Federal Reserve facts for kids

Seal of the Federal Reserve System

|

|

Flag of the Federal Reserve System

|

|

The Eccles Building in Washington, D.C., which serves as the Federal Reserve System's headquarters

|

|

| Headquarters | Eccles Building, Washington, D.C., U.S. |

|---|---|

| Established | December 23, 1913 |

| Governing body | Board of Governors |

| Key people |

|

| Central bank of | United States |

| Currency | United States dollar USD (ISO 4217) |

| Reserve requirements | None |

| Bank rate | 4.50% |

| Interest rate target | 4.25–4.50% |

| Interest on reserves | 4.40% |

| Interest paid on excess reserves? | Yes |

| Federal Reserve | |

| Agency overview | |

| Jurisdiction | Federal government of the United States |

| Child agency |

|

| Key document |

|

The Federal Reserve, often called "The Fed," is like the heart of the United States' money system. It works to keep the country's economy healthy and stable.

The Federal Reserve is a complex organization. But it plays a vital role in the United States economy. By understanding what the Fed does, you can better understand how the economy works. You can also see how it affects your life.

Contents

What is the Federal Reserve?

The Federal Reserve System is the central bank of the United States. Imagine a regular bank where people keep their money. They also borrow money and make payments. The Federal Reserve is a bank for banks! It helps make sure all the banks in the country are doing well. It also ensures the economy is running smoothly.

Why was the Fed created?

Before the Federal Reserve, the United States had big problems with its money and banks. Sometimes, people would panic. They would rush to take their money out of the banks all at once. This caused banks to run out of money and even close down. This was called a "banking panic."

In 1907, there was a really bad banking panic. This made people realize how important it was to have a central bank. So, Congress decided to create the Federal Reserve. This was to help prevent these problems in the future.

What does the Fed do?

The Federal Reserve has several important jobs:

- Keeping Prices Stable

The Fed tries to make sure that prices for things don't go up too quickly (this is called inflation). It also tries to make sure they don't go down too much (this is called deflation).

- Maximum Employment

The Fed wants as many people as possible to have jobs. When people have jobs, they can earn money and buy things. This helps the economy grow. The Fed works to create conditions that help businesses grow and hire more people.

- Supervising Banks

The Fed keeps an eye on banks. It makes sure they are following the rules. It also checks that they are not taking too many risks. This helps to protect people's money and keep the banking system safe.

- Managing the Money Supply

The Fed controls how much money is available in the economy. It can increase or decrease the amount of money. This helps to keep the economy stable.

- Being a Bank for Banks

The Fed provides financial services to banks. For example, it lends them money when they need it. It also helps banks move money around the country.

How does the Fed do all this?

The Federal Reserve uses several tools to do its job:

Changing Interest Rates

The Fed can change the interest rate. This is the cost of borrowing money. It's the rate banks charge each other for borrowing money. When the Fed lowers interest rates, it becomes cheaper to borrow money. This encourages people and businesses to spend more. When the Fed raises interest rates, it becomes more expensive to borrow money. This encourages people and businesses to save more and spend less.

Setting Reserve Requirements

The Fed can change the amount of money that banks are required to keep in reserve. If the Fed lowers this requirement, banks have more money to lend out. This can help the economy grow. If the Fed raises the requirement, banks have less money to lend out. This can slow down the economy.

Using Open Market Operations

The Fed can buy or sell government bonds. These are like certificates representing money the government has borrowed. This helps to increase or decrease the amount of money in the economy. When the Fed buys bonds, it puts more money into the economy. When the Fed sells bonds, it takes money out of the economy.

Who runs the Fed?

The Federal Reserve is run by a group of people. They are called the Board of Governors. There are seven members on the Board. They are chosen by the President of the United States. Then, the Senate must approve them.

The current chairman of the Federal Reserve is Jerome Powell. He helps to make important decisions about the economy. He works to keep it healthy.

Federal Reserve System Structure

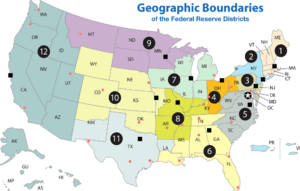

The Federal Reserve System isn't just one big bank in Washington, D.C. It's made up of 12 regional Federal Reserve Banks. These banks are located around the country.

These regional banks work together with the Board of Governors. They make sure the whole country's economy is doing well. Each of the 12 Federal Reserve Banks offers economic education programs for teachers. Some banks offer programs for students. Many have exhibits or museums that school groups can visit.

The Fed and Your Economy

The Federal Reserve plays a very important role in the economy. It helps to keep prices stable. It also helps create jobs and keep the banking system safe. By using its tools wisely, the Fed can help the economy grow. It works to make sure that everyone has a chance to succeed.

Fun Facts About the Federal Reserve

- The Federal Reserve was created in 1913. That's more than 100 years ago!

- The Fed has a special building in Washington, D.C. It's called the Marriner S. Eccles Federal Reserve Board Building.

- The Fed is responsible for making sure there are enough dollar bills and coins in circulation.

- The Fed works with other central banks around the world. This helps to keep the global economy stable.

Images for kids

-

Ben Bernanke (lower-right), Former Chairman of the Federal Reserve Board of Governors, at a House Financial Services Committee hearing on February 10, 2009.

See also

In Spanish: Sistema de la Reserva Federal para niños

In Spanish: Sistema de la Reserva Federal para niños

| Claudette Colvin |

| Myrlie Evers-Williams |

| Alberta Odell Jones |