Inflation facts for kids

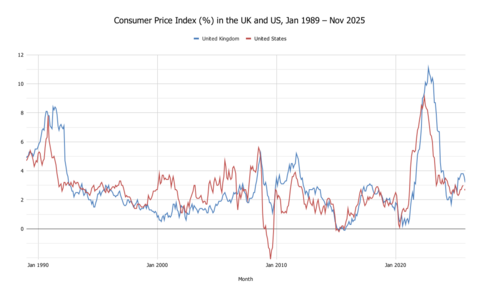

In economics, inflation means that the average price of goods and services goes up over time. Imagine your favorite candy bar; if it cost $1 last year and $1.10 this year, that's a small example of inflation. This increase is measured using something called a consumer price index (CPI).

When prices rise, your money buys less than it used to. This means the purchasing power of your money goes down. The opposite of inflation is deflation, which is when prices generally fall. The most common way to talk about inflation is the inflation rate, which is how much prices have changed in a year, shown as a percentage.

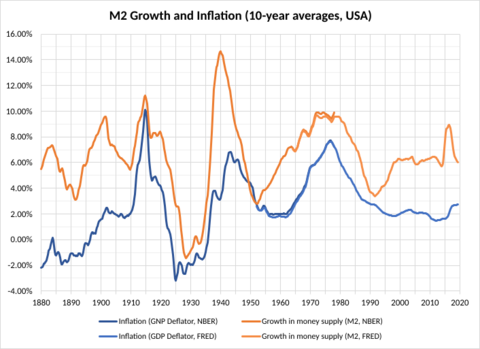

Inflation can happen for several reasons. Sometimes, there's more money in circulation, or people want to buy a lot more things than are available. Other times, the cost of making goods goes up, like during energy crises. Central banks often try to keep inflation low and steady. A little bit of inflation can be good for the economy, helping to reduce unemployment and encouraging people to invest rather than just save money. However, too much inflation can be bad, making it hard to plan for the future and causing prices to rise very quickly.

Contents

What is Inflation?

The word "inflation" comes from the Latin word inflare, meaning "to blow into" or "to inflate." Think of it like a balloon getting bigger. In economics, it refers to the general trend of prices going up, not just one item. For example, if the price of apples goes up because more people want them, but the price of oranges goes down, that's not inflation. Inflation is about the overall value of money itself. If money becomes less valuable, then everything costs more.

Related Concepts

Here are some other terms you might hear:

- Deflation: When the general price level falls. Your money buys more!

- Disinflation: When the rate of inflation slows down. Prices are still rising, but not as fast.

- Hyperinflation: This is when prices rise extremely fast and out of control. It can make money almost worthless.

- Stagflation: A tricky situation where there's inflation, slow economic growth, and high unemployment all at once.

- Reflation: An effort to raise prices to fight deflation.

- Asset price inflation: When the prices of things like houses or stocks go up, but not necessarily everyday goods.

- Agflation: A big increase in the price of food and farm products.

Sometimes, we talk about inflation in specific areas, like "house price inflation" for homes or "energy inflation" for fuel costs.

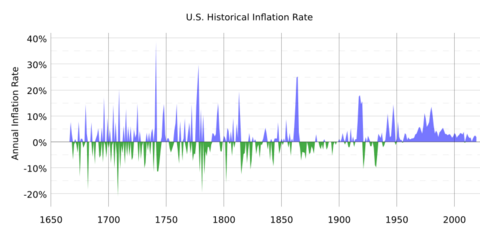

A Brief History of Prices

Inflation has been around for a long time, ever since people started using money. One of the earliest examples was in Alexander the Great's empire around 330 BC. In the past, when money was made of valuable metals like gold or silver, prices would go up and down depending on how much of these metals were found. If a lot of new gold was discovered, the value of gold (and thus money) would fall, and prices would rise.

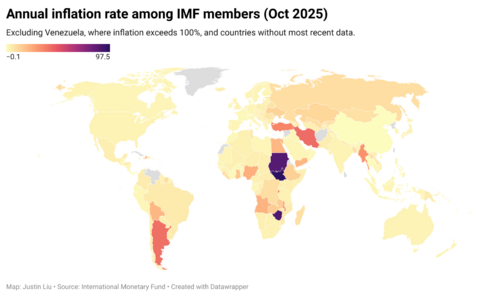

When countries started using paper money that wasn't directly backed by gold or silver (called fiat currency), it became easier for governments to print more money. Sometimes, during tough times or wars, governments printed too much money, leading to very high inflation. A famous example is the hyperinflation in the Weimar Republic in Germany after World War I. More recently, Venezuela experienced very high inflation.

Since the 1980s, many countries with independent central banks have managed to keep inflation low and stable. This has helped economies grow more smoothly.

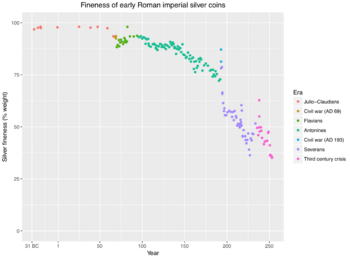

Ancient Times

In ancient Rome, emperors sometimes debased their silver coins. This meant they would melt down silver coins, mix the silver with cheaper metals like copper, and then make more coins. This increased the amount of money in circulation, but each coin was worth less. So, people needed more coins to buy the same things, causing prices to rise.

