Supply-side economics facts for kids

Supply-side economics is an idea about how to make a country's economy grow. People who support this idea believe that if taxes are lowered, especially for rich people and businesses, it will help the whole economy. They think that rich people will use their extra money to invest in new businesses, create jobs, and make more goods and services. This is sometimes called "trickle-down economics" because the idea is that the benefits will eventually "trickle down" to everyone else.

People who like supply-side economics often believe that high taxes stop people from working hard and being productive. They also usually support less government spending, keeping prices stable (low inflation), and having fewer rules for businesses.

Contents

What Is the Laffer Curve?

An economist named Arthur Laffer helped explain supply-side economics with a drawing called the Laffer Curve. This curve shows how tax rates might affect how much money the government collects.

Taxes and Government Money

The Laffer Curve suggests that if taxes are too high, people might not want to work as much or invest their money. This could mean the government actually collects less tax money because the economy slows down. On the other hand, if taxes are too low, the government also won't collect much money. The idea is to find a "sweet spot" where tax rates are just right to encourage economic activity and still bring in enough money for the government.

Supply-Side Economics in Action

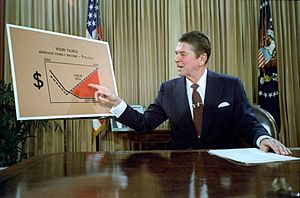

Supply-side economics became very popular in the United States when Ronald Reagan was president in the 1980s.

Reagan's Tax Cuts

During President Reagan's time in office, income taxes for the wealthiest Americans were cut a lot. They went from 70% down to 50%, and then even further to 28%. Taxes on capital gains (money made from selling investments) were also lowered.

Supporters of these tax cuts say that they helped the economy grow stronger in the 1980s. They also believe these policies led to the good economic times in the 1990s and early 2000s.

Arguments Against Supply-Side Economics

Not everyone agrees with supply-side economics. Critics have different ideas about its effects.

Concerns About Wealth Gap

Many critics say that supply-side policies mostly help the rich. They argue that giving a lot of money to wealthy people doesn't always "trickle down" to the poor. Instead, they believe it makes the gap between rich and poor people even bigger. Some critics even called it "voodoo economics" because they thought it wouldn't work.

Impact on Government Programs and Debt

Critics also point out that when taxes are cut, the government has less money. This can lead to cuts in important programs that help people in need. They also argue that big tax cuts, especially when combined with more spending (like on the military), can cause the government to go deeply into debt.

See also

In Spanish: Economía de la oferta para niños

In Spanish: Economía de la oferta para niños

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |