Private equity facts for kids

Private equity is a way of investing money directly into companies. These companies are not listed on a public stock exchange, which is a marketplace where shares of public companies are bought and sold.

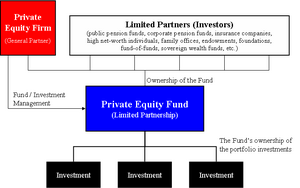

When investors put money into private equity, they are usually buying a part of a company. This helps the company grow or make big changes. These investors are often large groups, like special investment funds.

Contents

What is Private Equity?

Private equity involves investors giving money to a company. In return, they get ownership in that company. This is different from buying shares of a company on a stock market, like the New York Stock Exchange.

Why Invest in Private Companies?

Investing in private companies can be exciting. It allows investors to help businesses grow and become more successful. Sometimes, investors even help manage the company to make it stronger.

Helping Companies Grow

Private equity investors often provide money that companies need to expand. This could be for building new factories, developing new products, or reaching new customers. It's like giving a company a big boost to achieve its goals.

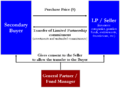

Buying and Selling Companies

Sometimes, private equity investors buy a large part, or even all, of a company. They might then work to improve the company's business. After a few years, they might sell their share for a profit.

Types of Private Equity Investments

There are different ways private equity investors put their money to work. Each type helps companies at different stages of their growth.

Venture Capital

Venture capital is a type of private equity that focuses on new, small companies. These are often called "start-up" companies. Venture capitalists invest in these young businesses because they believe they have a lot of potential to grow big and successful.

Supporting New Ideas

Imagine a brilliant new idea for a phone app or a new type of renewable energy. Venture capitalists provide the money needed to turn these ideas into real businesses. They take a risk, hoping the company will become very valuable.

Leveraged Buyouts

A leveraged buyout (LBO) is when investors buy a large, established company. They often use a lot of borrowed money (debt) to make the purchase. The goal is to improve the company and then sell it for more money later.

Making Companies Stronger

In an LBO, investors might help the company become more efficient. They could improve its operations or help it find new markets. This makes the company more valuable when it's time to sell.

Images for kids

See also

In Spanish: Capital inversi%C3%B3n para ni%C3%B1os

In Spanish: Capital inversi%C3%B3n para ni%C3%B1os