Mortgage facts for kids

A mortgage is a special kind of loan that helps people buy big things, like a house or land. When you get a mortgage, you borrow money from a bank or a lender. To make sure you pay back the loan, you use the house or land you are buying as a guarantee. This means if you can't pay back the money, the lender can take the property.

In a mortgage, there are two main parts:

- The borrower (also called the mortgagor) is the person who gets the loan and owns the property.

- The lender (also called the mortgagee) is the bank or company that gives the money.

The borrower promises to pay back the loan over time, usually in monthly payments. These payments include the money borrowed plus extra money called interest. If the borrower stops paying, the lender can take the property. This is called foreclosure.

In 2008, there was a big economic problem in America. Many lenders gave mortgages to people who couldn't really afford to pay them back. When these people couldn't make their payments, houses were taken by the lenders. This caused housing prices to drop a lot and hurt the economy.

Contents

Different Kinds of Mortgages

There are different ways mortgages can be set up. Here are a few types:

Simple Mortgage

A simple mortgage is when you get a loan for your property, but you don't give the property's ownership to the lender right away. You promise to pay back the money. If you don't pay, the lender can ask a court to sell your property to get their money back. You keep living in or owning the property unless you fail to pay.

English Mortgage

With an English mortgage, the borrower actually transfers the ownership of the property to the lender. This transfer is temporary. The lender promises to give the ownership back to the borrower once the entire loan is paid off. This type of mortgage usually has a set time, like 10 to 25 years, to pay back the money.

Reverse Mortgage

A reverse mortgage is different because the payments go the other way! Instead of the borrower paying the lender each month, the lender pays the borrower. This type of loan is mostly for older people who own their homes. It allows them to get regular tax-free income from the value of their home without having to sell it. The loan is usually paid back when the homeowner moves out or passes away.

Usufructuary Mortgage

In this type of mortgage, the property is given to the lender as a guarantee. The lender gets to use the property or collect money from it, like rent, until the loan is fully paid back. For example, the lender might rent out the property and use the rent money to pay off the loan. The borrower usually does not have to make monthly payments directly, and they keep the official ownership papers (title deeds).

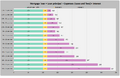

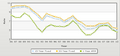

Images for kids

See also

In Spanish: Crédito hipotecario para niños

In Spanish: Crédito hipotecario para niños