Bush tax cuts facts for kids

The phrase Bush tax cuts refers to big changes made to the United States tax rules. These changes first happened when George W. Bush was president. They were later continued when Barack Obama was president.

These changes came from several important laws:

- Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA)

- Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA)

- Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

- American Taxpayer Relief Act of 2012 (this one only kept some parts)

Even though each law was different, the 2003 law made the changes from the 2001 law even stronger. Since 2003, people often talk about both laws together. They discuss how these laws affected the U.S. economy and its people. Both laws were passed using a special and sometimes debated process in Congress called reconciliation.

The Bush tax cuts were designed to end after a certain time, specifically at the end of 2010. This was due to something called a sunset provision. Deciding whether to keep these lower tax rates became a big political discussion. This was finally settled during President Barack Obama's time. A two-year extension was agreed upon as part of a larger tax and economic plan in 2010. Later, in 2012, during a time called the fiscal cliff, Obama made the tax cuts permanent for single people earning less than $400,000 a year. They also became permanent for couples making less than $450,000 a year. However, the tax cuts for people earning more than these amounts were allowed to expire. This happened under the American Taxpayer Relief Act of 2012.

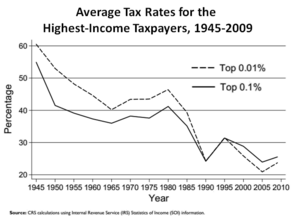

Before these tax cuts, the highest income tax rate was 39.6 percent. After the cuts, the highest rate dropped to 35 percent. Once the cuts ended for very high earners, the top income tax rate went back up to 39.6 percent.

Contents

How Did the Tax Cuts Affect the AMT?

The tax laws from 2001 and 2003 significantly lowered tax rates for almost everyone in the U.S. One unexpected result of these lower rates was that a lesser-known tax rule became very important. This rule is called the Alternative Minimum Tax (AMT).

The AMT was first created to make sure that very rich people couldn't use too many tax breaks. It was meant to ensure they still paid a fair amount of tax. The AMT is a separate way to calculate how much tax someone owes. It removes many common tax deductions. However, the AMT rates were not changed to match the lower rates from the 2001 and 2003 laws. This meant that many more people ended up paying higher taxes because of the AMT. This reduced the benefits of the tax cuts for many middle-to-upper income earners. This was especially true for those who had deductions for state and local taxes, family members, and property taxes.

Some changes were made to the AMT exemption levels in 2005. This was part of the Tax Increase Prevention and Reconciliation Act of 2005.

What Did the CBO Say About the Tax Cuts?

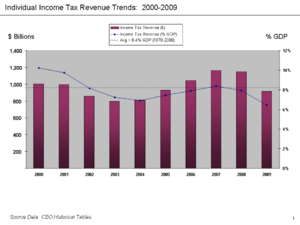

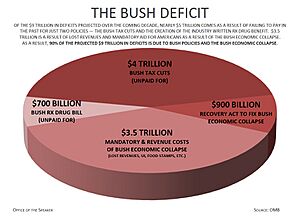

The Congressional Budget Office (CBO) is a non-political group that studies government spending and taxes. The CBO consistently reported that the Bush tax cuts did not "pay for themselves." This means they did not bring in enough new money to cover the lost tax revenue. Instead, they caused a big drop in money for the U.S. Treasury.

Here's what the CBO estimated:

- In 2012, the CBO thought the 2001 and 2003 tax cuts added about $1.5 trillion to the national debt. This was over the years 2002 to 2011, not counting interest.

- In 2009, the CBO estimated that if the tax cuts were fully continued for everyone, they would add about $3.0 trillion to the debt. This would be over the years 2010 to 2019, including interest.

- The CBO also estimated that extending the tax cuts for everyone would increase the yearly budget deficit. It would go up by about 1.7% of the total U.S. economy (GDP) on average.

How Did People Debate the Effects of the Tax Cuts?

There was a lot of disagreement about who truly benefited from the tax cuts. People also argued whether the cuts helped the economy grow enough.

Supporters of the tax cuts said they helped the economy recover faster. They also believed the cuts created more jobs. These supporters thought that lowering taxes for everyone, including the wealthy, would help everyone. They even said it would increase the amount of taxes paid by the richest Americans. This would happen because rich people would not need to hide their money in tax shelters.

Opponents, however, argued that the tax cuts for the wealthy were just a form of "trickle down economics." This idea suggests that if rich people get more money, it will eventually "trickle down" to everyone else. The Wall Street Journal newspaper said that taxes paid by millionaire households more than doubled from 2003 to 2006 because of one of the tax laws.

A group called The Heritage Foundation thought that the 2001 tax cuts alone would completely get rid of the U.S. national debt by 2010.

In 2007, The Heritage Foundation concluded that the Bush tax cuts made the rich pay a larger share of income taxes. They also said the poor paid less. However, another group, the Center on Budget and Policy Priorities (CBPP), disagreed. They said the tax cuts gave the "largest benefits, by far" to the richest households. The CBPP used data showing that 24.2% of the tax savings went to the top one percent of earners. Only 8.9% went to the middle 20 percent of earners. Critics from the Democratic Party said these tax cuts helped the rich with special tax breaks on investments.

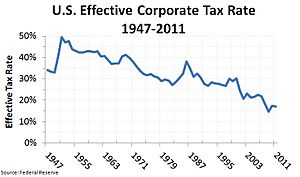

President Bush, Vice President Dick Cheney, and Senate leader Bill Frist said the tax cuts "paid for themselves." But the CBPP, the U.S. Treasury Department, and the CBO disagreed with this statement. Economist Paul Krugman wrote in 2007 that the idea tax cuts pay for themselves was not supported by economic research. Since 2001, federal income tax money has mostly stayed below the average of 8.4% of the economy's size (GDP).

Some experts and groups like OMBWatch and the Tax Policy Center believe the Bush tax policies caused much of the rise in income inequality. This means the gap between rich and poor grew wider. In 2007, President Bush spoke about rising inequality for the first time. He said it was because the economy increasingly rewarded education and skills.

Critics also said that the tax cuts, even those for middle and lower income families, did not help the economy grow. They also argued that the cuts increased the government's budget deficit. They believed the cuts shifted the tax burden from the rich to the middle and working classes. This also made income inequality worse. Economists Peter Orszag and William Gale said the Bush tax cuts were like a "reverse government redistribution of wealth." They believed the cuts moved the tax burden away from wealthy, capital-owning families. Instead, it moved it towards wage-earning families in the lower and middle classes. Supporters argued that the tax brackets were still fairer than those from 1986 to 1992. They had higher tax rates for the rich and lower rates for the middle class.

Economist Simon Johnson wrote in 2010 that the U.S. government does not collect much tax money. It collects at least 10% less of its economy's size (GDP) than similar developed countries. He said that cutting taxes, even if both political parties agree, might not make sense. He felt that today's tax cuts could lead to future money problems for the U.S.

A The Washington Post article had a different idea. It said that increased government spending was the biggest reason for the disappearance of expected money surpluses. This accounted for 36.5% of the problem. Incorrect CBO estimates were next, at 28%. The Bush tax cuts (and some Obama tax cuts) were responsible for only 24%.

The New York Times said in an opinion piece that the full Bush-era tax cuts were the single biggest reason for the deficit over the past decade. They reduced government money by about $1.8 trillion between 2002 and 2009. However, a 2006 article from the same paper said there was a "surprising jump" in tax money. This was "curbing" the deficit.

The CBO estimated in 2012 that the Bush tax cuts added about $1.6 trillion to the national debt. This was between 2001 and 2011, not including interest. A 2006 study by the Treasury Department estimated that the tax cuts reduced government money by about 1.5% of the economy's size (GDP) each year. This was for the first four years they were in place.

Should the Tax Cuts Have Continued?

Most of the tax cuts were set to end on December 31, 2010. What to do about this became a big topic in the 2004 and 2008 U.S. presidential elections. Republican candidates generally wanted the lower tax rates to become permanent. Democratic candidates usually wanted to keep the lower rates for middle-class incomes. But they wanted to return to higher rates for high incomes, like they were before the Bush cuts. During his campaign, then-candidate Obama said that couples earning less than $250,000 would not see tax increases. This income level later became a key point in the debate about what "middle class" meant.

