Value Added Tax facts for kids

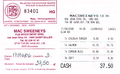

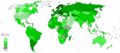

Value Added Tax, often called VAT, is a special kind of tax. It's added to the price of most things you buy, like clothes, toys, or even food (though some foods might be exempt). Think of it like a small extra charge that goes to the government. Many countries around the world use VAT, including those in the European Union. It's similar to a sales tax you might find in some places.

What is VAT?

VAT stands for Value Added Tax. It's a tax on the "value" that's added to products or services at each step of their journey. This journey goes from when they are made, to when they are sold in a shop. Even though businesses deal with VAT, the person who actually pays the full tax is the final customer.

How VAT Works

VAT can seem a bit tricky because it's collected in stages. Here's a simpler way to understand it:

- The Maker: Imagine a company that makes cool new video games. When they sell these games to a big store (a wholesaler), they add VAT to the price. The maker then sends this VAT money to the government.

- The Wholesaler: The big store (wholesaler) buys the games from the maker, paying the VAT. When they sell these games to smaller shops, they also add VAT to their price. But here's the clever part: the wholesaler only sends the difference in VAT to the government. They subtract the VAT they already paid to the maker.

- The Shop: Finally, the small shop buys the games from the wholesaler, paying VAT. When you, the customer, buy a game from the shop, the shop adds VAT to the price you pay. The shop then sends the VAT to the government, but again, they subtract the VAT they already paid to the wholesaler.

This system makes sure that the tax is collected bit by bit. The government gets its share at each stage, but the businesses don't end up paying the tax themselves. They just collect it and pass it on.

VAT on Services

VAT isn't just for physical items, or "goods." It's also charged on many "services." A service is when someone does something for you instead of selling you a product.

For example, if your bike needs fixing, the bike shop might sell you a new tire (a good) and charge VAT on it. If they also spend time fixing your bike, they'll charge you for their time (a service), and VAT will be added to that service charge too.

What Doesn't Have VAT?

Not everything has VAT added to it. Some items are "exempt" or "zero-rated," meaning they don't have VAT, or the VAT is 0%. This often happens for things that governments want to make more affordable or encourage people to buy. For instance, in some places, children's books and clothes do not have VAT added to their price.

Images for kids

See also

In Spanish: Impuesto al valor agregado para niños

In Spanish: Impuesto al valor agregado para niños