Quantitative easing facts for kids

Quantitative easing (often called QE) is a special way a country's main bank, called a central bank, tries to help the economy. It's like the captain of a ship, making sure the economy stays on course. When the economy is struggling, the central bank can use different tools to help.

One of these tools is QE. It involves the central bank creating new money. This money isn't printed as physical cash. Instead, it's added to the accounts of banks and other financial groups. The central bank then uses this new money to buy things like government bonds from these banks.

Government bonds are like IOUs that the government sells to get money. When the central bank buys these bonds, it gives the banks more money. This extra money makes it easier for banks to lend to people and businesses. The goal is to encourage more borrowing and spending, which can help the economy grow.

Contents

Why Central Banks Use QE

Central banks usually use quantitative easing when the economy is in trouble. This might be during a recession, which is when the economy slows down a lot. They also use it when inflation is very low. Inflation is when prices for things like food and gas go up.

When interest rates are already very low, close to zero, it's hard for the central bank to lower them more. Lowering rates usually helps the economy. This is where quantitative easing comes in. By creating new money and buying assets, the central bank hopes to make borrowing cheaper. This encourages more lending and spending.

How Quantitative Easing Works

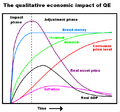

Quantitative easing helps the economy in several ways:

- Credit Channel: When banks get more money from QE, it becomes easier and cheaper for them to lend. This helps businesses grow and allows people to buy things like homes or cars.

- Portfolio Rebalancing: The central bank buys safe government bonds. This can make investors look for other types of investments, like company stocks or bonds. This can lower interest rates on those assets, making it cheaper for companies to borrow.

- Exchange Rate: QE can affect a country's money value compared to other countries. When more money is created, a country's currency can become less valuable. This can make the country's goods cheaper for buyers in other countries, boosting exports.

- Fiscal Effect: By lowering interest rates on government bonds, QE makes it cheaper for the government to borrow. This can allow the government to spend more on things like roads or schools. This spending can help the economy grow.

- Boosting Asset Prices: If a central bank buys bonds from a pension fund, the fund might invest that money in stocks. More demand for stocks can make their prices go up. This can make people and businesses who own stocks feel richer, encouraging them to spend more.

- Signaling Effect: QE can show everyone that the central bank is serious about helping the economy. This can make people more confident, leading to more investment and spending.

History of QE

Quantitative easing is a fairly new tool. Several countries have used it in recent years.

Japan (2001-2006)

The Bank of Japan was the first central bank to use QE. They used it in the early 2000s to fight deflation. Deflation is when prices keep going down.

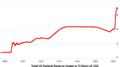

United States (2008-2014, 2020)

The Federal Reserve, which is the central bank of the United States, used QE during and after the 2007-2008 financial crisis. They used it again in 2020 because of the COVID-19 pandemic.

- November 2008: The Federal Reserve started buying $600 billion in mortgage-backed securities.

- November 2010: The Fed announced a second round of QE, buying $600 billion of Treasury securities.

- September 2012: A third round of QE was announced. The Fed bought $40 billion per month of agency mortgage-backed securities.

- March 2020: The Federal Reserve began its fourth QE operation. They announced about $700 billion in new asset purchases to help the US economy during the COVID-19 pandemic.

United Kingdom (2009-2020)

The Bank of England also used quantitative easing. This helped the UK economy recover from the financial crisis.

Eurozone (2015-2018, 2019-2020)

The European Central Bank (ECB) started a large QE program in 2015. Their goal was to fight deflation and help the Eurozone economy.

Switzerland

The Swiss National Bank also used quantitative easing.

Sweden

Sveriges Riksbank, Sweden's central bank, started quantitative easing in February 2015.

Does QE Always Work?

Experts and economists debate if quantitative easing always works. Some studies suggest it can help lower interest rates and boost economic growth. Other studies are not as clear.

One possible problem with QE is that it could lead to higher inflation if too much money is created. On the other hand, it might not work well if banks don't want to lend money. It also might not work if people and businesses don't want to borrow.

Risks and Side Effects

Quantitative easing also has some possible risks and side effects:

- Inflation: If the central bank creates too much money, prices could go up too much.

- Inequality: Some people say QE can help wealthy people more than others. This is because it can make prices of things like stocks and real estate go up.

- Impact on Savings and Pensions: Low interest rates caused by QE can hurt people who save money or have pension funds. They might earn less on their investments.

- International Effects: QE can change how much a country's money is worth compared to other countries. This can affect other nations, especially developing economies.

- Moral Hazard: Some worry that QE might make governments borrow too much money. This is because it makes borrowing cheaper for them.

- Reputational Risks: If people think a central bank is just printing money to pay for government debt, it can make the bank seem less trustworthy.

What Are the Alternatives?

If quantitative easing isn't the best solution, what else can be done to help the economy? Here are a few other ideas:

- QE for the People: Instead of giving money to banks, some suggest giving it directly to families. This could encourage more spending and help the economy.

- Fiscal Policy: This means the government spends money on things like roads, bridges, or schools. This can create jobs and help the economy grow.

- Monetary Financing: This is when the central bank directly pays for government spending. However, many see this as risky because it can lead to very high inflation.

- Neo-Fisherism: This is a less common idea. It suggests that raising interest rates might help fight low inflation.

Images for kids

See also

In Spanish: Expansión cuantitativa para niños

In Spanish: Expansión cuantitativa para niños