S7000A facts for kids

S.7000-A is a special law about property tax in New York State, especially for New York City. Places nearby, like Nassau County, have similar rules. This law was created in 1981 because of a court case called the Hellerstein decision. It's part of Article 18 of New York State's Real Property Law.

The most important parts of this law are:

- It created different groups for properties, called "tax classes."

- It limits how much the assessed value can go up for small homes (1 to 3 family homes, called Class 1).

- It also limits increases for other homes with 10 units or less (part of Class 2).

- It sets a maximum for how much the "assessed value" can be compared to the "market value" for different property types.

- It limits how much the total tax collected from each tax class can change from the year before.

Contents

How Property Tax Laws Changed

The S.7000-A law was created because of a court decision called Hellerstein v. Assessor of Islip in 1975. Before this, there was a big discussion about re-evaluating all properties in New York State at their full value. A group called the State Coalition Against 100% Re-Assessment (SCAR) worked for five years to stop this full re-evaluation. They helped make S.7000-A happen.

There was a lot of debate before S.7000-A became law. For example, in 1976, Assemblyman Brian Sharoff, who was in charge of the State Assembly Committee on Real Property Taxation, said the Hellerstein decision had caused "complete chaos" in how New York City and New York State collected taxes. He worried that middle-class families might see their taxes double or triple, causing big problems in cities.

What Was Taxed Before S.7000-A?

Before the S.7000-A law, New York State tax assessors often used "fractional assessments." This meant properties were valued at only a part of their true worth. Usually, properties were valued when they were first built and then rarely re-evaluated. Over many years, this led to big differences between the tax values of older buildings and newer ones.

When the Old Tax System Was Found Unfair

On June 5, 1975, a court in New York State decided that the way property taxes were valued was unfair and went against the state's constitution.

An early idea was to value all property at its full market price. But groups like SCAR fought against this idea, and it was not approved.

To make the tax law fair and follow the New York State Constitution, leaders suggested creating two different systems. One system would be for New York City and Nassau County, and another for the rest of the state.

The bill, called S.7000-A, was first stopped by Governor Hugh Carey on November 11, 1981. But in a rare move, the New York State Legislature voted to overrule the Governor's decision on December 4, 1981, making the bill a law.

Important Parts of the Law

Understanding Key Words

To understand property tax law, you need to know "market value" and "assessed value." Your property tax bill is a percentage of your property's assessed value. Sometimes, the assessed value and market value are the same by law. When the assessed value is only a part of the market value, it's called "fractional assessment."

- Market value is usually the price a property would sell for between a willing buyer and seller.

- However, for apartment buildings, including co-ops and condos in New York State, the market value is not the selling price. Instead, the New York City Department of Finance uses a special math model to figure it out.

How a Property's Tax Value Is Set

The assessed value of a property is figured out using its "market value," a special assessment ratio set each year, and certain rules from state law. New York City and Nassau County must adjust this ratio to match the market. They also have to make sure that properties within the same tax class are valued fairly and that taxes are equal for everyone in that class.

Changes to the Law Over Time

The New York City Department of Finance has lowered the assessment ratio in the past to keep the law fair. When the current system started, the Class One assessment ratio was about 25%. It was lowered to 18% in 1985, then to 12% in 1989. In 1992, it went down to 8%, and in 2004, it became the current 6%.

Setting the Tax Rate

The New York City Council and the Mayor of New York City decide the actual tax rate for the different property tax classes.

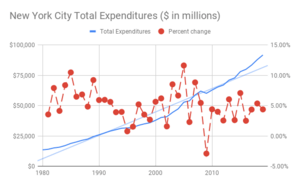

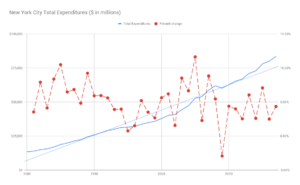

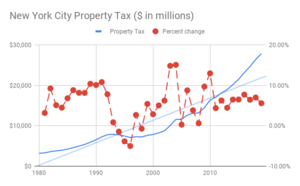

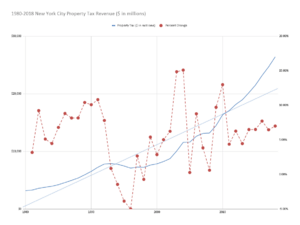

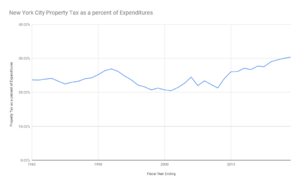

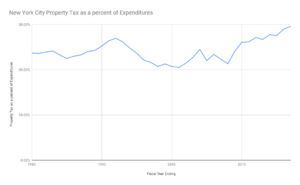

Charts

These charts show how New York State Tax Law S7000A has affected property tax growth over time.

You can see the data used for these charts here: link.

The New York City Independent Budget Office thinks there might be a $4.5 billion budget gap in 2022.

Trying to Change S7000A

On December 29, 2021, a group called the New York City Advisory Commission on Property Tax Reform shared its final ideas. They suggested creating a simpler, clearer, and fairer property tax system. This plan would make big changes to how New York City's property taxes work. If approved, it would mean that the "real" market value, not the assessed value, would decide the tax bill. It would also remove limits on how much taxes can increase. During a suggested five-year change period, the lower assessed value would not pass to a new buyer when a property is sold. Instead, the property's value would be reset to its current market value upon sale.

Lawsuits About the Tax System

On April 25, 2017, a lawsuit about property taxes was filed against New York City and New York State. This lawsuit was brought by a group called Tax Equity Now New York. This group includes Jonathan Lippman, the law firm of Latham and Watkins, and other people and groups who own homes or rent.

On September 29, 2017, some New York City council members supported the Tax Equity Now New York lawsuit. However, the New York City Mayor argued that the case should be dismissed.

| May Edward Chinn |

| Rebecca Cole |

| Alexa Canady |

| Dorothy Lavinia Brown |