Bond (finance) facts for kids

A bond is like a special promise or agreement between two sides, usually a government or a big company, and someone who lends them money. Imagine you lend your friend some money. They might give you a note saying they owe you the money and will pay you back later, plus a little extra for helping them out. That note is similar to a bond!

Governments and companies issue bonds when they need to borrow a lot of money for big projects, like building new schools or expanding a business. People or other companies who have extra money can buy these bonds. When they buy a bond, they are lending money to the issuer.

Bonds have a "maturity date." This is the date when the issuer promises to pay back the original amount of money to the person who bought the bond. Plus, they also pay a little extra money, called "interest," over time. This interest is like a thank-you payment for lending them the money.

Bonds are often bought and sold through special helpers called brokers. They are part of a group of financial tools known as "Fixed Income" because they usually pay a set amount of interest.

Contents

Different Kinds of Bonds

There are many types of bonds, each with slightly different rules. Here are some of the main ones:

Bonds with Different Interest Payments

- Fixed Rate Bonds: These bonds pay the same amount of interest throughout their entire life. It's like getting the same allowance every week.

- Floating Rate Bonds: The interest payments on these bonds can change. They are linked to a special interest rate that goes up or down over time. So, your interest payment might be different each month or every few months.

- Zero-Coupon Bonds: These bonds don't pay regular interest. Instead, you buy them for less than their face value. When the bond matures, you get the full face value back. The difference between what you paid and what you get back is your interest. For example, you might buy a $100 bond for $90 and get $100 back later.

Bonds Based on Risk

- High-Yield Bonds (Junk Bonds): These bonds are considered riskier because the company or government issuing them might have a harder time paying back the money. Because they are riskier, they offer a higher interest rate to attract investors.

- Subordinated Bonds: If a company goes out of business, some bonds get paid back before others. Subordinated bonds are lower on the list, meaning they get paid after other, "senior" bonds. Because of this higher risk, they usually offer better interest.

Bonds with Special Features

- Convertible Bonds: These bonds give the owner a choice. They can either keep the bond and get their money back with interest, or they can trade the bond for a certain number of shares in the company's stock.

- Inflation-Indexed Bonds: The amount you get back from these bonds, and the interest payments, are adjusted for inflation. This means if prices go up (inflation), your bond's value and payments also go up, helping you keep your money's buying power. The United Kingdom was the first country to issue these in the 1980s. The U.S. government offers Treasury Inflation-Protected Securities (TIPS).

- Perpetual Bonds: Most bonds have a maturity date, but perpetual bonds do not! They pay interest forever, or at least for a very, very long time. Some of these bonds from the UK were issued in 1888 and are still paying interest today!

- Methuselah Bonds: These are very long-term bonds, usually maturing in 50 years or more. They are named after Methuselah, a very old person mentioned in the Bible. Pension plans often like these bonds because they need long-term investments.

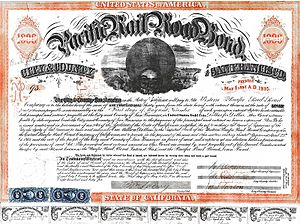

- Bearer Bonds: These are old-fashioned paper bonds that don't have a specific owner's name on them. Whoever holds the paper certificate owns the bond. They are risky because if you lose them, anyone can claim them. Most countries no longer issue these.

- Registered Bonds: Unlike bearer bonds, the owner of a registered bond is recorded by the issuer. Interest payments and the final payment are sent directly to the registered owner. This is the most common type of bond today.

Bonds by Issuer

- Government Bonds (Treasury Bonds): These are issued by a country's national government. They are considered very safe because it's highly unlikely a major government will fail to pay back its debts. Because they are so safe, they usually offer lower interest rates.

- Supranational Bonds: These are issued by international organizations like the World Bank. They also have a very good credit rating, similar to government bonds.

- Municipal Bonds (Muni Bonds): These bonds are issued by states, cities, or local governments. They are often used to fund local projects like roads, bridges, or schools. A cool thing about many municipal bonds in the U.S. is that the interest you earn is often free from federal income tax!

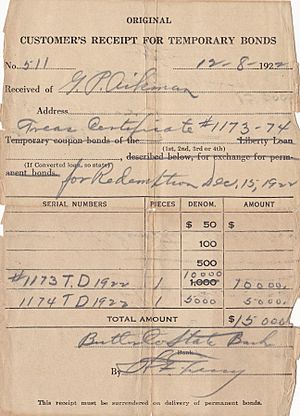

- War Bonds: These are special bonds issued by a government to help pay for military operations during wartime. They usually offer a low interest rate, but people buy them to support their country.

Other Interesting Bonds

- Lottery Bonds: These bonds pay regular interest, but some randomly selected bonds are chosen to be redeemed (paid back) for a higher value than their original price, like a lottery!

- Climate Bonds: These are issued by governments or companies to raise money specifically for projects that help fight climate change or adapt to its effects.

- Social Impact Bonds: These are a newer type of bond where private investors fund social programs. If the program succeeds and saves the government money (for example, by reducing crime or improving health), the investors get paid back.

Images for kids

-

Bond issued by the Dutch East India Company in 1623

See also

In Spanish: Bono (finanzas) para niños

In Spanish: Bono (finanzas) para niños

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |