Trickle-down economics facts for kids

Trickle-down economics is a term used to describe economic ideas that mostly help rich people and big companies. The main idea is that if these wealthy groups spend more money, it will "trickle down" to everyone else. This means it would help people who are not as rich by making the economy stronger.

Critics often use this term when talking about supply-side economics. They use it to describe government policies, like tax and spending rules, that might make the gap between rich and poor wider. It's also used when talking about neoliberalism, which is a set of political and economic ideas.

Similar ideas and criticisms have been around for a long time, even since the 1800s. But the term "trickle-down economics" became very popular in the U.S. when people talked about supply-side economics and the economic plans of Ronald Reagan, called Reaganomics.

Some big examples in the U.S. that critics call "trickle-down economics" include tax cuts made by Presidents Reagan, George W. Bush, and Donald Trump. In the UK, Liz Truss's tax cuts in 2022 were also called this.

Economists who support supply-side ideas usually don't use the "trickle-down" term themselves. They also don't agree that their focus is only on tax cuts for the rich. However, some who support these policies have used the phrase sometimes. As of 2023, studies have not clearly shown that cutting taxes for the rich leads to overall economic growth.

Contents

How the Idea Started

Early Mentions

The phrase "trickle-down economics" wasn't used much in books until the 1980s. However, the idea that wealth from the rich can flow down to others is much older. The term itself is mostly used by people who disagree with this idea.

In 1896, William Jennings Bryan, who was running for U.S. President, talked about a similar concept. He used the idea of a "leak" in his famous Cross of Gold speech.

The humorist Will Rogers is often given credit for coining the term. In 1932, he criticized President Herbert Hoover's policies during The Great Depression. Rogers wrote that money was given to the top in hopes it would "trickle down" to those in need. He joked that Hoover, an engineer, knew water trickles down, but didn't realize money trickled up!

In 1933, Indian leader Jawaharlal Nehru also used the term. He wrote that when England took wealth from India, some of it "trickled down" to the working class in England, improving their lives.

Later, President Lyndon B. Johnson (a Democrat) said that Republicans didn't know how to manage the economy. He claimed they were too busy with the "trickle-down theory," giving the richest companies the biggest breaks.

The Reagan Years

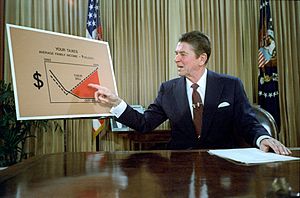

When Ronald Reagan ran for president in 1980, he supported supply-side economics. During his campaign, George H. W. Bush (who later became president) called Reagan's economic plan "voodoo economics."

After Reagan won, the term "trickle-down" became very popular. This happened after an interview in 1981 with David Stockman, who was Reagan's budget director. Stockman said that "supply-side" was just a way to make tax cuts for the rich sound better so they could pass into law. He said, "It's kind of hard to sell 'trickle down,' so the supply-side formula was the only way to get a tax policy that was really 'trickle down.' Supply-side is 'trickle-down' theory."

Reagan's political opponents quickly used this language. They wanted to show that his government only cared about the wealthy. In 1982, economist John Kenneth Galbraith said that "trickle-down economics" was like the "horse-and-sparrow theory." This idea suggests that if you feed a horse a huge amount of oats, some will pass through for sparrows to eat.

What Studies Say

Effects of Lowering Taxes on the Rich

Many economists have studied what happens when taxes are cut for wealthy people.

Nobel Prize winner Joseph Stiglitz wrote in 2015 that history after World War II doesn't support trickle-down economics. Instead, he suggested "trickle-up economics," where giving more money to the poor or middle class helps everyone.

In 2020, economists David Hope and Julian Limberg looked at 50 years of data from 18 countries. They found that tax cuts for the rich mostly made the rich wealthier and increased inequality. They saw no real benefit to a country's overall economic growth or jobs. This study suggested that tax cuts for the rich did not "trickle down" to the wider economy.

A 2015 report from the International Monetary Fund (IMF) also suggested that lowering taxes on the richest 20% could actually slow down economic growth.

Some political scientists have called the idea that tax cuts for the wealthy help everyone a "zombie idea." This means it's a policy idea that has failed but keeps coming back.

These studies suggest that trickle-down economics might not create jobs or growth. This means that leaders shouldn't worry that raising taxes on the rich will harm their country's economy.

See also

In Spanish: Efecto derrame para niños

In Spanish: Efecto derrame para niños

- Reaganomics

- Thatcherism

- A rising tide lifts all boats

- Trussonomics

- Austerity

- Economic inequality

- Keynesian economics

- Neoliberalism

- Progressive tax

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |