Provisions of the Affordable Care Act facts for kids

The Affordable Care Act (ACA) is a big law in the United States about healthcare. It's sometimes called "Obamacare." This law has many parts that started at different times, from 2010 all the way to 2020. The main goal of the ACA was to make health insurance and healthcare more affordable and available for more people.

Key Changes Over Time

Changes Starting in 2010

- New Medicine Approvals: The Food and Drug Administration (FDA) got new power to approve cheaper versions of special medicines called "biologics." This helps make these important drugs more available.

- Research for Better Care: A new group, the Patient-Centered Outcomes Research Institute, was created. Their job is to study different medical treatments to see which ones work best. They help doctors and patients make smart choices about care.

- Focus on Prevention: A special fund was set up to help prevent diseases and promote good health. There's also a council that works on a national plan for health and prevention.

- Calorie Information: Many restaurants and food places with 20 or more locations now have to show how many calories are in their food on menus. This helps people make healthier choices.

- Help for Young Adults: Young people could stay on their parents' health insurance plans until their 26th birthday. This was a big change, helping many young adults stay covered.

- No Lifetime Limits: Insurance companies could no longer put a dollar limit on how much they would pay for a person's essential health benefits over their lifetime.

- Help for Pre-Existing Conditions (Kids): For children under 19, insurance companies could not refuse to cover them or charge them more because they had a health problem before getting insurance.

- Free Preventive Care: New insurance plans had to cover important preventive care, like check-ups and screenings, without extra costs (like co-pays or deductibles).

- No Dropping Sick People: Insurance companies were stopped from canceling someone's policy just because they got sick.

- Tanning Tax: A 10% sales tax was added to indoor tanning services.

Changes Starting in 2011

- Insurance Spending Rules: Insurance companies had to spend a certain percentage of the money they collected from premiums on actual healthcare costs and claims. For most plans, this was 80% or 85%. If they didn't, they had to give money back to their customers. This is called the 'Medical Loss Ratio'.

- Rate Review: Health insurance companies had to tell the public when they wanted to raise their rates by 10% or more. This helped make insurance prices more open and fair.

Changes Starting in 2012

- Preventive Care for Women: New health plans had to cover specific preventive services for women, like mammograms and screenings for certain conditions, without extra costs.

- Hospital Payment Changes: Hospitals that had too many patients coming back soon after being discharged (readmissions) started to get lower payments from Medicare. This was to encourage hospitals to provide better care the first time.

Changes Starting in 2013

- Healthcare Spending Limits: There was a new yearly limit on how much people could put into special savings accounts (like Flexible Spending Accounts) for healthcare costs.

- Easier Comparisons: Insurance companies had to use simpler, more standard paperwork. This made it easier for people to compare different health plans and understand what they were buying.

Changes Starting in 2014

- No Denials for Pre-Existing Conditions: A very important change: insurance companies could no longer deny coverage or charge more to anyone based on their health history or gender.

- Health Insurance Marketplaces: New online marketplaces (called "exchanges") were set up in each state. People could go to these websites to compare and buy health insurance plans.

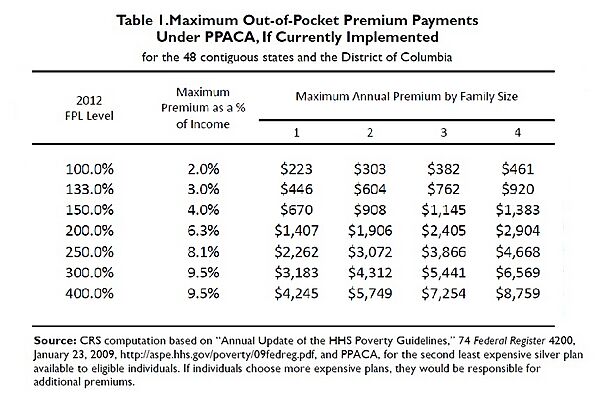

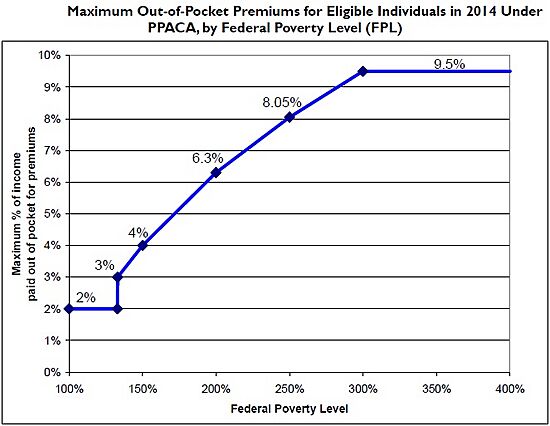

- Help with Costs: Many people who bought insurance through these marketplaces could get financial help (tax credits) to lower their monthly payments, depending on their income.

- Medicaid Expansion: In states that chose to participate, Medicaid (a government health program for low-income people) was expanded to cover more adults.

- Individual Mandate (Ended in 2019): Most people were required to have health insurance or pay a tax penalty. There were some exceptions. This part of the law was later removed in 2019.

- Employer Mandate (Delayed): Large employers (with 50 or more full-time employees) were required to offer health insurance to their workers or pay a penalty. This rule was delayed and started later for some employers.

- Waiting Period Limits: Health plans could not make new employees wait longer than 90 days before their health coverage started.

| Persons in Family Unit | 48 Contiguous States and D.C. | Alaska | Hawaii |

|---|---|---|---|

| 1 | $11,670 | $14,580 | $13,420 |

| 2 | $15,730 | $19,660 | $18,090 |

| 3 | $19,790 | $24,740 | $22,760 |

| 4 | $23,850 | $29,820 | $27,430 |

| 5 | $27,910 | $34,900 | $32,100 |

| 6 | $31,970 | $39,980 | $36,770 |

| 7 | $36,030 | $45,060 | $41,440 |

| 8 | $40,090 | $50,140 | $46,110 |

| Each additional person adds |

$4,060 | $5,080 | $4,670 |

Changes Starting in 2015

- Employer Mandate (Phase 1): The rule requiring large employers (with 100 or more employees) to offer health insurance officially began.

Changes Starting in 2016

- Employer Mandate (Phase 2): The employer mandate expanded to include businesses with 50 to 99 employees.

Changes Starting in 2017

- State Innovation Waivers: States could apply for special permission to try out their own healthcare plans, as long as they met certain rules, like covering just as many people and being just as affordable as the ACA.

Changes Starting in 2018

- Preventive Care for All Plans: All health insurance plans, even older ones, had to cover approved preventive care and check-ups without extra costs.

Changes Starting in 2019

- Medicaid for Former Foster Youth: Medicaid coverage was extended to young adults who had been in foster care for at least six months and were under 25 years old.

- Individual Mandate Penalty Removed: The tax penalty for not having health insurance was reduced to zero.

Changes Starting in 2020

- Medicare Part D "Donut Hole" Closed: The gap in Medicare prescription drug coverage, often called the "donut hole," was completely closed. This meant people on Medicare would pay less for their medications once they reached a certain spending amount.

Temporary Waivers

During the first few years of the ACA, some employers who offered very basic, low-cost insurance plans (called "mini-med" plans) were given temporary permission to keep their plans, even if they didn't meet all the new ACA rules right away. This was to make sure people didn't suddenly lose their coverage while the new marketplaces were being set up.

Delays in Rules

Some parts of the ACA, like the rule for employers to offer health insurance, were delayed by the government. This was done to give businesses more time to get ready for the new requirements and to make sure the changes happened smoothly. These delays sometimes caused debates about who had the power to change the law's timeline.

See also

- HealthCare.gov

- Health Care and Education Reconciliation Act of 2010