Health care reforms proposed during the Obama administration facts for kids

During the time Barack Obama was president, many ideas were suggested to make healthcare better in the United States. These ideas aimed to lower costs and help more people get health insurance. One big change was the Patient Protection and Affordable Care Act, often called the ACA or Obamacare. President Obama signed this law on March 23, 2010. It was a major step to change how healthcare works in the country.

Contents

Why Healthcare Needed Fixing

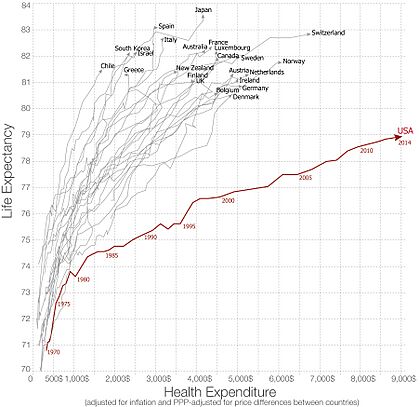

The United States spends much more on healthcare than other rich countries, but people don't always live longer or healthier lives because of it. In 2010, the U.S. spent about 17.6% of its total economy on health, which was much higher than the average of 9.5% for other wealthy countries.

Experts found that a lot of this money was wasted. For example, in 2012, about $750 billion each year in the U.S. was wasted or spent on things that weren't needed. This included money spent on services that weren't necessary, inefficient care, high administrative costs, inflated prices, and fraud.

President Obama wanted to fix these problems. His plan included:

- Using electronic health records to keep information organized.

- Focusing on preventing expensive health problems, like obesity.

- Paying doctors for the quality of care they give, not just how many services they provide.

- Making sure insurance companies couldn't deny coverage to people with existing health conditions.

- Setting limits on how much people had to pay out of their own pocket for healthcare.

- Creating places where individuals and small businesses could easily find and compare health insurance plans.

Lowering Healthcare Costs

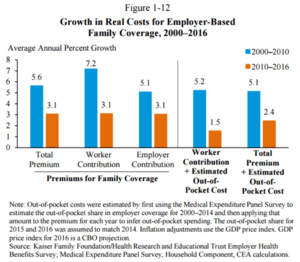

One of the biggest goals of healthcare reform was to lower costs. Even though the rate of cost increases slowed down a bit after 2010, the amount each person spent on healthcare kept going up. This was partly because people had to pay more out of their own pockets, and unemployment during the 2008-2012 recession meant fewer people could afford care.

High healthcare costs also meant that companies spent more on health benefits for their workers instead of giving them higher wages. This affected how much money people took home.

Smart Ways to Improve Healthcare

Many ideas were suggested to make healthcare better and more affordable.

Expert Advice Panels

President Obama suggested creating an "Independent Medicare Advisory Panel" (IMAC). This group of experts would give advice on how to improve Medicare and control costs. The idea was to have a group that could continuously find ways to make the healthcare system work better and save money over time.

Comparing Treatments

Sometimes, doctors order many tests or services that might not be truly needed. This is called "overutilization." Also, for the same health problem, there might be several treatment options with very different costs but similar results.

"Comparative effectiveness research" helps by studying which treatments work best and are most cost-effective. For example, studies showed that if high-cost areas could lower their spending to the level of low-cost areas, nearly 30% of Medicare's costs could be saved without hurting patient health.

Pilot Programs

The Affordable Care Act included many "pilot programs." These are like experiments to test new ways of providing care and paying for it. For example:

- Some programs pay doctors more for giving high-quality care at a lower cost.

- Others give bonuses to hospitals that improve patient results for certain conditions.

- There are programs that encourage medical teams to work together and get one payment for all services related to a specific treatment. This encourages them to be more efficient.

- Some ideas even encourage doctors to form "Accountable Care Organizations" that take responsibility for all their patients' needs, including prevention.

These pilot programs aim to find new ways to improve care and save money over time, similar to how farming became much more efficient in the U.S.

Preventing Illness

One way to save money is to prevent people from getting sick in the first place.

- Preventive Care: Regular doctor visits and screenings can catch problems early, which is often much cheaper than treating a serious illness later. For example, finding cancer early through screening costs much less than treating it at a very late stage.

- Obesity Prevention: Being overweight or obese leads to many expensive health problems. In 2008, obesity-related healthcare costs were estimated at $147 billion. Strategies to prevent obesity include making healthy foods easier to find, encouraging physical activity, and supporting healthy choices.

Avoiding Unnecessary Tests

In 2012, groups of doctors identified 45 common tests that didn't really help patients or could even be harmful. By avoiding these unnecessary tests, healthcare could become both safer and cheaper.

Focusing on Chronic Conditions

A small number of patients with long-lasting (chronic) health conditions, like heart disease or diabetes, account for a large part of healthcare spending. By focusing on better ways to manage these expensive cases, big savings could be made.

Market-Based Ideas

Some people suggested using market ideas to improve healthcare.

Changing Medicare

One idea was to change Medicare (the government health program for older people) into a "voucher system." This would mean older people would get money (a voucher) to buy health insurance from private companies instead of getting it directly from the government.

Insurance Company Rules

Some people believe that allowing more competition among health insurance companies across different states would lower costs. However, others worry that this could lead to companies offering less coverage or denying care to people with health problems.

Doctor Incentives

Many experts argue that the way doctors are paid encourages them to do more tests and procedures, even if they aren't always necessary. This is because doctors are often paid for each service they provide, not for keeping patients healthy. Changing this to pay doctors for the quality of care or for solving a patient's problem efficiently could lead to better and cheaper care.

Medical Lawsuits

The cost of medical malpractice lawsuits (when patients sue doctors for mistakes) is a debated topic. Some argue these lawsuits drive up costs because doctors order extra tests to avoid being sued ("defensive medicine"). However, studies have shown that these costs are a small part of overall healthcare spending. Some suggest using special healthcare courts instead of regular juries to handle these cases.

Doctor and Nurse Shortages

The U.S. is facing a shortage of doctors and nurses, which is expected to get worse as the population ages. This shortage can drive up the cost of care. Ideas to fix this include:

- Creating more training spots for primary care doctors and general surgeons.

- Helping medical students with their debt so they can choose primary care, which often pays less than other specialties.

- Allowing nurses and physician assistants to handle more routine care, freeing up doctors for more complex cases.

Tax Changes

The way health insurance is taxed also affects costs. When employers pay for health insurance, that money isn't taxed as income for the workers. This makes health insurance seem cheaper than it is and encourages people to choose more expensive plans. Some suggest taxing employer-provided health insurance to make people more aware of the true cost and encourage more cost-effective choices.

Government Actions

Fighting Medicare Fraud

Medicare, the government health program for older people, loses billions of dollars each year to fraud and improper payments. This means criminals bill Medicare for services that were never provided. The government has increased efforts to fight this fraud, including more audits and criminal charges.

Insurance Rules

The Affordable Care Act included rules that required most Americans to have health insurance. This was important because the law also said insurance companies could no longer deny coverage to people with pre-existing conditions. To make sure insurance companies could still afford to cover everyone, it was necessary for healthy people to also buy insurance, balancing the costs.

Some people worried that requiring everyone to buy insurance would make it too expensive or limit choices. However, the U.S. Supreme Court later said that the individual mandate (the requirement to have insurance) was constitutional.

Rationing Care

"Rationing" in healthcare means deciding how to share limited healthcare resources. President Obama argued that the U.S. already rations healthcare based on income or if someone has a pre-existing condition, leaving millions uninsured. The debate is not whether rationing happens, but how it should happen. Some argue that a budget should be set for government healthcare spending, and decisions should be made about which services are most important, especially for those at the end of life.

Using Technology Better

Electronic Patient Records

Using electronic health records (EHRs) can greatly reduce healthcare spending and improve care quality. When all doctors and hospitals use integrated EHRs, it helps them share information, avoid repeated tests, and provide better care.

Treatment Databases

Creating databases that track treatments and their results can help identify which treatments work best. This allows doctors to choose the most effective and cost-efficient options.

Payment System Changes

The U.S. has over 1,300 health insurance companies, each with different billing rules. This creates huge administrative costs for doctors and hospitals. A "single-payer" system, where one organization (like the government) handles all payments, could save billions by cutting down on this paperwork and insurance company overhead.

Reducing Imaging Costs

The use of medical imaging, like CT scans and MRIs, grew very quickly. Doctors sometimes ordered these scans because patients insisted, or because they feared lawsuits, or to increase revenue. Changes in how these services are paid for, and higher costs for patients, have helped slow down the growth of these expenses.

Why Reform Was Needed

The main reasons for healthcare reform were:

- High Costs: The U.S. spends more on healthcare than any other developed country, but doesn't always get better results.

- Lack of Coverage: Millions of Americans didn't have health insurance, or their insurance didn't cover enough. This meant they often couldn't get the care they needed.

- Aging Population: As more Baby Boomers get older, the costs for government programs like Medicare and Medicaid will increase greatly, putting a huge strain on the budget.

- Waste and Fraud: A significant amount of healthcare spending is wasted due to unnecessary services, inefficient care, and fraud.

These problems showed that the U.S. healthcare system needed big changes to make it more affordable, fair, and effective for everyone.

Images for kids

| Emma Amos |

| Edward Mitchell Bannister |

| Larry D. Alexander |

| Ernie Barnes |