In ancient China, the Song dynasty was the first to print paper money. Later, during the Mongol Yuan dynasty, the government printed too much money to pay for expensive wars, which led to inflation.

Medieval Times and the Price Revolution

During the Middle Ages in Europe, inflation was usually small. However, from the late 1400s to the mid-1600s, Europe saw a big "price revolution." Prices went up a lot, partly because a huge amount of gold and silver flowed into Europe from the New World (the Americas). This extra metal made money less valuable, so goods cost more.

Modern History

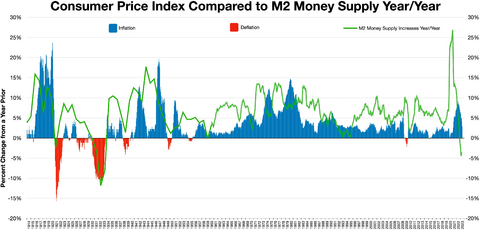

For centuries, prices would go up and down. But since the Great Depression in the 1930s, prices have generally risen every year. In the 1970s and early 1980s, many industrialized countries saw very high inflation, with prices rising by 10% or more each year. However, by the mid-1980s, inflation returned to lower levels.

How We Measure Inflation

Since there are many prices in an economy, there are many ways to measure inflation. Usually, "inflation" refers to the overall price level of goods and services.

The most common way to measure inflation is using the consumer price index (CPI). This index tracks the average change in prices paid by urban consumers for a "basket" of everyday goods and services. Think of it as a shopping cart filled with things like food, clothes, housing, and transportation. Statisticians track how the total cost of this basket changes over time.

For example, if the CPI was 200 last year and 204 this year, the inflation rate would be 2% (meaning prices rose by 2%).

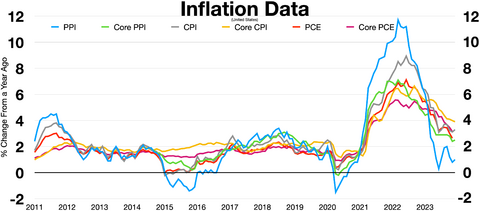

Other important ways to measure inflation include:

- Producer Price Indices (PPIs): These measure the average changes in prices that producers receive for their products. It can give an early hint of future consumer price changes.

- Commodity Price Indices: These track the prices of raw materials like food, oil, and metals.

- Core Price Indices: This measure removes very changeable prices, like food and energy, from the CPI. Central banks often look at core inflation to understand longer-term price trends.

- GDP deflator: This measures the price of all goods and services produced in a country.

Sometimes, people create fun or unusual ways to compare prices:

- The Christmas Price Index tracks the cost of items from the song "The Twelve Days of Christmas".

- The Big Mac Index compares the price of a Big Mac burger in different countries.

- The Jollof index tracks the cost of ingredients for Jollof rice, a popular African dish.

- The Lipstick index suggests that when the economy is tough, sales of small luxuries like lipstick might go up.

Why Prices Change

Economists have studied why inflation happens for centuries. Today, we generally understand that three main things can cause prices to change:

- Demand Shocks (Too Much Demand): If everyone suddenly wants to buy the same new video game, its price will likely go up because there's more demand than supply. This is called demand-pull inflation. It can happen when people have more money to spend or when the government spends a lot.

- Supply Shocks (Too Little Supply): If something happens that makes it harder or more expensive to produce goods, like a natural disaster destroying crops or a sudden rise in oil prices, then the cost of those goods will go up. This is called cost-push inflation. Producers pass their higher costs on to customers.

- Inflation Expectations: What people expect about future prices can also affect current prices. If workers expect prices to rise a lot next year, they might ask for higher wages. Businesses, expecting higher costs, might raise their prices now. This can create a cycle where expectations of inflation lead to actual inflation.

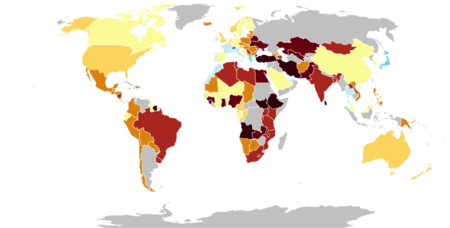

Recent Inflation (2021–2023)

Many countries experienced a big increase in inflation between 2021 and 2023. This was likely due to a mix of reasons. On the demand side, governments and central banks provided a lot of support to economies after the COVID-19 pandemic, which meant people had more money to spend. On the supply side, the pandemic caused problems with supply chains (how goods get from factories to stores), making things harder to get. Also, energy prices rose sharply after the 2022 conflict in Ukraine.

Some people also talked about "sellers' inflation," where companies might have raised prices more than their costs increased, especially if they had less competition.

