Image: US high-income effective tax rates

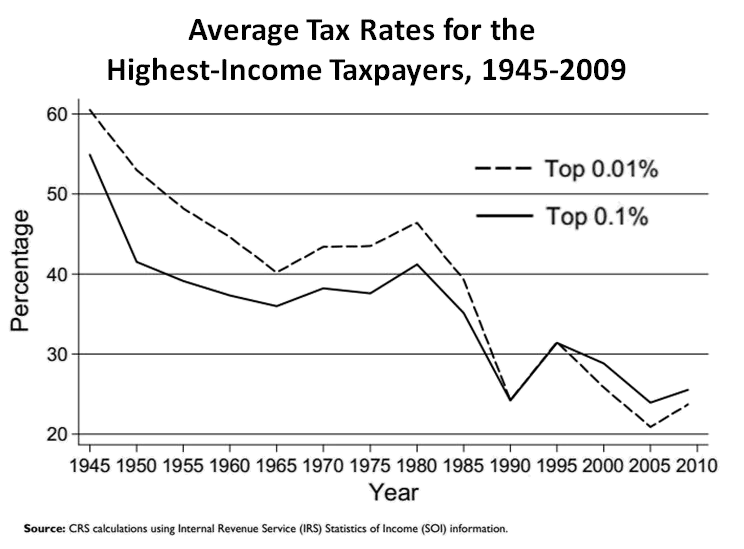

Description: Average tax rate percentages for the highest-income U.S. taxpayers, 1945-2009. The average tax rate for the top 0.01% (one taxpayer in 10,000) was about 60% in 1945 and fell to 24.2% by 1990. The average tax rate for the top 0.1% (one taxpayer in 1,000) was 55% in 1945 and also fell to 24.2% by 1990, following a similar downward path as the tax rate for the top 0.01%. Between 1990 and 1995, the average tax rate for both the top 0.1% and top 0.01% increased to about 31%. After 1995, the average tax rate for the top 0.01% was lower than that for the top 0.1%.

Title: US high-income effective tax rates

Credit: "Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945" CRS Report for Congress no. 7-5700 / R42729, page 3

Author: Thomas L. Hungerford, U.S. Congressional Research Service

Usage Terms: Public domain

License: Public domain

Attribution Required?: No

Image usage

The following page links to this image: