Growth–share matrix facts for kids

The growth–share matrix, also known as the BCG matrix, is a helpful chart. It was created by the Boston Consulting Group (BCG) to help companies understand their different products or services. This chart helps businesses decide where to put their money and effort. It's used in brand marketing, product management, and strategic management.

Contents

Understanding the Business Chart

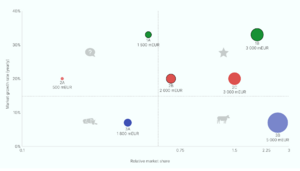

To use this chart, companies look at their products or business parts. They plot them on a graph based on how much of the market they control (their market share) and how fast that market is growing. There are four main groups:

- Cash cows are products that have a big share of a market that isn't growing much. Think of them like a steady source of income. They make more money than they need to stay in business. Companies often use this extra money to help other products grow.

- Dogs are products with a small share in a slow-growing market. These products usually just break even, meaning they don't make much profit. Companies might decide to sell these off or stop making them.

- Question marks (sometimes called problem children) are products with a small share in a fast-growing market. They are new or risky. They could become very successful (stars) if the company invests a lot in them. But if they don't succeed, they might become dogs. Companies need to think carefully if these products are worth the investment.

- Stars are products with a big share in a fast-growing market. These are often the future "cash cows." They need a lot of money to keep growing and fight off competitors. When the market growth slows down, if they are still leaders, they can turn into cash cows.

Most products follow a natural path: they start as question marks, then become stars. As the market stops growing, they become cash cows. Finally, at the end of their life cycle, they might turn into dogs.

In 1970, BCG said that a company with a good mix of products should have:

- Stars, which promise a good future.

- Cash cows, which provide money for future growth.

- Question marks, which can become stars with more money.

How Companies Use This Chart

Companies use the growth–share matrix to see the strengths and weaknesses of their products. It helps them understand how much money each product is making or using. This "map" helps them manage their money flow.

The main idea behind this chart is to manage how money moves in and out of the company. Products that make a lot of money (like cash cows) can fund products that need a lot of money to grow (like stars or question marks).

This shows how much of the market a product controls compared to its biggest competitor. If a product has a high market share, it usually means it makes more money. This is because bigger products can often produce things more cheaply (this is called 'economies of scale'). For example, if your product has 20% of the market and your biggest competitor also has 20%, the ratio is 1:1. If your competitor has 5%, your ratio is 4:1, which is a strong position.

A high relative market share also shows where a product stands against its rivals. It can suggest what kind of marketing might work best.

Market Growth Rate

Products in fast-growing markets often need a lot of money invested in them. This investment is usually made because the company expects these products to become very profitable in the future. The chart assumes that faster growth means more money is needed.

The market growth rate tells a lot about a product's future potential. It shows how strong the market is and how attractive it might be to new competitors.

Things to Consider

Even though the growth–share matrix is widely used, some studies question if it always helps businesses succeed. Some experts have even removed it from marketing textbooks.

One common problem is that people sometimes simplify the chart's message too much. They might focus only on the names (problem children, stars, cash cows, and dogs) and forget the deeper meaning.

Common Misunderstandings

- Not for all markets: The ideas about money flow work best in certain markets. These are usually markets where growth is high and products have a clear life cycle (like new medicines). In many other markets, using this chart might give wrong results.

- "Milking" cash cows: A big misunderstanding is that companies should take too much money from their "cash cows" to fund new products. This can be risky. The products that are leaders and make a lot of money should be protected. Taking too much money from them can hurt their strong position. New products might not become as successful as hoped.

The chart suggests that a company should have a balance of products in all four groups. It seems to imply that "cash cows" will always decline and become "dogs." However, the "cash cows" are often the most important products. A smart company will protect its cash cows and make sure they continue to do well. While it's good to have some "stars" for future growth, it's not wise to create "dogs" just to balance the chart. Sometimes, "dogs" can even be useful, like products that aren't very profitable themselves but help sell other, more profitable items.

Other Similar Tools

There are other tools similar to the growth–share matrix. One well-known alternative is the matrix developed by McKinsey and General Electric. It looks at 'industry attractiveness' and 'business strengths'. Both the growth-share matrix and this alternative are sometimes criticized for showing businesses only at one point in time, even though businesses are always changing.

The growth–share matrix was first made to look at different parts of a business. But it can also be used for product lines or any other part of a company that makes money.

See also

In Spanish: Matriz BCG para niños

In Spanish: Matriz BCG para niños