United States fiscal cliff facts for kids

The United States fiscal cliff was a big financial situation the United States faced in 2012. It was called a "cliff" because several important things were set to happen all at once. These included tax increases for many people and cuts in government spending. If these changes had happened suddenly, they could have caused a quick and sharp drop in the US budget deficit, which is the difference between what the government spends and what it collects.

To avoid this sudden economic shock, leaders in the government reached a compromise. This agreement helped to delay the full impact of these changes.

Contents

What Was the Fiscal Cliff?

The "fiscal cliff" was a term used to describe a mix of laws that were going to change at the end of 2012. These changes would have made the government spend less money and collect more taxes.

Why Did It Happen?

Two main things caused the fiscal cliff:

- Tax Cuts Ending: Some tax cuts that were put in place by President George W. Bush were set to expire. If they ended, taxes would go up for many people.

- Spending Cuts: A law called the Budget Control Act of 2011 had planned for automatic cuts in government spending. These cuts were meant to help reduce the national debt.

The Impact of No Action

If nothing had been done, these tax increases and spending cuts would have started on January 1, 2013. Experts worried this would slow down the economy a lot. It might have even pushed the country into another recession, which is a time when the economy shrinks.

How the Government Avoided the Cliff

To stop the economy from falling off the "cliff," leaders from both major political parties, the Democrats and Republicans, worked together. They held many meetings and discussions.

The Compromise Bill

After a lot of debate, Congress passed a bill called the American Taxpayer Relief Act of 2012 (ATRA). President Barack Obama signed it into law on January 2, 2013.

What the Bill Did

The ATRA bill did a few key things:

- It made most of the Bush-era tax cuts permanent for lower and middle-income families.

- It allowed taxes to go up for very high-income earners.

- It delayed the automatic spending cuts for a couple of months. This gave lawmakers more time to find a different solution.

Why Was It Important?

The fiscal cliff was a big deal because it showed how important it is for government leaders to work together. If they hadn't reached a compromise, millions of Americans could have faced higher taxes and fewer government services. It also highlighted the ongoing challenge of managing the country's budget and national debt.

Images for kids

-

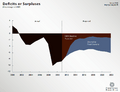

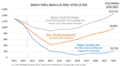

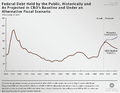

Budget deficits, projected through 2022. The "CBO Baseline" (in red) shows the expected effects of the fiscal cliff under then-current law, meaning if Congress took no action in 2012. The "Alternative Scenario" (in blue) shows what was expected to happen if Congress extended the Bush tax cuts and stopped the spending cuts.

-

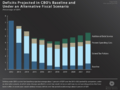

Three CBO deficit scenarios related to the American Taxpayer Relief Act of 2012 (ATRA) and the Fiscal Cliff. The blue line (August 2012 baseline) at the bottom was the "current law" baseline, with tax increases and spending cuts that would take effect if laws were not changed. The grey line (March 2012 alternative baseline) was the "current policy" baseline, which showed what would happen if the tax increases and spending cuts were avoided. The orange line (February 2013 baseline) was the result after ATRA was passed.

See also

In Spanish: Precipicio fiscal de Estados Unidos para niños

In Spanish: Precipicio fiscal de Estados Unidos para niños

| Leon Lynch |

| Milton P. Webster |

| Ferdinand Smith |