National debt of the United States facts for kids

The national debt of the United States is the total amount of money that the federal government owes to others. Just like a person might use a credit card to buy things they cannot pay for immediately, the government borrows money to pay for services, the military, and other programs.

The US Department of the Treasury keeps track of this debt. As of October 2025, the total national debt was $38 trillion. This number changes every day as the government spends money and receives taxes.

When the government spends more money in a year than it collects in taxes, it has a "deficit." To cover this deficit, it borrows money by selling Treasury securities (like bonds). People, companies, and other countries buy these bonds, effectively lending money to the U.S. government. The government promises to pay them back later with interest.

Contents

What makes up the National Debt?

The national debt is divided into two main parts:

- Debt held by the public: This is money the government owes to investors. These investors can be individuals, banks, insurance companies, and foreign governments.

- Intragovernmental debt: This is money the government owes to itself. For example, the Social Security program might collect more tax money than it needs right now. It lends that extra money to the rest of the government to be spent elsewhere.

History of the debt

The United States has had debt since it was founded in 1789. The amount of debt usually goes up during wars or economic hard times and goes down during peaceful and prosperous times.

Early history

For most of U.S. history, the debt was small compared to the size of the economy. There was only one time when the United States completely paid off its national debt. This happened in 1835 and 1836, while Andrew Jackson was president. However, the debt soon grew again.

The debt grew significantly during World War II because the government had to spend a lot of money on the military. After the war, the economy grew fast, which made the debt seem smaller by comparison.

Recent years (2000–2025)

In the 21st century, the national debt has grown much larger.

- 2008 Financial Crisis: The government borrowed money to help banks and businesses during a major economic downturn.

- COVID-19 Pandemic: In 2020 and 2021, the government spent trillions of dollars to help people who lost jobs and to support hospitals during the pandemic. This caused the debt to jump up very quickly.

- 2025 Government Shutdown: In October 2025, the debt reached a new record of $38 trillion. This happened during a time when the government had trouble agreeing on a budget, which caused a partial shutdown of government services.

Measuring the debt

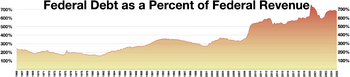

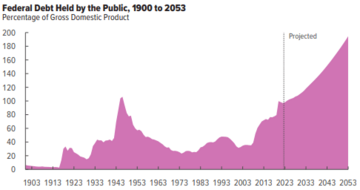

Debt-to-GDP ratio

Economists often look at the "Debt-to-GDP ratio" to see if the debt is too high. Gross domestic product (GDP) is the total value of all goods and services produced in the country in one year. It represents the country's income.

- If the debt is small compared to the GDP, it is easier for the country to pay it back.

- If the debt is larger than the GDP, it can be harder to manage.

During World War II, the debt was larger than the GDP. It fell for many years after that. However, by the 2020s, the debt was once again about the same size as or larger than the entire U.S. economy.

The Debt Ceiling

The debt ceiling is a limit set by Congress on how much money the government is allowed to borrow. It is like a credit limit on a credit card. If the government reaches this limit, Congress must vote to raise it so the government can pay its bills. If they do not raise it, the government could "default," meaning it fails to pay back what it owes. This would be very bad for the economy.

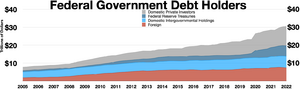

Who owns the debt?

Many different groups lend money to the United States.

Domestic holders

About two-thirds of the debt is held by people and institutions inside the United States.

- The Federal Reserve: The central bank of the U.S. buys government bonds to help manage the economy.

- Government Accounts: Programs like Social Security hold a lot of the debt.

- Private Investors: U.S. banks, mutual funds, and individual citizens buy savings bonds and Treasury notes.

Foreign holders

Foreign countries and investors own about one-third of the debt held by the public. They buy U.S. debt because they see it as a safe place to keep their money.

- Japan and China are the two countries that hold the most U.S. debt.

- The United Kingdom and other European countries also hold large amounts.

Some people worry that owing money to other countries could be a risk, but others say it shows that the world trusts the U.S. economy.

Costs of the debt

Because the government borrows money, it has to pay interest to the lenders. This is similar to paying interest on a car loan or mortgage.

- In 2024, the government spent more on interest payments than it did on Medicare or national defense.

- As interest rates go up, the cost of paying for the debt gets higher. This means there is less money available for other things like schools, roads, and science research.

See also

- Economy of the United States

- Federal Reserve System

- Taxation in the United States