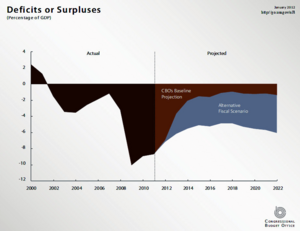

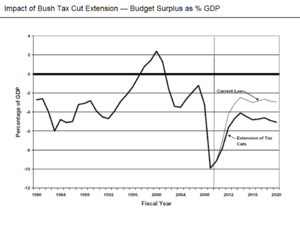

In August 2010, the Congressional Budget Office (CBO) estimated what would happen if the tax cuts were extended. They said extending them from 2011 to 2020 would add $3.3 trillion to the national debt. This included $2.65 trillion in lost tax money and $0.66 trillion for interest.

The non-political Pew Charitable Trusts estimated in May 2010 what extending the tax cuts would cost:

- Making the tax cuts permanent for everyone would increase the national debt by $3.3 trillion over the next 10 years.

- Only extending the tax cuts for individuals making less than $200,000 and couples earning less than $250,000 would increase the debt by about $2.2 trillion.

- Extending the tax cuts for everyone for just two years would cost $561 billion over the next 10 years.

The Congressional Research Service estimated that extending the 2001 and 2003 tax cuts beyond 2010 would mean $2.9 trillion in lost government money. Plus, there would be an extra $606 billion in interest costs. This would be a total of $3.5 trillion.

In July 2010, experts at Deutsche Bank said letting the Bush tax cuts expire for high earners would slow down the economy. However, Treasury Secretary Timothy Geithner disagreed. The Obama administration suggested keeping tax cuts for couples making less than $250,000 per year. Economist Mark Zandi thought that making the Bush tax cuts permanent would be one of the least helpful policies for the economy.

How Were the Bush Tax Cuts Extended?

The debate about the tax cuts became very intense in late 2010. This was during a "lame-duck" session of the 111th Congress. A "lame-duck" session happens after an election but before the new members of Congress take office.

A meeting called the "Slurpee Summit" took place at the White House on November 30, 2010. President Barack Obama met with leaders from Congress. The name "Slurpee Summit" came from a comparison Obama used during his election campaign. This was the first meeting after the November 2010 election. In that election, Republicans gained control of the House and won more seats in the Democratic-controlled Senate.

During the meeting, Obama apologized for not working more with Republican lawmakers in his first two years. He appointed Treasury Secretary Tim Geithner and budget chief Jack Lew to help Republicans and Democrats agree on extending the tax cuts. In return, all 42 Republican senators promised to block all other laws until the tax issue was solved.

Democrats in Congress tried twice to extend the lower Bush-era tax rates for "middle income" families. But they wanted the rates to expire for "high income" people. The first plan had a cutoff at $250,000, and the second raised it to $1 million. Both plans passed in the House. But on December 4, 2010, both failed in the Senate. They did not get the 60 votes needed to stop a filibuster (a way to delay a vote).

On December 6, 2010, President Barack Obama announced that a compromise tax plan had been reached. It focused on a temporary, two-year extension of the Bush tax cuts. The plan included:

- Extending the 2001/2003 income tax rates for two years. Also, changing the AMT so that 21 million more families would not face a tax increase. These changes aimed to help over 100 million middle-class families. They would prevent a yearly tax increase of over $2,000 for a typical family.

- Other rules to help the economy grow. This included $56 billion for unemployment benefits. There was also about a $120 billion payroll tax cut for working families. Plus, about $40 billion in tax cuts for families and students who were struggling. Businesses could also deduct 100% of certain costs in 2011.

- Adjusting the estate tax. The rate would be 35% after a $5 million exemption.

Obama said he was not willing to let working families suffer because of political fights in Washington. He also did not want the economy to go backward. He believed this plan was right for jobs, the middle class, businesses, and the economy. He felt it was an opportunity they needed to take.

Officials like Vice President Joe Biden then worked to convince Democrats in Congress to accept the plan. This was even though it continued lower rates for the highest-income taxpayers. The compromise was popular with the public. It allowed Obama to seem like someone who could bring people together. The bill was opposed by some very conservative Republicans. It was also opposed by some talk radio hosts and groups in the Tea Party movement. Some potential candidates for the 2012 Republican presidential election also opposed it. They usually argued that it did not make the Bush tax cuts permanent. They also said it would increase the national deficit.

