Janet Yellen facts for kids

Quick facts for kids

Janet Yellen

|

|

|---|---|

Official portrait, 2021

|

|

| 78th United States Secretary of the Treasury | |

| In office January 26, 2021 – January 20, 2025 |

|

| President | Joe Biden |

| Deputy | Wally Adeyemo |

| Preceded by | Steven Mnuchin |

| Succeeded by | Scott Bessent |

| 15th Chair of the Federal Reserve | |

| In office February 3, 2014 – February 3, 2018 |

|

| President | Barack Obama Donald Trump |

| Deputy | Stanley Fischer |

| Preceded by | Ben Bernanke |

| Succeeded by | Jerome Powell |

| 19th Vice Chair of the Federal Reserve | |

| In office October 4, 2010 – February 3, 2014 |

|

| President | Barack Obama |

| Preceded by | Donald Kohn |

| Succeeded by | Stanley Fischer |

| Member of the Federal Reserve Board of Governors | |

| In office October 4, 2010 – February 3, 2018 |

|

| President | Barack Obama Donald Trump |

| Preceded by | Mark W. Olson |

| Succeeded by | Lisa D. Cook |

| In office August 12, 1994 – February 17, 1997 |

|

| President | Bill Clinton |

| Preceded by | Wayne Angell |

| Succeeded by | Edward Gramlich |

| 11th President of the Federal Reserve Bank of San Francisco | |

| In office June 14, 2004 – October 4, 2010 |

|

| Preceded by | Robert T. Parry |

| Succeeded by | John Williams |

| 18th Chair of the Council of Economic Advisers | |

| In office February 18, 1997 – August 3, 1999 |

|

| President | Bill Clinton |

| Preceded by | Joseph Stiglitz |

| Succeeded by | Martin Neil Baily |

| Personal details | |

| Born |

Janet Louise Yellen

August 13, 1946 New York City, New York, U.S. |

| Political party | Democratic |

| Spouse | |

| Children | 1 |

| Education | Brown University (BA) Yale University (MA, PhD) |

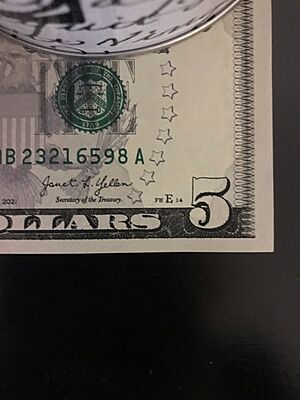

| Signature | |

| Scientific career | |

| Fields | Macroeconomics Labor economics New Keynesian economics |

| Institutions |

|

| Thesis | Employment, Output and Capital Accumulation in an Open Economy: A Disequilibrium Approach (1971) |

| Doctoral advisor | James Tobin |

| Other academic advisors | Joseph Stiglitz |

| Doctoral students | Charles Engel |

| Academic career | |

| Information at IDEAS / RePEc | |

Janet Louise Yellen (born August 13, 1946) is a famous American economist. She served as the 78th United States secretary of the treasury from 2021 to 2025. Before that, she was the chair of the Federal Reserve from 2014 to 2018.

Janet Yellen made history as the first woman to hold both of these very important jobs. She also led the White House Council of Economic Advisers. She is known for her work in economics and has taught at the University of California, Berkeley.

Yellen grew up in Bay Ridge, Brooklyn, New York City. She studied at Brown University and earned her PhD in economics from Yale University. She taught at Harvard University and the London School of Economics. Later, she became a professor at the University of California, Berkeley.

She held several key roles in the Federal Reserve, which is like the central bank of the U.S. She was a member of its Board of Governors and later led the Federal Reserve Bank of San Francisco. President Barack Obama chose her to be the Vice Chair, and then the Chair, of the Federal Reserve.

After leaving the Federal Reserve, she joined the Brookings Institution, a research group. In 2020, President Joe Biden nominated her to be the Secretary of the Treasury. She was confirmed in January 2021, becoming the first woman to hold that position.

Contents

Early Life and Education

Janet Yellen was born on August 13, 1946, in Bay Ridge, Brooklyn, New York City. Her family came from Poland. Her mother, Anna Ruth, was a teacher, and her father, Julius, was a doctor. Janet also has an older brother, John.

Yellen attended Fort Hamilton High School. She was a top student and the editor-in-chief of the school newspaper. She won several scholarships and graduated as the best student in her class in 1963.

She went to Brown University, where she first planned to study philosophy. She soon switched to economics and was greatly influenced by her professors. She graduated with honors in economics in 1967. She then earned her master's and PhD in economics from Yale University in 1971. Her PhD paper was about employment and how economies work. Her professors at Yale, including James Tobin and Joseph Stiglitz, praised her as a brilliant student.

