Management accounting facts for kids

Management accounting, also known as managerial accounting, is a special type of accounting. It gives important financial information to managers inside a company. This information helps them make good decisions about how to run the business. It helps them plan, control, and manage the company better.

Unlike financial accounting, which looks at past events for outside people like investors, management accounting is different:

- It mostly looks to the future, not the past.

- It helps with making general decisions, not just specific past situations.

- It's made for managers inside the company, not for shareholders or the public.

- The information is usually private and used only by the management team.

- It's created based on what managers need, often using management information systems. It doesn't follow strict public accounting rules.

Contents

What is Management Accounting?

The Institute of Management Accountants (IMA) says that management accounting is a job where people help managers make decisions. They create systems for planning and checking how well the company is doing. They also give expert advice on financial reports and controls. All of this helps managers create and follow the company's plans.

The American Institute of Certified Public Accountants (AICPA) explains that management accounting covers three main areas:

- Strategic Management: This means helping management accountants become key partners in the company's big plans.

- Performance Management: This involves improving how business decisions are made and how the company's performance is managed.

- Risk Management: This is about finding, measuring, managing, and reporting risks that could stop the company from reaching its goals.

The Institute of Certified Management Accountants (ICMA) says that a management accountant uses their skills to prepare financial information. This information helps managers set policies and plan and control how the company operates. Management accountants are seen as "value-creators." They focus on the future and making decisions that will help the company grow. They are less focused on just recording past events. Their knowledge can come from many areas like information management, marketing, and pricing.

Old Ways vs. New Ways of Costing

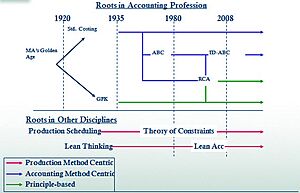

The difference between old and new accounting methods can be seen in a timeline of costing approaches. This timeline was shown at the Institute of Management Accountants conference in 2011.

Traditional Standard Costing (TSC) has been used since the 1920s. It is a main method in Cost Accounting. It's used for financial reports to value things like the cost of goods sold and inventory. Traditional costing must follow general accounting rules (like GAAP in the US). This means it often helps meet financial reporting needs more than management needs. These older methods only look at costs based on how much is produced or sold.

In the late 1980s, many people criticized accounting practices. They felt that management accounting hadn't changed much in 60 years. This was true even though the business world had changed a lot. Professional accounting groups then worked hard to develop new skills for management accountants.

Variance analysis is a way to compare actual costs with planned costs. It looks at things like raw materials and labor used during production. Most factories still use some form of variance analysis. But now, it's often used with newer methods. These include life cycle cost analysis and activity-based costing. These newer methods are designed for today's business world.

Life-cycle costing understands that managers can influence a product's cost most when it's still being designed. Small changes in the design can lead to big savings later on.

Activity-based costing (ABC) recognizes that in modern factories, many costs come from "activities." These activities include things like how many times production runs or how much equipment is sitting idle. So, controlling costs means making these activities more efficient. Both life-cycle costing and activity-based costing understand that avoiding problems (like machine breakdowns) is more important than just cutting raw material costs. Activity-based costing also looks at activities that cause costs, not just direct labor.

One of the newer accounting methods is Resource consumption accounting (RCA). The International Federation of Accountants (IFAC) sees RCA as a very advanced costing method. It helps companies understand costs directly from how resources are used. It can also measure the cost of unused resources. RCA combines good ideas from German accounting (Grenzplankostenrechnung) with activity-based drivers. With RCA, resources and their costs are seen as key to understanding costs and helping managers make decisions.

How Management Accountants Help Companies

Management accountants have two main roles. They are strategic partners who provide financial and operational information for decisions. They also manage their business team while reporting to the company's main finance department.

The tasks they do, like forecasting, planning, and checking costs, are important to both the business team and the finance department. For example, developing costs for new products or analyzing how profitable clients are, is very useful for the business team. On the other hand, preparing certain financial reports or checking financial data is more useful for the main finance team. This team collects financial information from all parts of the company.

Information technology (IT) costs can be a big expense for companies that earn money from information. These include banks, publishing houses, and telecom companies. IT costs are often the biggest expense after salaries and property costs. Management accountants work closely with the IT department to make sure IT costs are clear and understood. This is called IT Cost Transparency.

Many people believe that financial accounting is a first step to becoming a management accountant. Management accountants help drive the success of the business. Financial accounting is more about following rules and recording history.

A Different Idea

A less common idea about management accounting is that it's not always neutral. Some think it can be a way for managers to control workers by watching them. This idea sees management accounting information as a tool. It helps managers see the whole inside structure of the company to help them control things.

Key Ideas in Management Accounting

Cost Accounting

Cost accounting is a very important part of managerial accounting. It focuses on recording and analyzing the costs of a company's operations.

Lean Accounting

In the 1990s, books were written about accounting in "lean enterprises." These are companies that use methods like the Toyota Production System. The term "lean accounting" was created then. These books argued that old accounting methods were better for mass production. They didn't work well for "just-in-time" manufacturing and services. This idea became popular at the Lean Accounting Summit in 2005.

Resource Consumption Accounting (RCA)

Resource Consumption Accounting (RCA) is a detailed and complete management accounting method. It gives managers information to help them make the best decisions for the whole company. RCA started around 2000 and was developed further by CAM-I (Consortium for Advanced Manufacturing–International).

Throughput Accounting

A newer idea in managerial accounting is throughput accounting. It understands that different parts of modern production processes depend on each other. It helps measure how much each product, customer, or supplier contributes, especially when resources are limited.

Transfer Pricing

Management accounting is used in many different industries. The specific rules can change depending on the industry. For example, transfer pricing is used in manufacturing, but it's also used in banking. It's a basic idea used to give value and income to different parts of a business. In banking, transfer pricing is how the bank's interest rate risk is given to different funding sources. The bank's treasury department charges business units for using the bank's money when they make loans. They also give credit to business units that bring in deposits. This process is mainly for loans and deposits, but it applies to all assets and liabilities of the business unit. After transfer pricing and other management accounting entries, business units can create financial results. These results are used by people inside and outside the bank to see how well they are doing.

Learning More About Management Accounting

There are many ways to keep learning about management accounting. Just like Certified Public Accountants (CPAs) need to take classes every year, Certified Management Accountants (CMAs) have similar requirements. Some large companies, like those in the "Fortune 500" list, have their own libraries with training materials.

There are also many journals, online articles, and blogs. The journal Cost Management and the Institute of Management Accounting (IMA) website are good sources. They include publications like Management Accounting Quarterly and Strategic Finance. It's clear that management accounting is very important for any organization.

Tasks Management Accountants Do

Here are some of the main tasks and services that management accountants perform. The difficulty of these tasks depends on the accountant's experience.

- Analyzing rates and volumes

- Developing business measures

- Creating price models

- Checking product profitability

- Reporting by location or customer group

- Creating sales management scorecards

- Analyzing costs

- Cost-volume-profit analysis

- Analyzing costs over a product's entire life

- Analyzing how profitable clients are

- Making IT costs clear

- Capital budgeting (deciding on big investments)

- Analyzing whether to buy or lease something

- Strategic planning (long-term company plans)

- Giving advice on strategic management

- Presenting and sharing financial information internally

- Sales forecasting (predicting future sales)

- Financial forecasting (predicting future finances)

- Creating annual budgets

- Cost allocation (assigning costs)

Related Job Titles

Here are some professional qualifications and certifications in accounting:

- Management Accountancy Qualifications

- Certified Practicing Accountant (CPA Australia)

- Chartered Global Management Accountant

Methods Used

- Resource Consumption Accounting

- Standard costing

- Throughput accounting

- Transfer pricing

Images for kids

See also

In Spanish: Contabilidad de gestión para niños

In Spanish: Contabilidad de gestión para niños

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |