FTC v. Motion Picture Advertising Service Co. facts for kids

Quick facts for kids FTC v. Motion Picture Advertising Service Co. |

|

|---|---|

|

|

| Argued December 8, 1952 Decided February 2, 1953 |

|

| Full case name | Federal Trade Commission v. Motion Picture Advertising Service Co., Inc. |

| Citations | 344 U.S. 392 (more)

73 S. Ct. 361; 97 L. Ed. 426

|

| Prior history | 47 F.T.C. 378 (1950); reversed, 194 F.2d 633 (5th Cir. 1952); cert. granted, 344 U.S. 811 (1952). |

| Subsequent history | Rehearing denied, 345 U.S. 914 (1953). |

| Court membership | |

| Case opinions | |

| Majority | Douglas, joined by Vinson, Black, Reed, Jackson, Clark, Minton |

| Dissent | Frankfurter, joined by Burton |

| Laws applied | |

| Copyright Act of 1909 | |

FTC v. Motion Picture Advertising Service Co. was a very important case decided by the Supreme Court of the United States in 1953. The Court ruled that when a company and a few others control a huge part of a market using special contracts, it can be an "unfair method of competition." This is especially true if these contracts block other businesses from entering the market.

This case helped define what is considered unfair in business, especially when a few big companies dominate an industry.

Contents

What Was the Case About?

The Federal Trade Commission (FTC) is a government agency that works to prevent unfair business practices. The FTC started a case against a company called Motion Picture Advertising Service (MPAS).

MPAS's Business Practices

MPAS made short advertising films, often called trailer ads. These ads showed products and services for sale. MPAS would then pay movie theaters to show these ads to their customers before the main movie.

MPAS had special agreements with many movie theaters. These were called "exclusive dealing arrangements." This meant that a theater that signed with MPAS could only show ads from MPAS, and not from any other advertising company. These contracts lasted from one to five years.

The Problem: Blocking Competition

The FTC found that MPAS and three other big companies in the same business had these exclusive deals with about 75% of all movie theaters in the United States that showed advertising films.

This meant that smaller advertising companies had very few theaters where they could show their ads. It was hard for them to compete, and some even went out of business. The FTC believed these exclusive contracts were an "unfair method of competition" because they blocked others from doing business.

The FTC ordered MPAS to stop making or continuing any exclusive contracts that lasted longer than one year.

Appeals Court Decision

MPAS disagreed with the FTC's order. They appealed to a higher court, the United States Court of Appeals for the Fifth Circuit. This court sided with MPAS. They said that MPAS's exclusive contracts were not unfair. They believed these contracts were a "desirable and necessary" part of good business.

The Supreme Court's Decision

The case then went to the Supreme Court. In a 7-2 decision, the Supreme Court disagreed with the Appeals Court. They decided that the FTC's order was correct.

The Majority Opinion

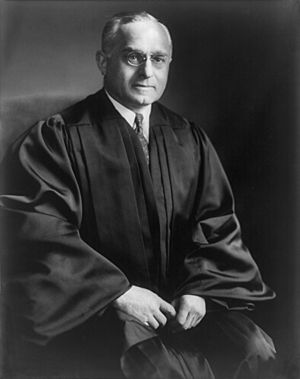

Justice William O. Douglas wrote the main opinion for the Court. He explained that Congress wanted the FTC to have the power to decide what "unfair competition" means. The FTC can "supplement and bolster" (support and strengthen) antitrust laws, which are laws designed to prevent monopolies and promote fair competition.

The Court agreed with the FTC that MPAS's exclusive contracts "unreasonably restrain competition" (unfairly limit competition) and "tend to monopoly" (move towards one company controlling everything).

The Court highlighted that the market for these advertising films was very limited. Because of the exclusive contracts, MPAS and the three other big companies had blocked 75% of all available theaters from their competitors. The Court said that a business practice that "sewed up a market so tightly for the benefit of a few" was clearly an "unfair method of competition."

The Supreme Court also said that it's the FTC's job, not the courts', to figure out how a business practice affects the market. They concluded that the FTC had not gone beyond its power in making its decision.

The Dissenting Opinion

Justice Felix Frankfurter, joined by Justice Burton, disagreed with the majority. He felt that the FTC's order didn't explain clearly enough why MPAS's actions were illegal.

He pointed out that many of MPAS's contracts were only for one year, which the FTC itself said was not too restrictive. He also questioned whether combining the market share of all four companies (MPAS and the other three) was fair, especially since there was no proof they were working together in a conspiracy.

Justice Frankfurter believed that while the FTC could stop unfair practices, it needed to show how those practices would eventually break antitrust laws. He felt the FTC hadn't fully explained this in the MPAS case.

How This Case Influenced Later Decisions

The MPAS case was important because it helped clarify the power of the FTC and how it can stop unfair business practices, even if they don't fully break other antitrust laws yet.

The Brown Shoe Case (1962)

In a later case, FTC v. Brown Shoe Co., the Supreme Court built on the ideas from the MPAS case. Brown Shoe Company had agreements with about 40% of its shoe stores. These agreements said the stores couldn't sell any other shoe brands. In return, Brown Shoe gave them special benefits.

The FTC found this was an "unfair method of competition." Brown Shoe argued that the FTC couldn't make this ruling because the practice didn't "substantially lessen competition" in the way required by other antitrust laws.

However, the Supreme Court referred back to the MPAS case. It reminded everyone that the FTC Act was created to "supplement and bolster" other antitrust laws. This means the FTC can stop unfair practices "in their incipiency" (when they are just starting) before they become full-blown violations of other laws. The Court ruled that the FTC was right to stop Brown Shoe's program, whether it was a full violation or just starting to be one.

The Liu Case (2010)

More recently, in Liu v. Amerco, Inc., a court applied the ideas from MPAS and Brown Shoe to a case about a state's unfair competition law. Amerco is the parent company of U-Haul, a truck rental company.

U-Haul's CEO tried to get other truck rental companies (Budget and Penske) to raise their prices together. Even though the price-fixing plan didn't fully succeed, the FTC said that just trying to fix prices was unlawful.

A customer, Liu, sued U-Haul, saying she paid higher rates because of this attempt. The court looked at the Brown Shoe and MPAS cases. It decided that even an attempt to fix prices, which has "a clear potential for harm," could be considered an unfair business practice. This showed how the FTC's power to stop "incipient" unfair practices can be used in other legal situations.

Images for kids

| Precious Adams |

| Lauren Anderson |

| Janet Collins |