sum of money. It's a bit like insurance for loans, but there are some big differences:

- With regular insurance, you must own the thing you are insuring. But with a CDS, you can buy protection for loans you don't even own!

- Governments have many rules (called regulations) for insurance companies. However, there aren't many rules for people who sell CDSs.

- Insurance companies must keep a lot of money ready in case many people need to claim insurance at once. Because there are fewer rules for CDS sellers, they don't have to be as careful.

Since you don't have to own the loans to buy a CDS, people can use them to speculate. This means they can bet on whether a company will get into financial trouble.

Contents

What Are Credit Default Swaps?

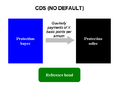

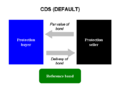

A credit default swap is a financial contract. One person, called the "protection buyer," pays regular fees to another person, the "protection seller." In return, the seller agrees to pay the buyer a large amount if a specific company or government (called the "reference entity") fails to pay its debts. This failure is known as a "credit event" or "default."

How CDSs Work

Think of it like this:

- You (the protection buyer) pay a small amount, perhaps every three months, to a bank (the protection seller).

- This payment is for a specific loan made by a company, let's call it "Company X."

- If Company X keeps paying its loan on time, you just keep paying your fees until the CDS agreement ends.

- But if Company X defaults on its loan, the bank pays you a large sum of money. This payment helps cover the loss you might have if you owned Company X's loan, or it simply means you won't lose your bet.

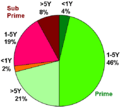

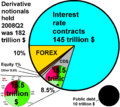

CDSs and the 2008 Financial Crisis

Credit default swaps played a big part in the worldwide financial crisis of 2008. Many companies had bought and sold huge amounts of CDSs.

The Lehman Brothers Collapse

On September 15, 2008, a large investment bank called Lehman Brothers went bankrupt. This meant they couldn't pay back their loans. A huge insurance company named AIG had sold many CDSs related to Lehman Brothers. When Lehman defaulted, AIG was supposed to pay out a lot of money to all the people who had bought CDSs from them.

The Domino Effect

The problem was that AIG didn't have enough money to pay everyone. Many companies had bought CDSs from AIG, but they had also sold CDSs to other companies. It was like a long chain. When Lehman defaulted, everyone in the chain tried to collect money from the company they bought CDSs from. But those companies didn't have enough money either, because they were waiting for money from someone else.

Because AIG had sold so many of these agreements, people worried that AIG would also fail. If AIG had collapsed, it would have created a "domino effect." Many other companies would have gone out of business too. This would have caused the entire economy to crash. To stop this, the government decided to help AIG pay its debts. This prevented a much bigger financial disaster.

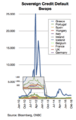

CDSs and the Greek Financial Crisis

Credit default swaps also played a role in the Greek financial crisis. This happened when people found out that the Greek government owed much more money than was previously thought.

Betting on Greece's Debts

People who didn't own any Greek government loans started buying CDSs on those loans. They did this because they thought Greece might not be able to pay its debts. If Greece defaulted, the people who sold the CDSs would have to pay them.

Making Things Worse

This situation made people who already owned Greek loans very nervous. They wanted to sell their loans quickly and avoid buying any new ones. This made it very hard for Greece to borrow the money it needed to fix its financial problems. It showed how CDSs, even when used by people who don't own the actual loans, can affect a country's ability to manage its money.

Images for kids

See also

In Spanish: Permuta de incumplimiento crediticio para niños

In Spanish: Permuta de incumplimiento crediticio para niños