Economic Recovery Tax Act of 1981 facts for kids

The Economic Recovery Tax Act of 1981, often called ERTA or the "Kemp-Roth Tax Cut", was an important American law signed in 1981. This law was created to help the economy grow. It did this by changing how much income tax people paid. It also offered ways to help businesses and encourage people to save money.

Contents

What Was the Economic Recovery Tax Act?

The Economic Recovery Tax Act of 1981 was a big change to the tax rules in the United States. It was signed into law by Ronald Reagan, who was the president at the time. The main goal of this law was to make the economy stronger. It aimed to do this by giving people and businesses more reasons to spend, invest, and save.

Why Was This Law Created?

In the early 1980s, the U.S. economy was facing some challenges. There was high inflation, which meant prices were going up quickly. There was also unemployment, meaning many people didn't have jobs. President Reagan and his team believed that lowering taxes would help fix these problems. They thought that if people and businesses paid less in taxes, they would have more money to spend and invest. This would then create more jobs and help the economy grow.

What Did the Law Change?

The ERTA law made several key changes to the tax system. These changes affected individuals, families, and businesses across the country. The idea was to put more money back into people's pockets and encourage companies to expand.

Helping Individuals and Families

One of the biggest parts of the ERTA was lowering income tax rates for individuals. This meant that people would pay a smaller percentage of their earnings in taxes. The law planned to cut these rates over three years. This was meant to give people more money to spend or save. It was hoped that this extra money would boost the economy.

Supporting Businesses

The law also included new rules to help businesses. It made it easier and cheaper for companies to buy new equipment or build new factories. This was called "expensing of depreciable property." It meant businesses could quickly write off the cost of new investments. This encouraged them to grow and create more jobs. Small businesses also received special benefits to help them succeed.

Encouraging Savings

Another goal of the ERTA was to encourage people to save money. The law introduced new tax breaks for certain types of savings accounts. For example, it expanded IRAs, which are special accounts for retirement savings. This made it more attractive for people to save for their future.

Who Was Ronald Reagan?

Ronald Reagan was the 40th President of the United States. He served from 1981 to 1989. Before becoming president, he was an actor and the governor of California. During his presidency, he focused on policies that aimed to reduce the size of government and lower taxes. The Economic Recovery Tax Act of 1981 was one of the most important laws passed during his time in office. It was a key part of his plan to improve the American economy.

Images for kids

-

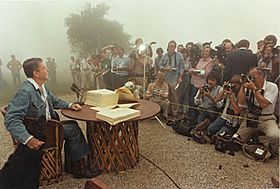

President Ronald Reagan meets with the press after signing the 1981 Tax Reconciliation Bill at Rancho del Cielo.