Fiscal policy facts for kids

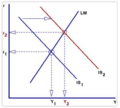

When a government uses taxes and its own spending to guide the country's economy, this is called fiscal policy. It's a key idea in how countries manage their money. A famous thinker named John Maynard Keynes helped develop this idea.

Governments use fiscal policy to change several important things:

- How much people want to buy and sell (this is called aggregate demand).

- How the country's resources (like materials and workers) are used.

- How money and wealth are shared among people.

There are two main types of taxes. Some taxes are on the money people earn or businesses make (like income tax). Other taxes are on specific activities or goods, often called excise taxes (like a tax on soda). If the government lowers excise taxes, people might buy more things, which can make the economy grow. Changes in welfare programs (money or help given to people) also affect how the economy works.

How Fiscal Policy Works

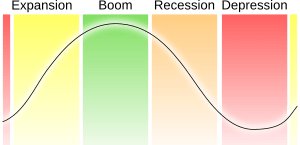

Fiscal policy usually works in cycles. This means that when the government changes taxes or spending, it takes some time to see the effects. It's not an instant change.

Different Ideas About Fiscal Policy

Not everyone agrees that governments should use fiscal policy to control the economy. For example, a group of thinkers called Monetarists believe that keeping money's value steady is the most important goal. They think the government should focus on that, rather than constantly changing taxes and spending.

Images for kids

See also

In Spanish: Política fiscal para niños

In Spanish: Política fiscal para niños