Economic bubble facts for kids

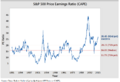

An economic bubble happens when the price of something in a market goes up super fast. It's like a balloon getting bigger and bigger! But then, it's followed by a quick drop in value, which is called a "crash" or a "bubble burst." Many experts think these bubbles are linked to inflation, which means prices generally go up. An economic bubble can cause big problems for the economy, like when people and companies lose a lot of money. Famous examples include the Great Depression and the Economic crisis of 2007-2010.

Economic bubbles often happen because people expect something to always be in high demand. When investors see prices rising quickly, they get excited and buy more, pushing prices even higher. But eventually, there might be too much of that item for sale, and not enough people want to buy it. This causes prices to fall, and the bubble bursts. It's very hard to know exactly when this will happen, so it often surprises investors.

Contents

What is an Economic Bubble?

An economic bubble is like a roller coaster ride for prices. Imagine everyone suddenly wants the same toy. The price of that toy would go up and up because people are willing to pay more to get it. That's the "bubble" forming.

How Bubbles Form

- Excitement builds: People get very excited about a certain item, like houses, stocks, or even old collectible cards.

- Prices soar: More and more people want to buy, so prices go up very quickly.

- Hope for more: Buyers think the price will keep going up forever, so they keep buying, even if the price seems too high.

When Bubbles Burst

- Too much supply: Eventually, there are too many items for sale, or not enough new buyers.

- Prices drop fast: People start selling their items quickly before the price drops even more.

- Panic selling: This causes prices to crash, and the bubble "bursts." Many people can lose a lot of money.

Famous Economic Bubbles

History has seen many economic bubbles. They show us how human excitement can sometimes get out of control in markets.

Tulip Mania (1630s)

One of the earliest famous bubbles was the Tulip Mania in the Netherlands.

- People started paying incredibly high prices for tulip bulbs.

- Some rare bulbs were worth more than houses!

- Eventually, the prices crashed, and many people who had invested a lot lost everything.

South Sea Bubble (1720)

The South Sea Company was a British company that promised huge profits.

- People rushed to buy shares in the company, driving the price very high.

- The company's promises were not real, and the bubble burst.

- Many investors, including rich and powerful people, lost their fortunes.

Dot-com Bubble (Late 1990s)

In the late 1990s, there was a huge excitement about internet companies.

- Many new "dot-com" companies started, and their stock prices went sky-high.

- Investors hoped these companies would make huge profits, even if they weren't making money yet.

- In the early 2000s, the bubble burst, and many of these companies failed.

Why Are Bubbles Important?

Economic bubbles can cause big problems for the economy. When a bubble bursts, it can lead to:

- Loss of jobs: Companies might have to close or lay off workers.

- Less spending: People who lost money might spend less, which hurts businesses.

- Economic crises: Sometimes, a big bubble burst can even lead to a recession or a depression.

It's important to understand economic bubbles to learn from history and try to prevent similar problems in the future.

Images for kids

-

A card from the South Sea Bubble

See also

In Spanish: Burbuja económica para niños

In Spanish: Burbuja económica para niños

| Claudette Colvin |

| Myrlie Evers-Williams |

| Alberta Odell Jones |