Double-entry bookkeeping facts for kids

Double-entry bookkeeping is a smart way businesses keep track of their money. Imagine every money action has two sides, like two sides of a coin. When a business spends or receives money, it records that action in at least two different places. This helps make sure everything stays balanced.

Think of it like this: if you borrow $10 from a friend, your friend records that they are owed $10 (an asset for them). You record that you owe $10 (a liability for you). Both sides of the transaction are recorded.

In double-entry bookkeeping, these two sides are called debit and credit. For every debit (money coming in or increasing something), there must be an equal credit (money going out or decreasing something else). This system helps find mistakes and keeps financial records accurate.

For example, if a business gets a $10,000 loan from a bank:

- The bank records a $10,000 DEBIT to an account called "Loan Receivable" (money they will get back).

- The bank also records a $10,000 CREDIT to their "Cash" account (money they gave out).

For the business that borrowed the money:

- They record a $10,000 DEBIT to their "Cash" account (money they received).

- They also record a $10,000 CREDIT to a "Loan Payable" account (money they owe).

This way, both sides of the money story are always written down.

Contents

How Bookkeeping Balances

Double-entry bookkeeping is all about keeping things balanced. It uses a basic idea called the "accounting equation." This equation is:

Assets = Liabilities + Equity

- Assets are things the business owns (like cash, buildings, or equipment).

- Liabilities are what the business owes to others (like loans or bills).

- Equity is what the owners have put into the business, plus any profits.

If the books are balanced, the total value of everything the business owns (assets) will always equal what it owes (liabilities) plus what the owners have (equity). If these numbers don't match, it means there's a mistake somewhere!

A Look at History

People have been keeping financial records for thousands of years. But the modern way of double-entry bookkeeping started in Europe. The earliest records using this system come from a merchant named Amatino Manucci in Florence, Italy, around the late 1200s. His company's ledger from 1299-1300 clearly shows they were using a full double-entry system.

This method became popular in Italian merchant cities during the 1300s. It helped businesses keep better track of their money and control their finances.

A very important person in the history of accounting is Luca Pacioli. He was a Franciscan friar and even worked with Leonardo da Vinci. In 1494, Pacioli published a detailed description of the double-entry system in his mathematics textbook. Because he was the first to explain it so clearly, many people call him the "father of accounting." His work helped spread this useful system to many other places.

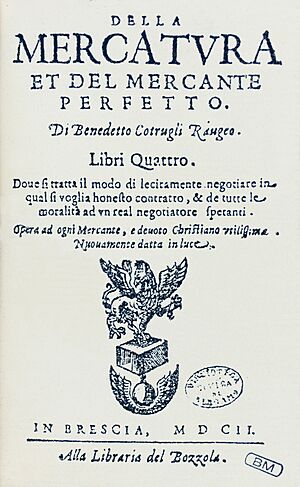

Before Pacioli, another merchant named Benedetto Cotrugli from Ragusa (now in Croatia) also described double-entry bookkeeping in a book he wrote in 1458. However, his book wasn't printed until much later, in 1573.

Interestingly, some historians think similar ideas for tracking money with two sides might have existed in other parts of the world even earlier. For example, some Jewish bankers in Old Cairo in the 1000s used a form of credit-debit accounts. There was also an old Indian system called "Jama–Nama" that had debits and credits, but in a different order. The Republic of Genoa in Italy also had complete double-entry records in 1340. And in Korea, a "four-element bookkeeping system" is said to have started around the 11th or 12th century.

How Entries Are Made

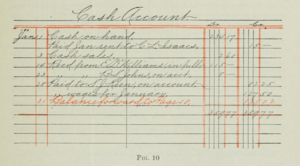

When a business records a financial action, it makes at least two entries. These entries go into different accounts, like "Cash," "Loans," or "Sales." One entry will be a debit, and the other will be a credit. The total amount of debits must always equal the total amount of credits for that action.

This balancing act helps make sure that if you add up all the debits in all accounts, it will match the sum of all the credits. If they don't match, it means there's a mistake. Each entry also gets the same date and a special code. This helps trace every money action back to its original record, creating an "audit trail." An audit trail is like a path that lets you follow where every dollar came from and where it went.

Understanding Debits and Credits

In accounting, "debit" and "credit" have very specific meanings. They don't always mean "good" or "bad" like they might in everyday talk.

- Debits are recorded on the left side of an account.

- Credits are recorded on the right side of an account.

Whether a debit or credit increases or decreases an account depends on the type of account:

| Debit | Credit | |||

|---|---|---|---|---|

| Asset | Increase | Decrease | ||

| Liability | Decrease | Increase | ||

| Capital | Decrease | Increase | ||

| Revenue | Decrease | Increase | ||

| Expense | Increase | Decrease | ||

Here's a simple way to remember:

- Assets (like cash, buildings) and Expenses (like rent, salaries) usually increase with a debit.

- Liabilities (like loans), Revenue (money earned), and Capital (owner's money) usually increase with a credit.

There are even memory tricks to help! One is DEADCLIC:

- Debit to increase Expense, Asset, and Drawing accounts.

- Credit to increase Liability, Income, and Capital accounts.

Another trick is DEA-LER:

- DEA (Dividend, Expenses, Assets) increase with a Debit.

- LER (Liabilities, Equity, Revenue) increase with a Credit.

Books of Accounts

Businesses use special books or computer systems to record these entries. These are called "nominal ledgers." Each financial action is recorded in at least two different ledger accounts. This ensures that the total debits always equal the total credits.

Sometimes, businesses first record daily actions in "daybooks" (like a sales journal or a cash journal). Then, they regularly transfer the totals from these daybooks into the main nominal ledgers. This helps keep the main ledgers neat and organized.

After all the entries are made, accountants can create a "trial balance." This is a list of all the account balances. It has two columns: one for debit balances and one for credit balances. If the double-entry system is working correctly, the total of the debit column will always equal the total of the credit column. This is a quick way to check for errors.

See also

- Debits and credits

- Single-entry bookkeeping

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |