Jerome Powell facts for kids

Quick facts for kids

Jerome Powell

|

|

|---|---|

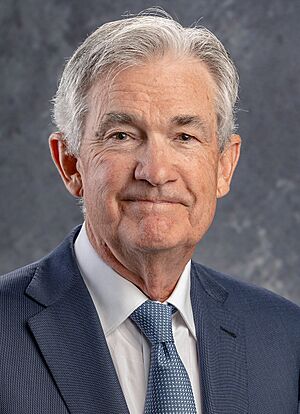

Official portrait, 2022

|

|

| 16th Chair of the Federal Reserve | |

| Assumed office February 5, 2018 |

|

| President | Donald Trump Joe Biden Donald Trump |

| Deputy | Richard Clarida Lael Brainard Philip Jefferson |

| Preceded by | Janet Yellen |

| Member of the Federal Reserve Board of Governors | |

| Assumed office May 25, 2012 |

|

| Nominated by | Barack Obama |

| Preceded by | Frederic Mishkin |

| Under Secretary of the Treasury for Domestic Finance | |

| In office April 7, 1992 – January 20, 1993 |

|

| President | George H. W. Bush |

| Preceded by | Robert R. Glauber |

| Succeeded by | Frank N. Newman |

| Assistant Secretary of the Treasury for Financial Institutions | |

| In office 1990 – April 7, 1992 |

|

| President | George H. W. Bush |

| Preceded by | David W. Mullins Jr. |

| Succeeded by | John Cunningham Dugan |

| Personal details | |

| Born |

Jerome Hayden Powell

February 4, 1953 Washington, D.C., U.S. |

| Political party | Republican |

| Spouse |

Elissa Leonard

(m. 1985) |

| Children | 3 |

| Education | Princeton University (BA) Georgetown University (JD) |

| Signature | |

Jerome Hayden "Jay" Powell (born February 4, 1953) is an American lawyer and investment banker. He has been the 16th Chair of the Federal Reserve since 2018. The Federal Reserve is like the central bank of the United States. It helps manage the country's money and economy.

Powell grew up in Washington, D.C.. He studied at Princeton University and then at Georgetown University Law Center. After working as a lawyer, he moved into investment banking in the 1980s. He worked for several financial companies, including the Carlyle Group. In 1992, he worked for the U.S. Treasury under President George H. W. Bush.

Later, President Barack Obama chose Powell to be a member of the Federal Reserve Board of Governors in 2012. He was then chosen by President Donald Trump to lead the Federal Reserve in 2018. President Joe Biden nominated him for a second term, which he began in 2022. Powell is known for trying to find common ground and solve problems.

Powell received both praise and criticism for how the Federal Reserve handled the economy during the COVID-19 pandemic in 2020. The Fed took strong actions to help the economy. Some people worried these actions could lead to higher prices and more differences in wealth. Powell said his main goal was to keep prices stable and help people find jobs.

Early Life and Education

Jerome Powell was born on February 4, 1953, in Washington, D.C. His father, Jerome Powell Sr., was a lawyer. Jerome has five siblings.

He went to Georgetown Preparatory School and finished in 1971. He then studied political science at Princeton University, graduating in 1975. After working for a U.S. Senator, Powell went to Georgetown University Law Center. He became the editor of the Georgetown Law Journal and earned his law degree in 1979.

Career Highlights

Early Legal and Finance Work

After law school, Powell worked as a law clerk for a judge in New York City. He then worked at law firms.

From 1984 to 1990, Powell worked at an investment bank called Dillon, Read & Co.. He focused on helping companies get money and buy other companies. He became a vice president there.

Between 1990 and 1993, Powell worked for the United States Department of the Treasury. He became the Under Secretary of the Treasury for Domestic Finance in 1992. In this role, he helped oversee important financial matters for the country.

Later, Powell worked for Bankers Trust and then returned to Dillon, Read & Co. From 1997 to 2005, he was a partner at The Carlyle Group, a large investment firm. After that, he started his own investment company, Severn Capital Partners. He also worked for a firm that invested in sustainable energy.

From 2010 to 2012, Powell was a visiting scholar at the Bipartisan Policy Center. This is a group that studies public policy. He worked on issues like the United States debt ceiling, which is the limit on how much money the U.S. government can borrow. He helped explain what could happen to the economy if the debt limit was not raised. He worked for a salary of only $1 per year.

Joining the Federal Reserve

In December 2011, President Barack Obama chose Powell to join the Federal Reserve Board of Governors. This board helps guide the Federal Reserve's actions. Powell started his role on May 25, 2012. In 2014, he was confirmed by the United States Senate for a 14-year term.

