1978 California Proposition 13 facts for kids

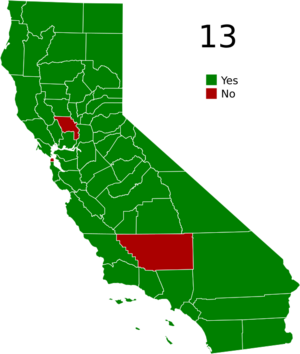

Proposition 13 is a special rule added to the California Constitution in 1978. It was officially called the People's Initiative to Limit Property Taxation. Voters in California approved it on June 6, 1978. This rule was later checked by the highest court in the United States, the U.S. Supreme Court, and they said it was legal.

The main idea of Proposition 13 is to limit how much people pay in property taxes on their homes and other buildings. It said that property taxes could not be more than 1% of the property's value. This value was set based on how much the property was worth in 1976.

Here's the most important part of the rule:

Section 1. (a) The most you can be taxed on your property is one percent (1%) of its full value. This one percent (1%) tax will be collected by counties and shared with local areas.

After 1976, the value of a property for tax reasons could only go up by a small amount each year, no more than 2%. This means your taxes wouldn't suddenly jump up a lot. The only times a property's value could be fully re-checked (and taxes might go up a lot) are when:

- Someone new buys the property.

- New buildings or big additions are built on the property.

These rules apply to all kinds of property, whether it's a home or a business.

Proposition 13 also made it harder to raise other taxes. For the state government to increase any state tax (like income tax), two-thirds of the lawmakers in both parts of the state legislature have to agree. For local governments to increase special taxes (money for a specific purpose like road repair), two-thirds of the local voters have to approve it.

Proposition 13 became very famous across the United States. Many people think it started a "taxpayer revolt" where people wanted to pay less in taxes. This movement might have even helped Ronald Reagan become president in 1980.

Many older Californians supported Proposition 13 because they worried about being forced out of their homes by high property taxes. Because it's so popular, politicians in California usually avoid trying to change Proposition 13. It's often called the "third rail" of California politics, meaning it's too risky to touch.

Contents

Why was Proposition 13 created?

Proposition 13 was made for a few reasons. People had different ideas about why it became so popular.

To limit property taxes

The main goal was to limit how much people paid in property taxes. Before Proposition 13, property taxes were rising very fast. This was because California's population was growing, and housing prices were going up a lot. Many people, especially older people on fixed incomes, found it hard to afford their homes because their taxes kept increasing.

Proposition 13 set property values for tax purposes back to their 1976 level. It also limited how much these values could increase each year to a maximum of 2%. This meant that property taxes would not go up as much, unless the property was sold or new construction was completed.

To control state spending

Another idea was that people wanted to stop the California government from spending too much money. Before 1978, the government in California had grown quite a bit. Some people believed that voters wanted to limit how much the government could spend in the future.

Concerns about fairness

There were also concerns about fairness in the tax system. In the 1960s, some scandals showed that property values were sometimes set unfairly, helping friends of officials. This made people feel cynical about the tax system. When property values started to rise sharply, people became angry. This anger helped lead to Proposition 13.

What did Proposition 13 do?

Proposition 13 changed how property taxes work in California in a big way.

How property taxes are calculated

Under Proposition 13, the yearly property tax on a piece of property is limited to 1% of its "assessed value." This assessed value is usually the price the property was bought for. This value can only go up by a maximum of 2% each year.

However, if the property is sold, its assessed value can be reset to its current market value. This new value then becomes the new starting point for future 2% yearly increases.

Property values can also be lowered if the market value drops, like during a housing market slump. This was made possible by another rule called Proposition 8, passed in the same year.

Rules for state taxes

Proposition 13 also made it harder for the state government to raise taxes. To increase any state tax, like income tax or sales tax, two-thirds of the lawmakers in both the State Assembly and the State Senate must vote yes.

Rules for local taxes

For cities, counties, and other local groups to add "special taxes" (taxes for a specific project, like a new park), two-thirds of the voters in that area must approve it. This makes it harder for local governments to raise money for specific projects without strong public support.

How did Proposition 13 affect California?

Proposition 13 had many effects on California, both good and bad, depending on who you ask.

Lower taxes for some

Right after Proposition 13 passed, the money collected from property taxes for local governments dropped by about 60%. This was a huge tax cut for many property owners.

However, over time, the amount of property tax collected has actually gone up again, even more than before 1978, when you adjust for inflation. This is because properties are sold over time, and new construction happens, which resets their assessed values.

Differences in property taxes

One big effect is that properties of the same value can have very different tax bills. If your neighbor bought their house in 1980 and you bought yours last year, even if your houses are exactly alike, you will likely pay much more in property taxes. This is because their assessed value has only gone up by 2% each year, while yours was reset to the current market value when you bought it. This difference grows bigger when housing prices go up quickly.

People stay in their homes longer

Studies show that Proposition 13 might make homeowners stay in their homes for a longer time. If you sell your home, your new home will be reassessed at its current market value, meaning higher taxes. So, it often makes financial sense to stay put. This can also make it harder for new families to find homes to buy.

Changes for businesses

Businesses that own property also benefited from Proposition 13. If a company owned a building and the company itself was sold, the property's assessed value might not change, as long as the property technically stayed with the original company. This was a "loophole" that some businesses used to avoid reassessments. This loophole has been changed over time, but some still exist.

New ways to raise money

Because local governments got less money from property taxes, they had to find other ways to pay for services.

- They started asking voters to approve "parcel taxes" (a flat tax per property) for specific services.

- Sales tax rates also went up in many areas.

- Cities sometimes focused on attracting businesses like big stores or car dealerships because these businesses generate more sales tax revenue, which helps the city's budget. This is sometimes called the "fiscalization of land use."

Impact on schools and services

Some people say that Proposition 13 hurt public schools and other public services. Before Proposition 13, California schools were considered among the best. After it passed, school funding changed a lot. The state government took on more responsibility for school funding, which some argue led to less money per student over time compared to other states.

However, voters later approved new measures, like Proposition 30, which raised taxes on wealthier residents to give more money to schools. This has helped California's schools get closer to the national average in spending per student.

How popular is Proposition 13?

Proposition 13 is still very popular with voters in California, especially homeowners. Most Californians think it has been a good thing. Even among different age groups and political parties, a majority usually supports it.

Because it's so popular, politicians are usually very careful about talking about changing it. They often call it the "third rail" of California politics, meaning it's politically dangerous to try and change it. For example, when Arnold Schwarzenegger was governor, his advisor suggested changing Proposition 13, but Schwarzenegger quickly said no, joking that his advisor would have to do sit-ups for even mentioning it.

Changes and attempts to change Proposition 13

Over the years, there have been some changes to Proposition 13, and many attempts to change or get rid of it.

Important changes

- 1978 Proposition 8: This rule allows property values to be lowered for tax purposes if the market value of the property goes down.

- 1986 Proposition 58: This allows parents to pass their main home and some other property to their children without the property being reassessed for taxes.

- 1986 Proposition 60 & 1988 Proposition 90: These rules allow homeowners over 55 to transfer their old home's assessed value to a new, less expensive home, sometimes even in a different county.

- 1996 Proposition 193: This extended Proposition 58 to allow grandparents to pass property to their grandchildren under certain conditions.

- 1996 Proposition 218: This rule, also called the "Right to Vote on Taxes Act," made it even harder for local governments to create new taxes or fees without voter approval. It was designed to stop local governments from finding ways around Proposition 13.

- 2000 Proposition 39: This lowered the number of votes needed to pass local school bonds from two-thirds to 55%.

- 2020 Proposition 19: This rule changed Proposition 58 and 193. It allows homeowners over 55 to transfer their tax value to a new home up to three times. However, it also limits the tax breaks for inherited properties, especially if the heir doesn't live in the home.

Failed attempts to change it

Many times, people have tried to change Proposition 13, but most attempts have failed.

- Legal Challenges: In 1992, the U.S. Supreme Court looked at Proposition 13 in a case called Nordlinger v. Hahn. A woman named Stephanie Nordlinger argued it was unfair because her taxes were much higher than her neighbors' who had owned their homes longer. But the Supreme Court said Proposition 13 was constitutional, meaning it was legal.

- Recent Ballot Measures:

* 2018 Proposition 5: This would have expanded the tax savings for older homeowners moving to a new home. Voters rejected it. * 2020 Proposition 15: This was a big attempt to change Proposition 13. It would have made commercial and industrial properties (like stores and factories) reassessed at their current market value, while homes would still keep their current rules. This was called "split roll." Supporters said it would bring in billions for schools and local services. Opponents said it would hurt businesses. Voters rejected this measure.

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |