Online banking facts for kids

Online banking, also known as internet banking or web banking, lets people manage their money using a bank's website or mobile app. It's like having a bank branch right on your computer or phone! This way of banking has become super popular since around 2010.

Online banking helps banks save money because they don't need as many physical branches. For customers, it's really handy because you can do banking anytime, anywhere. You can even bank when regular branches are closed, like at night or on weekends. With online banking, you can check how much money you have, see what you've spent, pay bills, and move money between accounts. Some banks, called "direct banks" or "neobanks," only exist online and don't have physical branches at all.

Contents

A Look Back: History of Online Banking

Early Steps

Before the internet, people could do some banking from a distance. This started in the early 1980s using phones or special computer terminals. The word "online" became popular then. It meant connecting to a bank's computer system using phone lines.

Computers and Banking

The very first home banking service for regular people started in December 1980. A bank in Tennessee worked with Radio Shack to let customers check their accounts using a special computer. You could pay bills, check balances, and even apply for loans. Other big banks in New York also started offering similar services in 1981. These early systems used something called "videotex." It was popular in countries like France and the UK.

The Internet Arrives

In the late 1990s, the internet became widely available. Many banks realized that offering banking services online was a great idea. It helped them save money and made banking much easier for customers. In 1995, Wells Fargo was one of the first U.S. banks to let customers access their accounts on its website.

At first, not many people used online banking. But by the early 2000s, it started to grow quickly. More and more people began to use it to manage their money. By 2018, about 61% of people in the U.S. were using digital banking. In some European countries like Norway, over 90% of people use it! This shows how much online banking has changed how we handle our money.

Online Banking Around the World

Online banking spread across the globe at different times.

- In the United Kingdom, online banking began in 1982 with the Homelink service.

- In the United States, early services like "Pronto" appeared in 1983.

- France launched its online banking services in 1988 using special Minitel terminals.

- Japan saw its first online banking service in 1997.

- In India, ICICI Bank introduced internet banking in 1998.

- Australia started offering online banking to customers in 1995.

- Canada had its first full online bank, mbanx, in 1996.

- Ukraine introduced online banking for individuals around 2000.

- In Slovenia, online banking became available in 1997.

- The Cook Islands introduced online banking in 2015.

- Hong Kong started issuing licenses for "virtual banks" (banks without physical branches) in 2018.

How Does Online Banking Work?

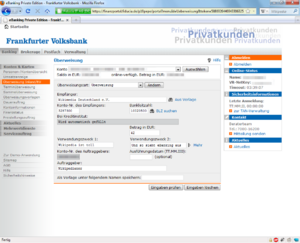

To use online banking, you first need to sign up with your bank. They will give you a special customer number and help you set up a password. Then, you visit your bank's secure website. You enter your customer number and password to log in.

Once you are logged in, you can do many things. You can check your account balance. You can see a list of your recent transactions. You can pay bills online. You can also move money between your own accounts or send money to other people's accounts. Banks often have limits on how much money you can transfer. You can also download copies of your bank statements. Some banks even let you order new checkbooks or report a lost credit card.

Keeping Your Money Safe Online

Keeping your money safe online is super important. Banks use many security steps to protect your information. They use secure websites, which means your information is encrypted. This makes it very hard for others to see your private details.

How Banks Protect You

Banks use different ways to make sure it's really you logging in.

- PIN/TAN System: You use a Personal Identification Number (PIN) to log in. Then, for transactions, you use a Transaction Authentication Number (TAN). These TANs are like one-time passwords. They can be sent to you in a list or generated by a special device called a security token. Some banks send the TAN to your mobile phone via SMS. This is called "SMS TAN." The message usually includes details of the transaction. This helps you check if everything is correct.

- Digital Signatures: Some online banking systems use digital signatures. This means your transactions are signed and encrypted using special digital keys.

Common Online Dangers

Even with bank security, you need to be careful. Some people try to trick you to steal your login details or TANs.

- Phishing: This is when someone tries to trick you with fake emails or websites. They pretend to be your bank to get your login information.

- Malware: This is harmful software, like a "Trojan horse," that can get onto your computer. It might try to steal your information or change what you see on your screen. For example, it could change the account number when you are trying to send money.

Staying Safe: Your Role

You can do a lot to protect yourself:

- Always use a computer or phone with an updated operating system.

- Be very careful about emails or messages asking for your bank details. Your bank will almost never ask for your password or TANs by email.

- Always check the website address to make sure it's your real bank's site. Look for "https://" at the beginning of the address.

- Never click on suspicious links.

- Consider using "two-factor authentication" (2FA) if your bank offers it. This means you need two ways to prove who you are, like a password and a code from your phone.

- If something feels wrong or too good to be true, it probably is. Always double-check with your bank directly if you are unsure.

See also

- Contactless payment

- Direct bank

- Electronic funds transfer

- Mobile banking

- Neobank

- Open banking

- SMS banking

- Telephone banking

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |