Financial crisis of 2007–2008 facts for kids

The financial crisis of 2007–2008 was a very big money problem. It was the worst of its kind since the Great Depression in the 1930s.

In September 2008, many large financial companies in the United States had serious troubles. Some went out of business, others joined with different companies, or had someone else take over their management. Experts had been talking about the reasons for this crisis many months before it happened.

Contents

Why the Crisis Happened

There are many reasons why this big money problem started. Most experts who study how money works believe it began in the United States.

Easy Money for Homes

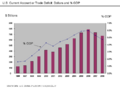

From 1997 until 2006, many people bought expensive houses. They did this even if they didn't have a lot of money saved. Money came from other countries, which made it easy for people to get good credit. Credit is like a trust score that shows if you're good at paying back money.

People used this easy credit to get expensive loans for houses. This made the price of homes go up very quickly. It created something called an economic bubble. When prices go up too fast and get really high, it's like a bubble that can pop.

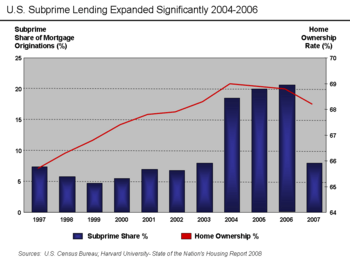

Because there was a lot of money available, companies that gave out loans made it easier to get one. They even gave loans to people who didn't have a great credit history. These types of loans are known as subprime loans. They were riskier because the borrowers might have trouble paying them back.

Changing Home Loans

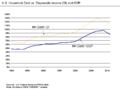

During this time, many homeowners changed their home loans to new ones. This is called refinancing. It often gave them a lower interest rate on their mortgage. A mortgage is a special loan you get to buy a house. Interest is the extra money you pay back on a loan.

After refinancing, some homeowners took out another mortgage. They used this extra money for spending. Loan companies also changed their loans so they would have low interest at first, but then the interest would increase later. This is called an adjustable-rate mortgage. Companies often used these to get more people to take loans. Many people with subprime loans also took these adjustable-rate mortgages. They hoped that the good price of housing would help them refinance again later.

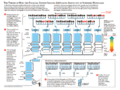

Investing in Risky Loans

While house prices were still high, many American and European companies, including banks, put their money into these subprime loans. This meant more money went to the loan companies, which then gave out even more subprime loans. These investments seemed like a good idea and would make a lot of money as long as house prices stayed high.

The Housing Bubble Pops

However, companies built too many houses. This caused the price of housing to start going down in the summer of 2006. The value of many homes dropped below the amount of money people still owed on their mortgage. This meant owners couldn't sell their homes without losing money. This situation is called negative equity.

By March 2008, about 8.8 million homeowners in the U.S. owed more on their homes than the homes were worth. This led to more foreclosures. A foreclosure is when the bank takes back a house because the owner can't pay the mortgage. In 2007, almost 1.3 million U.S. homes started foreclosure.

As more houses were for sale, their prices continued to drop. Homeowners with subprime loans were left with houses worth less than what they paid. This meant the loans were worth more money than the houses. The loan companies couldn't make money from these houses anymore.

Big Losses for Companies

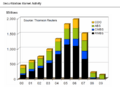

When the housing bubble popped, the value of investments in these risky loans fell sharply. Companies that had invested in subprime loans lost about $512 billion in total. Citigroup and Merrill Lynch were two companies that lost a lot of money. More than half of the money lost, about $260 billion, was lost by American companies.

Overall, the total money lost from this crisis, including lost business and drops in the stock market, is estimated to be around $15 trillion.

Images for kids

-

A person protesting on Wall Street after a controversy about bonus payments at AIG.

See also

In Spanish: Crisis financiera de 2007-2008 para niños

In Spanish: Crisis financiera de 2007-2008 para niños