Financial rand facts for kids

Quick facts for kids Financial rand |

|

|---|---|

| ISO 4217 Code | ZAL |

| User(s) | {{{using_countries}}} |

The financial rand was a special type of money used in South Africa. It was part of a system called capital controls. These controls helped the government manage how money moved in and out of the country. Even though the financial rand was stopped in March 1995, some rules about money movement still exist. Today, these rules are more about watching and reporting foreign money deals, rather than strictly controlling them.

Contents

What Was the Financial Rand?

The financial rand was a unique way South Africa managed its money. It was a special exchange rate for the rand. This system meant there were two different prices for the rand. One price was for everyday spending and trade. The other price, the financial rand, was for big investments. This system mainly affected people from other countries who wanted to invest in South Africa.

Why South Africa Used Capital Controls

South Africa has used capital controls for a long time. These rules started during World War II. Back then, Great Britain and its allies, including South Africa, set up a system called the Sterling area. This system helped control money flow among these countries.

After a sad event in 1960 called the Sharpeville massacre, a lot of money started leaving South Africa. People and companies were taking their investments out of the country. To stop this, the government added more capital controls. This new system was called the Blocked Rand.

The Blocked Rand System

The Blocked Rand system made it hard for money to leave South Africa. Especially, it stopped money from going to other countries in the Sterling Area, like Britain. This system created a kind of "closed loop" for money within South Africa. It meant that foreign investors could not easily take their money out of the country. This helped South Africa keep its foreign money reserves.

In 1978, a group called the De Kock Commission suggested making these rules less strict. So, in early 1979, the Blocked Rand was replaced by the Financial Rand. This new financial rand was then removed in 1983. This allowed most foreign investors to take their money out using the regular rand.

Financial Rand Returns

However, this freedom did not last long. The Financial Rand system was brought back on September 1, 1985. This happened because many countries were putting economic sanctions on South Africa. These sanctions were a protest against apartheid. Apartheid was a system of unfair laws that separated people based on their race.

Because of these sanctions, a lot of money started leaving South Africa again. To stop this, the government brought back the financial rand. From then on, if foreigners invested money in South Africa, they could only sell their investments for financial rand.

How the Financial Rand Worked

The financial rand system created two different exchange rates for the South African rand. One rate was for normal everyday money transactions. The other rate was the financial rand. This special rate was only for big investments made by people from other countries.

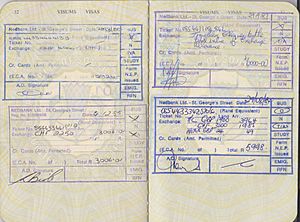

If someone from another country invested in South Africa, they had to use the financial rand. When they wanted to sell their investment, they would get financial rand back. It was difficult to change financial rand into other foreign money. The financial rand had a special code, ZAL, which is like a currency ID.

Ending the Financial Rand

The financial rand system was used from January 1979 to February 1983. Then, it was brought back in 1985. The crisis in 1985 also involved the South African government not being able to pay back some of its foreign debts. This was a difficult time for the country's economy. The financial rand was finally abolished in March 1995.

| James B. Knighten |

| Azellia White |

| Willa Brown |