Social Security (United States) facts for kids

Social Security is a special program in the United States run by the government. Its official name is the Old-Age, Survivors, and Disability Insurance (OASDI) program. It helps people who are retired, people who have lost a family member, or people who cannot work because of a disability.

This program gets its money from special taxes on people's paychecks. These taxes are called FICA or Self Employed Contributions Act Tax (SECA). The money is collected by the Internal Revenue Service (IRS). Most of the money people earn from their jobs is taxed for Social Security, but only up to a certain amount each year. For example, in 2019, the maximum amount of money that was taxed for Social Security was $132,900.

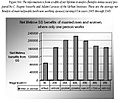

In 2017, Social Security spent a lot of money to help people. It spent about $806.7 billion for the Old-Age and Survivors part and $145.8 billion for the Disability part.

History of Social Security

The idea for Social Security started a long time ago. President Franklin D. Roosevelt signed the original Social Security Act into law in 1935. He did this during a tough time called the Great Depression. Many people needed help, and this program was created to give them some financial support. It was a way for the government to provide "social insurance" to its citizens.

Images for kids

See also

In Spanish: Seguridad Social (Estados Unidos) para niños

In Spanish: Seguridad Social (Estados Unidos) para niños

| Calvin Brent |

| Walter T. Bailey |

| Martha Cassell Thompson |

| Alberta Jeannette Cassell |