International Finance Corporation facts for kids

IFC logo

|

|

IFC headquarters building, designed by architect Michael Graves

|

|

| Formation | July 20, 1956 |

|---|---|

| Type | Development finance institution |

| Legal status | Treaty |

| Purpose | Private sector development, Poverty reduction |

| Headquarters | Washington, D.C., United States |

|

Membership

|

186 countries |

|

Managing Director

|

Makhtar Diop |

|

Parent organization

|

World Bank Group |

| Website | ifc.org |

The International Finance Corporation (IFC) is a global financial group. It is based in Washington, D.C., USA. The IFC is part of the World Bank Group. Its main goal is to help businesses grow in countries that are still developing.

The IFC offers different services. These include helping with investments and giving advice. They also manage money for companies. The IFC started in 1956. It was created to help countries grow their economies. It does this by investing in private businesses. This helps reduce poverty and create jobs. The IFC wants to help people escape poverty. They aim to improve living standards for everyone. They do this by finding money for private companies.

The IFC provides loans and helps companies with their money. They also advise businesses. This advice helps companies make good decisions. It also helps them think about their impact on the environment and society. An independent group checks the IFC every year. The IFC is financially strong. It received top ratings from two credit agencies in 2018.

Contents

How the IFC Started

The World Bank and International Monetary Fund were created in 1944. This happened at a meeting called the Bretton Woods conference. The World Bank started working in 1946. At first, it was just the International Bank for Reconstruction and Development.

Robert L. Garner joined the World Bank in 1947. He believed private businesses could help countries grow. In 1950, Garner and his team suggested a new organization. This group would invest in private companies in developing countries. The U.S. government liked this idea. They wanted an international group to work with the World Bank. This group would invest in private businesses. It would not need guarantees from governments. It also would not manage the companies it invested in.

In 1955, World Bank President Eugene R. Black described the IFC. He said it would only invest in private firms. It would not give loans to governments. Also, it would not manage the projects it invested in.

The idea was debated in the U.S. Some businesses were worried about public ownership of private firms. But in 1956, the International Finance Corporation began. Robert Garner led the new organization. It started with 12 staff members. It had $100 million in capital. In 1957, the IFC made its first investment. It gave a $2 million loan to a company in Brazil. This company was connected to Siemens & Halske.

In 2007, the IFC bought part of an Indian financial company. In December 2015, the IFC helped Greek banks. They bought 150 million euros worth of shares in four banks.

The IFC has also partnered with Mohinani Group. This partnership supports plastic recycling in Ghana and Nigeria. The IFC will provide a $37 million loan. This loan will help build new recycling plants. Each plant will make 15,000 tons of recycled plastic every year. This will reduce the need for new plastics. It will also lower greenhouse gas emissions. This project is expected to create over 4,000 jobs. It will also save about $21 million in imports each year for each country. The IFC will also offer advice. This advice will help improve environmental and social practices. This project fits with the IFC's goals. It supports climate change action and economic growth.

How the IFC is Managed

The IFC is owned by its member countries. These countries also govern it. But the IFC has its own leaders and staff. They handle its daily work. It is like a company. Its shareholders are the member governments. They provide money and vote on important matters.

At first, the IFC was closely linked to the World Bank Group. Later, it became separate. It was allowed to make its own investment decisions. It also became financially independent.

The IFC is governed by its Board of Governors. This board meets once a year. It has one governor from each member country. Often, this is the country's finance minister. The governors give most of their power to the board of directors. This board handles daily business.

The IFC's Board of Directors has 25 executive directors. They meet regularly at the IFC's headquarters. The President of the World Bank Group leads this board. These directors represent all 186 member countries. When they vote, each director's vote counts differently. It depends on the total money from the countries they represent.

Currently, Makhtar Diop leads the IFC. He became the Managing Director in February 2021. Before this, he worked for the World Bank. He helped build sustainable infrastructure in developing countries.