How Inflation Affects Us

Inflation means your money buys less. If prices go up by 5%, your $100 can only buy what $95 bought before. Inflation affects different people in different ways. People who own things like property or stocks might see the value of their assets go up. But people with fixed incomes, like some pensioners, might find their money doesn't stretch as far.

Negative Effects of High Inflation

High or unpredictable inflation can be harmful to an economy:

- Uncertainty: It becomes hard for businesses to plan for the future or for people to save money, because they don't know what prices will be like.

- Hidden Taxes: If your income goes up just because of inflation, you might end up in a higher tax bracket, even if your real buying power hasn't increased.

- Hoarding: People might buy and store goods they think will become more expensive, leading to shortages.

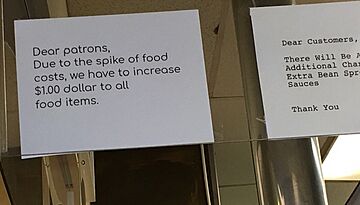

- Social Problems: When prices rise very quickly, especially for basic needs like food, people can become very unhappy and frustrated. This can lead to protests and instability.

- Hyperinflation: If inflation gets totally out of control, money can become almost worthless. People might stop using their country's currency and try to use foreign money instead.

- "Shoe Leather" Costs: This is a funny name for the idea that when inflation is high, people might make more trips to the bank to take out smaller amounts of cash, because they don't want their money to lose value sitting in their wallet.

- "Menu" Costs: Businesses have to spend time and money constantly changing their prices, like printing new menus or updating price tags.

Positive Effects of Moderate Inflation

A low and steady rate of inflation can actually be helpful:

- Easier Adjustments: It can help the job market adjust. If wages don't fall easily, a little inflation allows real wages to go down without cutting people's paychecks directly.

- More Room for Central Banks: Central banks use interest rates to control the economy. If inflation is too low or even negative (deflation), interest rates can hit zero, making it hard for central banks to boost the economy during a downturn. Moderate inflation gives them more room to adjust rates.

- Encourages Investment: A little inflation can encourage people to invest their money rather than just keeping it as cash, because cash loses value over time. This can lead to more economic growth.

- Avoids Deflation Problems: Deflation (falling prices) can be very bad for an economy. People might delay buying things, expecting prices to fall further, which slows down spending and economic activity. Moderate inflation helps avoid this.

Cost-of-Living Adjustments

To help people cope with inflation, some payments, like pensions or salaries, are adjusted regularly. This is called a cost-of-living adjustment (COLA). It means your payment goes up to match the rise in prices, so your buying power stays the same.

Controlling Inflation

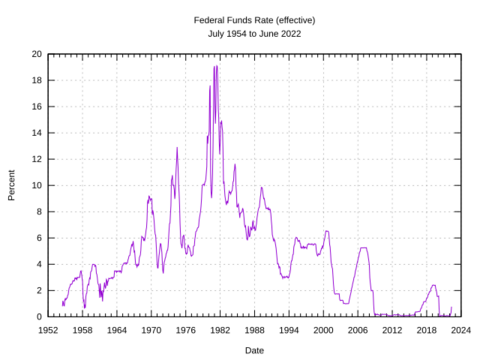

Monetary policy is how central banks manage the money supply and interest rates to achieve economic goals, like keeping inflation low and stable.

How Central Banks Control Inflation

Most modern central banks try to keep inflation around 2%. They do this mainly by adjusting interest rates.

- If inflation is too high, the central bank might raise interest rates. This makes borrowing money more expensive, so people and businesses spend less, which can slow down price increases.

- If inflation is too low, the central bank might lower interest rates. This makes borrowing cheaper, encouraging spending and investment, which can help prices rise a little.

This strategy is called inflation targeting. New Zealand was the first country to officially adopt it in 1990, and now many developed countries use a similar approach.

Historical Ways to Control Prices

- Gold standard: In the past, many countries used a gold standard, where their currency was directly linked to a fixed amount of gold. This meant the amount of money in circulation was limited by the amount of gold. However, this system often made it harder to manage the economy and avoid recessions, so it was eventually abandoned.

- Fixed Exchange Rates: Some countries tie their currency's value to another country's currency. If the other country has low inflation, it can help keep inflation low in the country with the fixed exchange rate.

- Wage and Price Controls: Sometimes, governments have tried to directly limit how much wages and prices can rise. These "incomes policies" have had mixed results. They can sometimes help in very specific situations, like wartime, but economists generally don't recommend them for long-term use because they can cause other problems in the economy.

See also

In Spanish: Inflación para niños

In Spanish: Inflación para niños

- Artificial scarcity

- Core inflation

- Cost of living

- Cumulative process

- Fisher equation

- Food prices

- Hyperinflation

- Indexed unit of account

- Inflationism

- Inflation accounting

- Inflation beta

- Inflation derivative

- Inflation hedge

- Headline inflation

- Measuring economic worth over time

- Overconsumption

- Real versus nominal value (economics)

- Shrinkflation and Skimpflation

- Secular inflation

- Steady-state economy

- Stealth inflation

- Supply shock

- Welfare cost of inflation