International Bank Account Number facts for kids

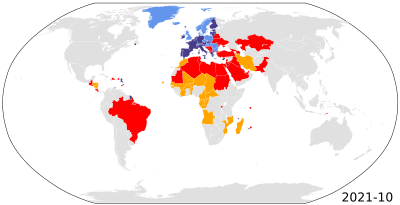

The International Bank Account Number, or IBAN for short, is a special code that helps identify bank accounts around the world. It was created to make sending money between different countries, especially in Europe, much easier and safer. When you use a computer to send money, the IBAN has a built-in check to catch any typing mistakes. Today, many countries in Europe and other parts of the world use IBANs. However, countries like the United States, Australia, and Canada do not use them.

Contents

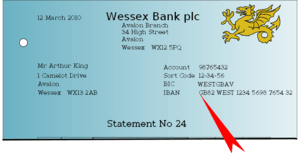

What an IBAN Looks Like

IBANs are usually written in groups of four characters. This makes them easier for people to read and copy correctly.

The first four characters of an IBAN always mean the same thing, no matter where you are. The rest of the IBAN changes depending on the country. For example, here is a British IBAN for a bank account at the National Westminster Bank:

GB29 NWBK 6016 1331 9268 19

Let's break down what each part means:

ccxx bbbb ssss ssaa aaaa aa

- cc shows the country where the bank account is. For example, "GB" means Great Britain, and "FR" means France.

- xx is a special two-digit number called a checksum. A computer uses this number to check if you made any typing errors. If the checksum doesn't match, the computer will warn you.

- The rest of the IBAN follows rules for that specific country. For the British example:

- bbbb is the bank's code. "NWBK" is the code for National Westminster Bank.

- ssss ss is the bank's sort code. In our example, "601613" comes from the sort code "60-16-13".

- xx xxxx xx is the bank account number. In our example, "31926819" is the account number.

How Computers Check an IBAN

Computers can check if an IBAN is valid by doing a special math test. They change the IBAN into a very long number. Then, they divide this number by 97. If the IBAN is correct, the leftover number (called the remainder) will always be 1.

Here are the steps a computer takes:

| Step 1: | Move the first four characters of the IBAN to the very end of the code. |

| Step 2: | Replace any letters with numbers. For example, "A" becomes "10", "B" becomes "11", and so on. Also, remove any spaces. |

| Step 3: | Divide this new, long number by 97. Note down the remainder. |

| Step 4: | If the remainder is 1, the IBAN has passed the check! |

For example, let's check the IBAN "GB29 NWBK 6016 1331 9268 19":

| IBAN: | GB29 NWBK 6016 1331 9268 19. |

||

| Step 1: | Rearrange: | N W B K60161331926819 G B29. |

|

| Step 2: | Convert to number: | 2332112060161331926819161129. |

|

| Step 3: | Calculate remainder: | 2332112060161331926819161129 mod 97 = 1. |

|

| Step 4: | Check result: | The answer is 1, so the IBAN is valid. |

Many computer programs use this method to check IBANs. These programs don't check if the IBAN belongs to a real person. Instead, they check if a real IBAN has been copied correctly. This helps catch common mistakes like:

- Missing a character.

- Adding an extra character.

- Typing a number instead of a letter.

- Typing a letter instead of a number.

- Swapping two characters around.

Who Manages IBANs?

The IBAN was created to make it easier to send money between banks in different EU countries. This was very helpful when people bought things from other countries.

The rules for IBANs were first made by the International Organization for Standardization (ISO) in 1997. These rules were updated in 2003 and again in 2007. The 2007 rules have two parts:

- ISO 13616-1:2007 explains how to create IBANs.

- ISO 13616-2:2007 describes the rules for a special group called the Registration Authority (RA). This group keeps a list of which countries use IBANs. Since 2003, SWIFT has been the Registration Authority.

All bank accounts in the European Union must have an IBAN. Banks in Europe that use the euro currency had to start using IBANs for all customer accounts by 2014. They are no longer allowed to use older national bank account systems.

IBANs are also used in many developing countries, including Brazil, Pakistan, Turkey, and several countries in the Middle East.

Images for kids

See also

In Spanish: International Bank Account Number para niños

In Spanish: International Bank Account Number para niños

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |