Health insurance marketplace facts for kids

In the United States, health insurance marketplaces (also called health exchanges) are like online stores where people can shop for health insurance. These marketplaces help people find health plans that follow the rules of a law called the Patient Protection and Affordable Care Act (ACA), which many people know as "Obamacare."

At these marketplaces, you can pick from different health plans. These plans are regulated by the government and offered by various insurance companies. This helps make sure everyone gets fair options.

The ACA health exchanges officially started on January 1, 2014. People began signing up on October 1, 2013. By April 2014, over 8 million people had signed up through these marketplaces. Millions more joined a program called Medicaid, which helps people with lower incomes get health coverage. By April 2020, over 11 million people were signed up through the marketplaces.

It's good to know that there are also private health care exchanges. These existed before the ACA and help businesses offer insurance plans to their employees. About 3 million people get their insurance this way.

Contents

What Are Health Insurance Marketplaces?

Health insurance marketplaces help more people get insurance coverage. They also let different insurance companies compete, which can help keep costs down. These marketplaces are not insurance companies themselves, so they don't take on the financial risk. Instead, they decide which insurance companies can offer plans through their platform.

A good marketplace makes it clear what each plan offers and how much it costs. It also helps people sign up and get financial help if they qualify. By bringing many people together, these marketplaces help share the costs of expensive medical treatments across a large group, instead of just a few people.

A Look Back: How Health Exchanges Started

Health exchanges first appeared in the private sector in the early 1980s. They used computers to manage claims and check who was eligible for insurance. They became popular because they allowed small and medium-sized businesses to team up. This gave them more buying power, which helped lower costs. It also let smaller businesses offer a variety of plans, just like bigger companies. One of the largest private exchanges before the ACA was CaliforniaChoice, started in 1996.

When President Obama worked on the Patient Protection and Affordable Care Act (ACA), he wanted to keep the idea of health insurance exchanges. He imagined a place where Americans could easily shop for health plans, compare prices, and pick the best one for them. He also wanted to make sure that no one could be denied coverage because of a preexisting condition (a health problem they had before getting insurance).

The ACA was signed into law on March 23, 2010. It required health insurance exchanges to be ready in every state by October 1, 2013. The first sign-up period ran until March 31, 2014. If you bought a plan by December 15, 2013, your coverage started on January 1, 2014.

The creation of these exchanges changed how individuals get insurance. It was a big part of the ACA's goal to expand health coverage. By early 2015, about 11.4 million people had signed up for or renewed their marketplace coverage.

ACA Rules for Health Insurance

The Patient Protection and Affordable Care Act (ACA) set up important rules for health insurance:

- Insurance companies cannot refuse to cover you or charge you more because of a pre-existing medical condition or your gender.

- Insurance companies cannot put a yearly limit on how much they will pay for essential health benefits.

- All private health plans offered in the Marketplace must cover certain "essential health benefits." These include things like ambulatory care (outpatient care), emergency services, hospitalization (like surgery), maternity and newborn care, mental health services, prescription drugs, and pediatric (children's) services.

- There was a rule called the "individual mandate." This meant most people had to have health insurance or pay a penalty on their taxes. This penalty increased over time. However, there were some exceptions, for example, for religious reasons or if insurance was too expensive.

- In states that chose to participate, the ACA expanded Medicaid. This meant more people with lower incomes could get coverage, including adults without children. The government helps states pay for this expansion. However, some states decided not to expand Medicaid.

- The ACA also removed lifetime and annual spending limits from plans in the exchanges. This means there's no cap on how much an insurance company will pay for your care over your lifetime or in a year.

Help with Costs: Subsidies

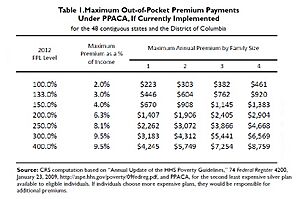

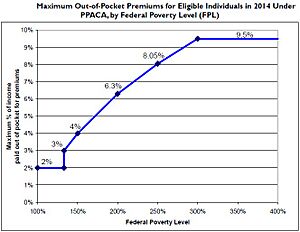

The ACA offers financial help, called subsidies, to people who buy a plan from an exchange and have a household income between 133% and 400% of the poverty line. This help comes as a tax credit that can lower your monthly insurance payments.

The idea is to make health insurance more affordable for families. For example, a family of four with an income of $44,100 might pay around 6.3% of their income for health insurance, and they could get significant savings through subsidies.

Guaranteed Coverage

Before the ACA, insurance companies often checked people's health history (a process called underwriting) to decide how much to charge them or even if they would cover them at all. This meant many people with pre-existing medical conditions were denied insurance.

The ACA changed this by making it illegal for insurance companies to deny coverage or charge more because of a pre-existing condition. This started on January 1, 2014. This rule means that insurance companies now share the financial risk of covering people with health problems among a larger group of insured individuals.

Fair Pricing Rules

The ACA also put limits on how much insurance companies can vary prices. They can charge different amounts based on:

- Your age (older people can be charged up to 3 times more than younger people).

- Whether you smoke (smokers can be charged up to 1.5 times more).

Prices can also vary slightly depending on your location within a state and the size of your family.

Different Levels of Plans

Within the exchanges, health plans are offered in four main levels, from lowest to highest monthly cost:

- Bronze: Covers about 60% of your medical bills.

- Silver: Covers about 70% of your medical bills.

- Gold: Covers about 80% of your medical bills.

- Platinum: Covers about 90% of your medical bills.

For people under 30 (or those with a special hardship), there's also a "catastrophic" plan. These plans have very low monthly payments but very high deductibles, meaning you pay a lot out-of-pocket before insurance starts to cover costs.

Each plan also has a limit on how much you have to pay out of your own pocket each year. For individuals, this limit is $6,350, and for families, it's $12,700. Once you hit this limit, your insurance pays 100% of your covered medical costs for the rest of the year.

Why the Individual Mandate Was Important

The individual mandate, which required most people to have health insurance, was a key part of the ACA. Insurance companies agreed to the rules about not denying coverage for pre-existing conditions and limiting price variations because of this mandate.

The idea was that if everyone, including healthy people, bought insurance, it would create a larger pool of insured individuals. This larger pool helps spread the financial risk of covering people with pre-existing conditions, making it more affordable for everyone.

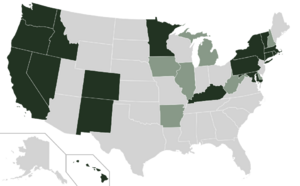

State-Based Marketplaces

A State-based Marketplace (SBM) is an online marketplace created and managed by an individual state. It's similar to the federal website, Healthcare.gov, but it's run by the state government. These state marketplaces aim to make it easier for people to compare health insurance plans, understand their benefits, and see how much they cost.

States that run their own marketplaces must offer help to consumers. This includes toll-free phone lines, assistance to figure out if you qualify for federal subsidies or Medicaid, and outreach to teach people about their options.

States with State-based Marketplaces

Many states have chosen to set up their own State-based Marketplaces. This list includes:

- California – Covered California

- Colorado – Connect for Health Colorado

- Connecticut – Access Health CT

- District of Columbia – DC Health Link

- Idaho – Your Health Idaho

- Kentucky - kynect

- Maryland – Maryland Health Connection

- Massachusetts – Health Connector

- Minnesota – MNsure

- Nevada - Nevada Health Link

- New Jersey – Get Covered NJ

- New York – New York State of Health

- Pennsylvania – Pennie(tm)

- Rhode Island – HealthSource RI

- Vermont – Vermont Health Connect

- Washington – Washington Healthplanfinder

Some states faced challenges with their own marketplaces. For example, Oregon eventually switched from its state-run exchange, "Cover Oregon," to the federally run exchange.

Private Health Insurance Exchanges

A private health insurance exchange is run by a private sector company or a nonprofit organization. These exchanges also offer health plans and help people find coverage. They often use technology and customer support to help consumers find plans that fit their health needs, preferred doctors, and budget.

These private exchanges existed before the ACA. One well-known example is CaliforniaChoice, started in 1996. Another early example was International Medical Exchange (IMX) in the 1980s, which aimed to simplify health insurance and claims processing.

Sometimes, the same insurance company might offer plans through both a state-run marketplace and a private exchange. It's important to know that even if the company is the same, the specific doctor networks might be different between the public and private plans.

Images for kids

-

Maximum Out-of-Pocket Premium Payments Under PPACA by Family Size and federal poverty level. (Source: CRS)

-

Maximum Out-of-Pocket Premium as Percentage of Family Income and federal poverty level (Source: CRS)

See also

- Health care reform

- Health care reform in the United States

- Health system

- Health Advocate

- Health insurance

- Health Insurance Innovations

- Universal health coverage by country