Powell was careful about a program called quantitative easing (QE3), which involved the Fed buying bonds to help the economy. However, he eventually voted for it. He also supported rules to prevent very large banks from failing, which could harm the entire financial system.

Leading the Federal Reserve

On November 2, 2017, President Donald Trump nominated Powell to become the chairman of the Federal Reserve. This is the most important job at the central bank. The Senate approved his nomination, and he became chairman on February 5, 2018.

First Term as Chair (2018–2021)

One of Powell's first actions was to raise interest rates in the U.S. This was done because the U.S. economy was getting stronger. He also planned to reduce the Fed's large collection of assets, a process called quantitative tightening. This meant the Fed would hold fewer bonds.

President Trump publicly disagreed with Powell's decisions to raise rates. Markets became unstable in late 2018. Powell stopped the quantitative tightening in early 2019, and asset prices began to recover. As a trade war with China grew, Trump continued to criticize Powell.

In October 2019, Powell announced the Fed would start expanding its balance sheet again. This helped global markets. Powell said this was not the same as earlier quantitative easing. The Fed used short-term loans called "repos" to add money to the banking system.

Responding to the COVID-19 Pandemic

In early 2020, Powell led the Fed in taking many actions to help the economy during the COVID-19 pandemic. The Fed greatly increased its support and even bought corporate bonds directly. Powell stressed that the Fed's actions alone were not enough; Congress also needed to provide financial help. His actions were praised by both political parties.

In November 2020, Powell agreed to return unused crisis funds to the U.S. Treasury. He and Treasury Secretary Steve Mnuchin both asked Congress for more economic support.

Concerns About Asset Prices

To help the economy during the pandemic, Powell accepted that the Fed's policies might cause asset prices (like stocks and housing) to go up a lot. Some people criticized this, saying it led to very high valuations, similar to past economic bubbles.

The rise in asset prices also led to greater wealth inequality. This meant wealthier people, who owned more assets, benefited more from the Fed's actions. Some worried this could cause social problems.

Powell defended the Fed's actions. He said he did not think there was a strong link between the Fed buying assets and financial stability. He also said he was not worried about creating asset bubbles. However, some investors and experts warned about a "speculative bubble" forming.

By the end of 2020, the Fed's policies had created very easy financial conditions. This led to rising prices in many asset classes, including stocks, housing, and even Cryptocurrencies.

Second Term as Chair (2021–Present)

In April 2021, Powell said he was not concerned about a new housing bubble like the one before the Great Recession. He stated that loans were not bad and prices were not unsustainable.

In August 2021, Powell expected the Fed to reduce its economic support later that year. He had previously called inflation "transitory," meaning temporary, but later said that term should be "retired." By December, he indicated the Fed would speed up reducing its asset purchases due to high inflation. In early 2022, he described inflation as a "severe threat" to the U.S. economy.

To fight high inflation, the Federal Reserve began raising interest rates in March 2022. They raised rates several more times through July 2023. The U.S. consumer price index (CPI), a measure of inflation, reached its peak in July 2022.

As his first term ended in February 2022, some politicians opposed Powell's reappointment. However, President Joe Biden nominated him for a second term on November 22, 2021. The Senate confirmed his nomination on May 12, 2022, with a large majority vote. He began his second term as chair on May 23, 2022.

Second Trump Administration (2025–Present)

President Trump has continued to express his disapproval of the Fed keeping interest rates higher. Powell has stated that a sitting Fed Chair cannot be removed without a legal reason. In April 2025, Trump posted on social media that Powell's "termination cannot come fast enough!" Legal experts agree that a Fed Chair can only be removed for cause. Trump has continued to discuss the possibility of firing Powell.

Personal Life

Powell married Elissa Leonard in 1985. They have three children and live in Chevy Chase Village, Maryland. Elissa is involved in local community leadership.

As of 2019, Powell's wealth was estimated to be between $20 million and $55 million. He has served on the boards of several charities and educational groups. These include DC Prep, a public charter school, and The Nature Conservancy. He also helped start the Center City Consortium, a group of schools in poorer areas of Washington, D.C.

Powell is a registered Republican. He is also a longtime fan of the American rock band the Grateful Dead.

See also

In Spanish: Jerome Powell para niños

In Spanish: Jerome Powell para niños

- 2020 stock market crash

- COVID-19 recession

- Financial market impact of the COVID-19 pandemic