The IFC works with other World Bank Group organizations. But it usually operates on its own. It is a separate group with its own legal and financial rules. The IFC has over 3,400 employees. Half of them work in offices in different member countries.

What the IFC Does

Investment Services

The IFC offers many investment services. These include loans and equity investments. They also help with trade finance. They arrange loans from many banks. They offer special financial products. They help clients manage risks. They also manage money for the IFC itself. In 2010, the IFC invested $12.7 billion. This was for 528 projects in 103 countries. About 39% of this went to 255 projects. These projects were in 58 countries that needed the most help.

The IFC gives loans to businesses and private projects. These loans usually last seven to twelve years. They set up repayment plans for each loan. This helps meet the borrower's needs. The IFC can give longer loans if a project needs it. Leasing companies and financial groups can also get loans.

The IFC used to give loans in major international currencies. Now, they try to give loans in local currencies. In 2010, their loans were in 25 local currencies. In 2011, this grew to 45 local currencies. Developing local financial markets is a key goal for the IFC. They have strict rules for managing their money. In 2010, the IFC committed about $5.7 billion in new loans. In 2011, it was $5 billion.

At first, the IFC could only give loans. In 1961, they were allowed to invest in companies directly. Their first direct investment was in 1962. They bought a share in FEMSA, a Spanish auto parts maker. The IFC invests in companies directly or through special funds. They usually own 5% to 20% of a company. The IFC's direct investment portfolio is about $3.0 billion. It is spread across 180 funds. These funds are in Africa, Asia, Europe, and Latin America. The IFC likes to invest for a long time. This is usually 8 to 15 years. Then, they sell their shares. This often happens when a company first sells shares to the public. When the IFC invests, it does not manage the company.

The IFC has a Global Trade Finance Program. This program helps reduce risks for international trade. It guarantees payments for over 200 banks. These banks are in more than 80 countries. This helps make international deals safer. In 2010, the IFC issued $3.46 billion in guarantees. Over half of these were for countries needing the most help. In 2011, they issued $4.6 billion in guarantees. In 2009, the IFC started another program. It is called the Global Trade Liquidity Program. This program helps with trade among developing countries during crises. By 2011, this program had helped with over $15 billion in trade.

The IFC also has a Syndicated Loan Program. This program brings together money for development projects. It started in 1957. By 2011, it had brought about $38 billion. This money came from over 550 financial groups. It went to projects in over 100 developing markets. In 2011, the IFC arranged $4.7 billion in syndicated loans. This was double the amount from 2010.

The IFC uses special financial products. These help clients who cannot easily get low-cost financing. These products include partial credit guarantees. They also use Islamic finance. In 2010, the IFC committed $797 million to these products. For companies seen as high risk, the IFC helps. They make assets with steady cash flows more attractive to investors. This helps improve the companies' credit.

The IFC offers financial tools to its clients. These tools help manage risks. For example, they help with interest rate changes. They also help with changes in currency exchange rates. The IFC acts as a link. It connects businesses in developing markets with international financial experts. This helps more companies manage their risks.

The IFC borrows money from international markets. This money is used to fund its lending activities. It is often one of the first groups to issue bonds. They also do swaps in local currencies in developing markets. In 2010, the IFC borrowed $8.8 billion. In 2011, it was $9.8 billion. The IFC also manages its money carefully. This helps maximize returns. It also ensures money is always available for investments.

Advisory Services

In 2011, a report looked at the IFC's work. It found that investments did well and helped reduce poverty. But it suggested the IFC should be clearer about its goals. This would help them understand their impact better. In 2011, the IFC's total investments were $18.66 billion. They spent $820 million on advice for 642 projects. They also had $24.5 billion in liquid assets.

Besides investing, the IFC gives advice. This advice helps companies make decisions. It covers business, environmental, and social impacts. It also helps with sustainability. The IFC advises on how companies are run. They help with management skills and growth. They also help with corporate responsibility.