During these debates, former President Bush said he wished they had called them something other than "Bush tax cuts." He thought it would make it easier for some people to pass the law. He strongly argued for keeping the rates. He believed it was important to show businesses and families that the government trusted them to spend their own money. He also thought lower taxes help the economy grow.

On December 15, 2010, the Senate passed the compromise plan with an 81–19 vote. Most Democrats and Republicans supported it. Late on December 16, the House passed the plan with a vote of 277–148. Most Republicans voted for it, but only a small majority of Democrats did. Before that, an amendment to raise the estate tax failed. This was a big sticking point for some Democrats. The Washington Post called the approved deal "the most significant tax bill in nearly a decade." President Barack Obama signed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 on December 17, 2010.

What Was the Fiscal Cliff?

The "fiscal cliff" referred to December 31, 2012. This was the date when government spending was set to be cut. Also, a large number of tax cuts were set to expire. Many of these were the tax cuts from George W. Bush's time that President Obama had extended.

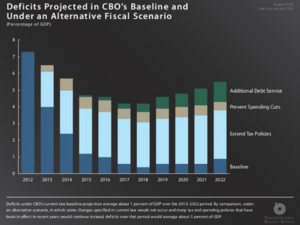

In a report from May 2012, the Congressional Budget Office (CBO) said that these changes could lead to less economic growth. It might even cause a recession. However, the budget deficit for 2013 would be cut by about half. The national debt over the next ten years would also look much better.

Republicans, including House Speaker John Boehner, said the tax rate increases would be the largest in U.S. history. But the U.S. would actually just be returning to the tax rates from the Clinton era. According to the Associated Press, the increase would be the second largest after 1942. This is if you consider population growth, increased pay, and the size of the economy.

Based on numbers from the CBO, federal taxes would have gone up by $423 billion in 2013. This would happen if the tax cuts had been allowed to expire. The Tax Policy Center estimated that 83% of U.S. households would see an average tax increase of $3,701. The Heritage Foundation said that those most affected would be middle- and low-income groups. Their research found families would see an average tax increase of $4,138.

According to the Center on Budget and Policy Priorities, if the Bush income tax rates had expired, it would have affected higher income families more. The Bush tax cuts reduced income taxes for those earning over $1 million by $110,000 per year on average. This was from 2004 to 2012. The tax cuts made the tax system less fair for lower incomes. From 2004 through 2012, the tax cuts increased the money left after taxes for the richest people much more. For example, in 2010, the tax cuts increased the after-tax income of people making over $1 million by more than 7.3%. But for the middle 20% of households, it increased by only 2.8%.

A CBO report said that extending the tax cuts and spending policies would cause federal debt to increase. It would go from 73% of the U.S. economy (GDP) in 2012 to over 90% by 2022. But the debt-to-GDP ratio would drop to 61% in 2022 if the tax cuts expired and spending cuts happened. The CBO said that the huge increase in debt showed a need for big policy changes. They said lawmakers would need to increase government money or decrease spending.

Republicans in the House Ways and Means Committee opposed the expiration of the tax rate cuts. They tried to create a bill to extend all federal tax rates for one year. This included income levels, capital gains, dividends, and estate taxes. The bill would also keep tax credits like the child tax credit. But it would end the current payroll-tax cut. The Democratic-majority Senate wanted to extend the tax cuts only for household income below $250,000 per year.

What Was the American Taxpayer Relief Act of 2012?

On January 1, 2013, the Bush Tax Cuts officially ended. However, on January 2, 2013, President Obama signed the American Taxpayer Relief Act of 2012. This law brought back many of the tax cuts, making them effective from January 1. But the 2012 Act did not cancel the increase in the highest income tax rate. This rate had gone from 35% to 39.6% on January 1 because the Bush Tax Cuts expired for high earners.

See also

- Economic policy of Barack Obama

- Economic policy of the George W. Bush administration

- Economists' statement opposing the Bush tax cuts

- Taxation in the United States