Poor rate facts for kids

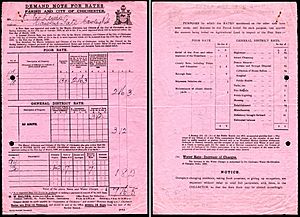

The poor rate was a special tax in England and Wales. It was collected from people who owned property in each local area, called a parish. The money from this tax was used to help poor people. This system was part of the Old Poor Law and later the New Poor Law. In the 1920s, the poor rate became part of a bigger local tax. It's a bit like today's Council Tax, which helps pay for local services.

Contents

What Was the Poor Rate?

Back in 1601, a law called the Poor Relief Act 1601 brought together older rules about helping the poor. This law also started the system of the poor rate. Each year, local leaders in every parish would meet. This meeting was called a vestry. They would decide how much the poor rate should be.

They also chose a person called an overseer of the poor. This person's job was to collect the tax money. Local judges, known as justices of the peace, would check the money records. They did this at special meetings called quarter sessions.

Changes to the Poor Rate System

Over time, the poor rate system changed. For example, people only paid the tax for property within their own parish. This meant that if poor people moved from one parish to another, they might not get help. A law in 1662, the Poor Relief Act 1662, made this idea of "settlement" stronger. It meant that parishes were mainly responsible for their own poor.

New Ways to Collect the Tax

In 1834, a new law, the Poor Law Amendment Act 1834, changed who collected the poor rate. The local vestry no longer did it. Instead, groups called poor law guardians took over. They still collected the tax for each parish. Even though many parishes were grouped together into "unions," each parish could still have a different tax rate. This depended on how much money they needed to help their poor.

Defining Local Areas

During the 1800s, some confusing parts of the parish system were fixed. For instance, some parishes were divided into smaller areas that acted like separate parishes. A law in 1866, the Poor Law Amendment Act 1866, helped define what a civil parish was. A key rule was that a civil parish was an area that set its own poor rate.

The Poor Rate in London

London had its own special rules for the poor rate. In 1867, the Metropolitan Poor Act 1867 created a poor rate for the whole London area. Later, in 1894, the London (Equalisation of Rates) Act 1894 made things fairer. It meant that richer parishes in London would help pay for the poor rate in less wealthy areas. This was important because poorer areas often had more people needing help.

When the Poor Rate Ended

The system used for the poor rate became the basis for other local taxes. For example, a general county tax started in 1738 using this system.

The poor rate as a separate tax ended in 1925. It was combined with other local taxes by the Rating and Valuation Act 1925. By 1930, parishes and guardians no longer set or collected these taxes. Instead, local districts and boroughs became the main groups responsible for taxes. This system is similar to how billing authorities today set and collect Council Tax.