The IFC focuses on encouraging reforms. These reforms make it easier to do business. They also make trade more friendly. This helps countries create a good environment for investment. They also advise governments on building infrastructure. They help with partnerships between public and private groups. The IFC tries to guide businesses toward more sustainable practices. This includes good governance. It also means supporting women in business. And it means actively fighting climate change. The IFC has said that cities in developing markets could attract over $29 trillion. This money could go to climate-related projects by 2030.

Asset Management Company

The IFC created IFC Asset Management Company LLC (IFC AMC) in 2009. This company manages all capital funds. These funds are invested in developing markets. The AMC manages money from the IFC. It also manages money from other groups. These include government funds and pension funds.

Even though the IFC owns it, the AMC makes its own investment decisions. It has a duty to manage its four funds responsibly. It also aims to bring in more money for IFC investments. It can make investments that the IFC itself cannot. As of 2011, the AMC managed several funds. These included the IFC Capitalization Fund (Equity) Fund, L.P. and the IFC Capitalization (Subordinated Debt) Fund, L.P. It also managed the IFC African, Latin American, and Caribbean Fund, L.P. (IFC ALAC Fund). And it managed the Africa Capitalization Fund, Ltd.

The IFC Capitalization (Equity) Fund had $1.3 billion in equity. The IFC Capitalization (Subordinated Debt) Fund was worth $1.7 billion. The IFC ALAC Fund started in 2010 and was worth $1 billion. By March 2012, the ALAC Fund had invested $349.1 million in twelve businesses. The Africa Capitalization Fund started in 2011. It invests in commercial banks in Africa. By March 2012, it had committed $181.8 million. As of 2018, Marcos Brujis was the CEO of the AMC.

Financial Health of the IFC

The IFC prepares its financial reports using U.S. accounting rules. These reports are checked by KPMG. In 2011, the IFC reported $2.18 billion in income. This was before grants to countries needing help. This was up from $1.95 billion in 2010. The increase was due to higher earnings from investments. It was also from higher service fees. The IFC's total capital was $20.3 billion in 2011. Of this, $2.4 billion came from member countries.

The IFC's financial ratings are very high. It received AAA ratings from Standard & Poor's in December 2012. It also got AAA from Moody's Investors Service in November 2012. These ratings mean the IFC is very strong financially. It has enough money and manages it carefully. It invests in many different places. It is also seen as a preferred creditor. This is because it is part of the World Bank Group.

Helping the Environment and Society

Since 2009, the IFC has focused on specific development goals. These goals include:

- Increasing sustainable farming opportunities.

- Improving healthcare and education.

- Helping small businesses get financing.

- Improving infrastructure.

- Helping small businesses grow their income.

- Investing in projects that help with climate change.

The IFC has a Sustainability Framework. This shows its commitment to sustainable development. It is also part of how they manage risks. The IFC's environmental and social rules are widely used. Companies, investors, and governments use them as standards. These rules include levels and measures for environmental health and safety. These are usually acceptable to the World Bank Group. They are also considered achievable with current technology.

Green Buildings in Developing Countries

The IFC created a certification system called EDGE. This stands for "Excellence in Design for Greater Efficiencies." It is for fast-growing developing markets. The IFC and the World Green Building Council are working together. They want to speed up the growth of green buildings. Their goal is to have 20% of the property market be green buildings in seven years. A building gets certified when it meets the EDGE standard. This means it uses 20% less energy, water, and materials than regular homes.

More to Explore

- Environment, Health and Safety

- Global Environment Facility

- Multilateral Investment Guarantee Agency

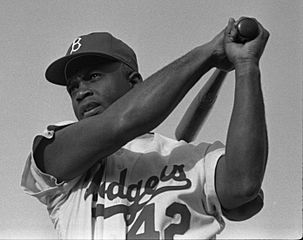

| Jackie Robinson |

| Jack Johnson |

| Althea Gibson |

| Arthur Ashe |

| Muhammad Ali |