Global financial crisis in October 2008 facts for kids

Imagine a time when the world's money system felt like it was about to break. That's what happened in October 2008. After some big banks failed, governments and financial leaders around the world had to act fast. They worked together to stop the crisis from getting even worse. This article explains what happened during that critical month.

Contents

Beginning of October: Governments Step In

After a big bank called Lehman Brothers failed in September 2008, governments realized they needed to do a lot more to fix the money problems. They started making big plans to help banks and keep the economy from crashing.

United States Takes Action

On October 1, the United States Senate approved a huge plan to help the economy. It was worth $700 billion! This plan aimed to protect people's savings in banks. It also offered tax breaks for businesses and clean energy projects. Soon after, the House of Representatives also voted yes on this important plan.

Europe and Iceland Face Challenges

Leaders in Europe also met to figure out how to deal with their own money troubles. Countries like Ireland and Greece promised to protect all money that people had in banks. This was to make sure people didn't panic and pull all their money out.

In Iceland, things got very bad very quickly. Their money, called the krona, lost a lot of its value. The government had to take control of several big banks to try and save them. They even stopped trading on their stock market for a few days.

More Countries Offer Guarantees

Other countries, like Denmark, Austria, and Germany, also started promising to protect bank deposits. This was a big step to calm people down. In Britain, the government also increased how much money they would guarantee in bank accounts.

On October 6, the stock market in London had its biggest drop in points since 1984. The Dow Jones Industrial Average in the U.S. also fell below 10,000 points. This was a big deal because it showed how serious the crisis was.

Central Banks Cut Interest Rates

On October 8, central banks around the world made a big move together. The European Central Bank, the Bank of England, the U.S. Federal Reserve, and others all cut their interest rates. This meant it would be cheaper for banks to borrow money. The idea was to encourage banks to lend money to each other and to businesses again.

Despite these efforts, stock markets worldwide still saw huge losses. In the U.S., the Federal Reserve had to lend even more money to a big insurance company called AIG to keep it from failing.

Iceland's Currency Struggles

Iceland's money problems continued. The Central Bank of Iceland tried to fix its currency's value, but it didn't work. By October 9, the government had to stop all trading of their currency. This showed how difficult it was for smaller countries to handle such a big crisis.

Global Stock Market Plunge

On October 9, the Dow Jones Industrial Average in the U.S. dropped to a five-year low. This was a very worrying sign. The next day, stock markets in Asia and Europe also crashed. A Japanese insurance company even went bankrupt.

Governments realized they needed to do more than just lend money. The U.S. government announced plans to buy parts of banks. This was a way to put money directly into banks and help them get back on their feet. It was a bit like the government becoming a part-owner of these banks.

On October 10, stock markets in Europe and Asia crashed again. The global markets had their worst week since 1987. This was a scary time for many people.

Week of October 12: Coordinated Global Response

Leaders from around the world met in Washington to discuss how to work together. They decided that governments needed to step in and help important financial companies to prevent them from failing.

Europe's Big Rescue Plan

On October 12, European leaders met in Paris. They announced a huge plan to help Europe's banks. They promised to guarantee bank deposits for five years. This was a massive effort, totaling about €1 trillion (that's a thousand billion euros!). Australia and New Zealand also announced similar plans to protect their banks.

Norway's Approach

Norway, which is not part of the euro zone, also announced a big plan to help its banks. They offered banks new government bonds. The head of Norway's central bank, Svein Gjedrem, said it was important to be careful with these rescue measures. He warned against doing too much too soon.

On October 13, stock markets around the world saw a big jump. The Dow Jones Industrial Average had a record climb, going up over 900 points! This happened after many countries announced their rescue plans.

On Tuesday, October 14, the United States announced its own plan to buy shares in U.S. banks. They planned to invest $250 billion. The nine largest banks in the U.S. were called into a meeting and agreed to this plan. The idea was that by putting money directly into banks, they would be more willing to lend money to each other and to people again.

Global Efforts Continue

Other countries also continued their efforts. The United Arab Emirates injected billions of dollars into its banks. Japan announced a plan to help its market. Australia also revealed a $10.4 billion plan to help families and first-time home buyers.

On October 15, stock markets fell sharply again. The London stock exchange dropped a lot, and the Dow Jones Industrial Average in the U.S. had its biggest percentage drop since 1987. This showed that the crisis was still very serious.

On October 16, Switzerland announced a rescue plan for its big banks, UBS and Credit Suisse. This involved government money and funds from other investors.

Week of October 19: Ongoing Challenges

Leaders continued to meet to discuss the crisis. President George W. Bush announced a big international conference for November 15 in Washington, D.C. This meeting would include leaders from both rich and developing countries.

More Bank Bailouts

On October 19, the Netherlands helped its bank ING with a €10 billion plan. Belgium also rescued an insurance company. Sweden created a large fund to help banks lend money to each other. France announced a €10.5 billion plan to help its largest banks.

Even with these efforts, stock markets and some currencies continued to struggle. Countries in Asia were hit particularly hard. The U.S. dollar and the Japanese yen became stronger as investors looked for safer places to put their money.

Countries Seek International Help

Many countries, like Pakistan, Iceland, Hungary, and Ukraine, asked the International Monetary Fund (IMF) for help. These countries were having trouble borrowing money. The IMF is an organization that helps countries with financial problems. There were discussions about giving the IMF more money to help even more countries.

On October 24, stock markets around the world fell sharply again. People were worried that a deep global economic slowdown was coming. A famous economist, Alan Greenspan, even called the crisis a "once-in-a-century credit tsunami."

Week of October 26: Signs of Hope?

Hungary and Ukraine made plans with the IMF for emergency help. Other countries like Poland, South Africa, Brazil, and Turkey were also affected by the crisis.

Markets Fluctuate

On October 27, stock markets in Hong Kong and Japan crashed. However, European markets had mixed results. The Dow Jones Industrial Average in the U.S. also closed down. Oil prices continued to fall, and the Japanese yen kept getting stronger.

The U.S. Treasury continued to put money into banks. They funded 22 more banks with $38 billion. This was part of the plan to help banks lend money again.

Interest Rate Cuts and Recovery

On October 28, stocks rose dramatically around the world. People hoped that central banks would cut interest rates again. In the U.S., the Dow Industrial Average rose over 10%. On October 29, the U.S. Federal Reserve cut its interest rate to 1 percent. By the end of the week, U.S. markets were up, cutting some of the losses from October.

Russia also had a big rescue program to help its companies. Its stock markets had crashed, and people were losing faith in their currency, the ruble.

In Asia, Japan announced its second economic plan. Hong Kong and Taiwan also cut interest rates. The U.S. Federal Reserve also set up agreements with South Korea, Singapore, Brazil, and Mexico to help them get money if needed.

Some big banks, like JPMorgan Chase and Bank of America, announced plans to help homeowners who were struggling to pay their mortgages. They offered to reduce interest payments or the amount owed. This was a way to help people keep their homes during the crisis.

See also

- Global financial crisis in September 2008

- Global financial crisis in November 2008

- Global financial crisis in December 2008

- Global financial crisis in 2009

- Subprime crisis impact timeline

- Timeline of the United States housing bubble for the pre-subprime crisis timeline

Images for kids

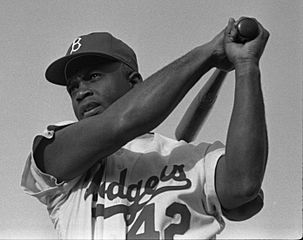

| Jackie Robinson |

| Jack Johnson |

| Althea Gibson |

| Arthur Ashe |

| Muhammad Ali |