Short (finance) facts for kids

To short an asset means to make a bet that its price will go down. If you are right and the asset's value drops, you make money! But if the value goes up instead, you will lose money.

This idea might sound a bit tricky, but it's like borrowing something, selling it, and then buying it back later for less money to return it.

For example, imagine you think Tesla stocks are going to drop in price. You could "short" the stock. This means you would borrow some Tesla shares from someone and sell them right away at their current high price. Then, if the price of Tesla stock goes down, you buy those shares back at the lower price. You then return the shares to the person you borrowed them from. The money you made from selling them high, minus the money you spent buying them back low, is your profit! However, if Tesla stock goes up instead, you would have to buy them back at a higher price, and you would lose money.

Contents

What is Short Selling?

Short selling is a way for investors to try and make money when they believe the price of something, like a stock or a commodity, will fall. It's the opposite of buying something and hoping its price goes up. People who short sell are betting against the market.

Why Do People Short Sell?

People short sell for a few main reasons:

- To make a profit: If they are very sure an asset's price will drop, short selling can be a way to earn money from that prediction.

- To protect other investments: Sometimes, investors use short selling to reduce the risk of other investments they own. This is called "hedging." For example, if you own shares in a company, but you're worried the whole market might fall, you could short sell a market index to balance out potential losses.

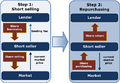

How Does Short Selling Work?

The process of short selling usually involves these steps:

- Borrowing shares: An investor borrows shares of a stock from a broker (a company that helps people buy and sell investments). The broker usually charges a small fee for this.

- Selling the borrowed shares: The investor immediately sells these borrowed shares on the open market at the current price.

- Waiting for the price to drop: The investor hopes the price of the stock will go down.

- Buying back the shares: If the price drops, the investor buys the same number of shares back at the new, lower price.

- Returning the shares: The investor returns the shares to the broker they borrowed them from.

- Making a profit (or loss): The difference between the higher price they sold the shares for and the lower price they bought them back for is their profit. If the price went up instead, they would have to buy them back at a higher price, resulting in a loss.

Risks of Short Selling

Short selling can be very risky. When you buy a stock, the most you can lose is the money you invested (if the stock goes to zero). But with short selling, your potential losses are unlimited. If you short a stock at $10 and it goes up to $100, you lose $90 per share. If it keeps going up, your losses keep growing. This is why short selling is often done by experienced investors.

History of Short Selling

The idea of short selling has been around for a long time. Some historians believe it might have started in the 17th century in the Netherlands with the Dutch East India Company. This company was one of the first to issue shares to the public, and people would trade these shares on the Amsterdam Stock Exchange.

One of the earliest known short sellers was Isaac Le Maire, a Dutch merchant. He reportedly tried to drive down the price of Dutch East India Company shares in the early 1600s by selling shares he didn't own, hoping to buy them back cheaper later. This shows that the basic idea of betting on a price drop has been part of financial markets for centuries.

Images for kids

-

Replica of an East Indiaman of the Dutch East India Company/United East India Company, or (VOC).

See also

In Spanish: Posición corta para niños

In Spanish: Posición corta para niños