Affordability of housing in the United Kingdom facts for kids

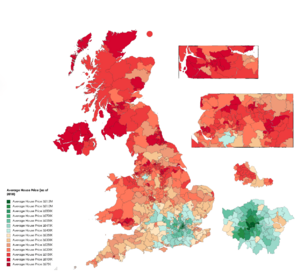

The affordability of housing in the UK means how easy or hard it is for people to rent or buy a home. One common way to measure this is by comparing the average price of a home to the average yearly earnings of full-time workers. Since 1997, it has become harder to afford a home in the UK, especially in London. In 2021, the most affordable places to live were in the North West, Wales, Yorkshire and The Humber, West Midlands, and North East of England.

In the UK, people live in homes in a few main ways:

- They own their home (owner-occupied).

- They rent from a private landlord (private rented sector).

- They rent from the local council or a housing association (social rented sector).

How much homes cost to rent or buy changes a lot across different parts of the UK. Prices and rents depend on things like the local economy, transport, and how many homes are available.

Contents

What Makes Housing Affordable?

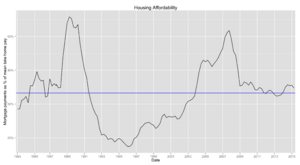

For people who own their homes, the main things that affect affordability are house prices, how much money they earn, interest rates on loans, and the costs of buying a home. For rented homes, private rents usually follow house prices. However, rents for social housing are set by local councils or housing associations.

How House Prices Have Changed

Figures show that house prices in England and Wales went up a lot between 1998 and 2018. They rose from about £70,000 to £224,000. Prices kept going up almost all the time, except for a couple of years around 2008 because of a big banking crisis.

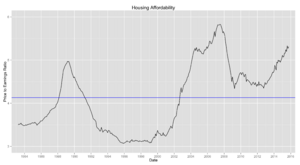

House Prices Compared to Salaries

The difference between average earnings and average house prices grew a lot between 1985 and 2015. A house that once cost about twice an average salary could later cost up to six times an average salary. In London, a house can now cost up to 12 times the average London salary. For example, in 1995, the average house price was £83,000, which was 4.4 times the average income. By 2012–13, the average London income was £24,600, but the average London house price was £300,000. This was 12.2 times the average income.

How Planning Rules Affect House Prices

Studies have shown that house prices in England might have been 35% cheaper if there were fewer rules about building. One report suggested that if just a small part of London's green belt land was used, one million homes could be built close to train stations.

Some experts believe that if more houses are not built by changing planning laws and using some green belt land, then living space will become very limited. They point out that Britain is "building less homes today than at any point since the 1920s". If general prices had risen as fast as housing prices since 1971, a chicken would cost £51 today!

However, others argue that green belt land is important for our environment. It provides trees and open spaces that help reduce heat in big cities. They suggest we should use this green space wisely instead of building on it.

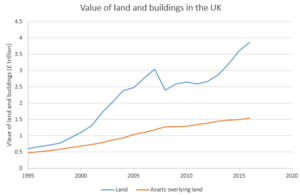

Land Value and House Prices

Property companies say that the value of land usually follows house prices. A developer figures out how much a new house can sell for in an area. Then, they work out the total value of all homes they can build on a piece of land. The actual value of the land is this total value minus the cost of building and a profit for the developer.

Research suggests that up to 80% of the increase in house prices between 1950 and 2012 was due to land becoming more expensive. This is partly because after 1950, it became harder to use new land for building due to rules.

Costs When Buying a Home

When you buy a home, there are extra costs on top of the house price. The main taxes from the government are Stamp Duty and VAT. Other costs include fees for estate agents, legal work (conveyancing), surveys, and moving.

Stamp Duty Land Tax

Stamp Duty Land Tax is a tax you pay when you buy property in England and Northern Ireland. The amount you pay depends on the price of the home. You pay different rates on different parts of the price.

For example, on a £600,000 house:

- You pay 0% tax on the first £250,000.

- You pay 5% tax on the part between £250,001 and £925,000. So, on the remaining £350,000, you pay £17,500.

- The total tax would be £17,500.

| Purchase price of property | Rate of SDLT on portion of purchase price |

|---|---|

| £40,000 - £250,000 | 0% |

| £250,001 to £925,000 | 5% |

| £925,001 to £1,500,000 | 10% |

| Over £1,500,000 | 12% |

Scotland and Wales have their own property taxes instead of Stamp Duty Land Tax. Scotland uses the Land and Buildings Transaction Tax (since 2015), and Wales uses the Land Transaction Tax (since 2018).

Other Fees

- Estate Agent Fees: In 2011, the average fee for an estate agent was about 1.8% of the house price. This can change depending on where you are in the UK.

- Surveys: Before buying, you might get a survey to check the condition of the house. There are different types, from a basic check to a full structural survey.

- Legal Fees: You need a lawyer to handle the legal side of buying a house. Their fees depend on the house value and the services they provide.

- Mortgage Arrangement Fees: If you get a mortgage (a loan to buy a house), there might be a fee to set it up. In 2013, the average fee was around £1522.

Housing Shortage

In 2020, it was reported that the UK needed over one million more homes. Many people in England live in homes that are too expensive, unsafe, or not suitable for them. A home is considered unaffordable if its costs are more than 30% of a household's income.

Not having enough homes can cause problems like:

- More people living in overcrowded homes.

- It being very hard to afford a home.

- Young people staying with their parents for longer.

- Businesses finding it hard to hire and keep staff because housing is too expensive.

- More people becoming homeless.

Even though more homes are being built, some experts say that simply building more homes won't make them much cheaper very quickly. It would take a very long time and a lot more new homes than are currently being built. Because of this, some groups argue that alongside building more homes, a large number of them must be affordable homes.

Other Things Affecting Affordability

Council Tax

The Joseph Rowntree Foundation has suggested changing the current Council tax system. They think the tax should be more closely linked to the actual value of a property. This would mean higher taxes for very expensive homes and lower taxes for cheaper ones. They believe this could also make house prices more stable.

Some people suggest a Land value tax instead of council tax. This tax would only be based on the value of the land itself, not on the buildings on it or any improvements made.

International Investment

Some people believe that when foreign investors buy property in the UK, it can push up prices. In 2015, one group suggested limiting foreign residents to buying only one new-build property, with penalties if they sell it too quickly. In 2016, London's mayor, Sadiq Khan, also looked into how foreign investment affects housing costs in the city.

Second Homes

The government has set up a fund to help local councils deal with areas where many people own second homes. In 2016, people in St Ives, Cornwall voted that new housing projects should only be for people who live there full-time. This is because Cornwall is a popular place for second homes and holiday properties.

Buy-to-Let Tax Changes

From April 2016, people buying homes to rent out (buy-to-let) had to pay an extra 3% Stamp Duty tax. Also, from April 2017, the government started to reduce the tax relief on mortgage interest payments for buy-to-let landlords. However, companies that own rental properties were not affected by these new rules.

Rented Homes

In 2013/14, there were 4.4 million households renting from private landlords and 3.9 million renting from social housing providers (like housing associations or local councils). Private renters generally paid the most, averaging £176 per week in rent. People paying a mortgage paid about £153 per week. Social housing tenants paid less, around £98 per week for housing association homes and £89 for local council homes.

When looking at how much of their income people spent on housing costs (including benefits), private renters spent the most (34%). Social renters spent 29%, and people with mortgages spent 18%.

London

The need for affordable housing is often much higher in London than in the rest of the UK. Research found that only about 24% of new homes built in London between 2013 and 2016 were affordable. This was far less than the target set for the city. The number of affordable homes being built also varied a lot between different London boroughs. Affordable housing is usually defined as housing that costs no more than 80% of the average local market rent.

See Also

- Affordable housing by country

- Homelessness in the United Kingdom

- Gazumping

- Green belt (United Kingdom)

- Housing in the United Kingdom

- Great Recession

- Help to Buy

- List of entities involved in 2007–2008 financial crises

- National Approved Letting Scheme

- Real estate economics

- Subprime mortgage crisis