Academic Career

After getting her PhD, Yellen became an assistant professor at Harvard University from 1971 to 1976. She was one of only two female professors in Harvard's economics department at that time.

In 1977, she joined the Federal Reserve Board as an economist. There, she met her future husband, economist George Akerlof. They married in 1978.

Yellen and her husband moved to the United Kingdom, where she taught at the London School of Economics. In 1980, they returned to the U.S., and Yellen joined the University of California, Berkeley. She taught business and economics there for over two decades. She was recognized for her excellent teaching and became a full professor in 1985.

From 1994 to 1999, Yellen took a break from teaching to work in public service. She later returned to Berkeley. In 2004, she became the president of the Federal Reserve Bank of San Francisco. She was named a professor emeritus at UC Berkeley in 2006.

Throughout her career, Yellen also advised groups like the Congressional Budget Office and the National Science Foundation. She also worked as a researcher at the National Bureau of Economic Research.

Economic Ideas

Janet Yellen's research often focused on unemployment, job markets, and how governments use money and taxes to manage the economy. She often worked with her husband, George Akerlof.

One of their ideas was the "efficiency wage theory." This idea suggests that paying workers more than the usual market wage can actually make them more productive. They also explored why people might work less hard if they feel they are not paid fairly.

Federal Reserve and Government Roles

Federal Reserve Board Member (1994–1997)

In 1994, President Bill Clinton nominated Janet Yellen to be a member of the Federal Reserve Board of Governors. She was praised as a leading economist. The Senate approved her nomination, and she became the fourth woman to serve on the Board.

While at the Fed, she helped convince Chairman Alan Greenspan that a small amount of inflation (around 2 percent) was better for the economy than trying to have zero inflation. She believed this would help reduce unemployment and boost economic growth.

Council of Economic Advisers (1997–1999)

In 1996, President Clinton asked Yellen to lead his Council of Economic Advisers (CEA). This group advises the President on economic matters. She was the second woman to hold this important role.

During her time at the CEA, Yellen oversaw a report about the difference in pay between men and women. The study found that even though the pay gap had shrunk, there was still a difference that couldn't be explained by productivity. This suggested that discrimination played a role.

In 1999, Yellen decided to leave the CEA and return to teaching at UC Berkeley.

Return to the Federal Reserve (2004–2018)

Federal Reserve Bank of San Francisco

In 2004, Yellen became the president and CEO of the Federal Reserve Bank of San Francisco. She was the first woman to lead this regional Fed bank. While there, she was part of the Federal Open Market Committee (FOMC), which sets the nation's money policies.

She warned about banks taking on too many risky loans, especially in housing. She also suggested that the Federal Reserve might need to raise interest rates earlier to prevent new housing bubbles.

Vice Chair of the Federal Reserve

In 2010, President Barack Obama nominated Yellen to be the Vice Chair of the Federal Reserve. The Senate confirmed her, making her the second woman to hold this high position.

As Vice Chair, Yellen played a key role in pushing the Federal Reserve to set a clear inflation target of two percent per year. She believed that the Fed should take strong actions to help the economy and reduce unemployment.

She was widely seen as the top choice to become the next Chair of the Federal Reserve. Many economists and senators supported her.

Chair of the Federal Reserve

On October 9, 2013, Janet Yellen was officially nominated to replace Ben Bernanke as chair of the Federal Reserve. President Obama called her "one of the nation's foremost economists."

On January 6, 2014, the U.S. Senate confirmed her. She became the first woman to lead the U.S. central bank. She preferred the gender-neutral title "chair."

Under her leadership, the Federal Reserve raised its key interest rate for the first time since 2006. This was done to prevent financial instability. She also strongly defended the Dodd–Frank Wall Street Reform and Consumer Protection Act, a law designed to prevent another financial crisis.

In 2017, President Donald Trump chose Jerome Powell to succeed her as Fed Chair. Yellen resigned from the Federal Reserve Board in February 2018. During her time as Chair, the unemployment rate in the U.S. dropped significantly, reaching its lowest point in 17 years.

After the Federal Reserve (2018–2020)

After leaving the Federal Reserve, Yellen joined the Brookings Institution, a research organization. She provided her expertise on economic issues and commented on various topics.

In 2018, she warned about "gigantic holes in the system" that could lead to another financial crisis. In 2019, she expressed concerns about President Trump's understanding of economic policy and his views on the central bank's independence.

In 2020, during the coronavirus pandemic, Yellen urged lawmakers to provide more financial help to people and states. She also advised then-presidential candidate Joe Biden on economic matters.

Secretary of the Treasury (2021–2025)

Nomination and Confirmation

In November 2020, President-elect Joe Biden announced he would nominate Janet Yellen as United States Secretary of the Treasury. Biden praised her as a leading economic thinker.

The Senate confirmed her nomination on January 25, 2021. The next day, she was sworn in by Vice President Kamala Harris. This made Yellen the first female Secretary of the Treasury. She also became the first person in U.S. history to lead the three most powerful economic bodies: the Treasury Department, the Federal Reserve, and the White House Council of Economic Advisers.

Tenure

International Tax Reform

In 2021, Yellen proposed a global minimum corporate tax rate. This idea aimed to stop large companies from avoiding taxes by moving their profits to countries with lower tax rates.

In June 2021, finance ministers from the G7 countries agreed to a minimum corporate tax rate of at least 15%. This was a big step towards modernizing the international tax system. Later, over 130 countries agreed to this plan, which was expected to increase tax revenues worldwide.

Debt Ceiling Crisis

Yellen repeatedly urged Congress to raise or suspend the United States debt ceiling. This limit controls how much money the U.S. government can borrow. She warned that not raising it could cause "irreparable harm" to the U.S. economy and lead to a financial crisis.

In June 2023, President Biden signed a law that suspended the debt limit. This agreement between the White House and Congress ended the debt-ceiling crisis.

Sanctions Against Russia

In 2021, Yellen and her team worked on a plan to put economic pressure on Russia. After Russia invaded Ukraine in February 2022, the Treasury Department worked with other countries to impose strong international sanctions.

Yellen was a strong supporter of putting a price cap on Russian oil. This plan aimed to reduce Russia's funding for the war while keeping global oil supplies stable. In December 2022, many countries agreed to cap the price of Russian oil at $60 per barrel.

Digital Assets Regulation

In April 2022, Yellen spoke about the growing impact of digital assets, like cryptocurrencies, on the U.S. economy. She emphasized that new technologies should be used responsibly. She also mentioned that the government was looking into creating a central bank digital currency (CBDC), or a "digital dollar."

Friendshoring of Supply Chains

In April 2022, Yellen suggested a "friendshoring" strategy for supply chains. This means limiting supply networks to countries that are allies and partners. She argued this would reduce risks from relying on goods from countries with authoritarian governments, like Russia or China.

She also highlighted that friendshoring could help protect against geopolitical risks and ensure that goods are not made using forced labor.

Internal Revenue Service Reforms

After the Inflation Reduction Act was passed in August 2022, Yellen directed the Internal Revenue Service (IRS) to use new funding to improve taxpayer services, update technology, and hire more employees. This was aimed at clearing backlogs and making the IRS more efficient.

Visit to Ukraine

In February 2023, Yellen made a surprise visit to Kyiv, Ukraine. She confirmed that the U.S. would continue to provide economic support to Ukraine in its fight against Russia. She met with Ukrainian President Volodymyr Zelenskyy and discussed financial aid for schools, hospitals, and emergency services.

She wrote that the U.S. must help Ukraine avoid losing the war for economic reasons.

Banking Crisis

In March 2023, during a banking crisis, Yellen assured the public that financial regulators were closely monitoring the banking system. After the collapse of Silicon Valley Bank, she approved actions to protect all depositors, even those with very large accounts. These steps were taken to maintain confidence in the U.S. banking system and prevent a wider bank run.

She stated that these actions were necessary to protect the entire U.S. banking system, not just specific banks.

Economic Approach to China

In April 2023, Yellen outlined the Biden administration's economic goals for China. These included protecting U.S. national security, seeking fair economic competition, and working together on global challenges like climate change. She emphasized that national security would always come first.

From July 6–9, 2023, Yellen visited China. It was the first trip by a U.S. Treasury Secretary to China in four years. She met with Chinese economic leaders to reopen communication and find common ground. She stressed that U.S. restrictions on Chinese investment were specific and not meant to harm China's overall economy. She also raised concerns about China's treatment of foreign companies.

Yellen described her visit as a success in improving communication and putting U.S.-China ties on a "surer footing." She stated that the U.S. is not trying to separate its economy from China's, but wants fair competition and cooperation on global issues.

Economic Philosophy

Janet Yellen is often seen as a "dove" on monetary policy. This means she is more concerned about unemployment than inflation. She generally prefers lower interest rates to help the economy grow and create jobs. She also supports strong financial regulation to prevent risks in the financial system.

On fiscal policy (government spending and taxes), she has expressed concerns about the national debt. She has suggested raising taxes and making changes to programs like Medicare and Social Security to control spending. She also supports removing the debt ceiling, calling it "very destructive."

Yellen is a Keynesian economist. This type of economics believes that governments can use policies to fix problems in markets and help the economy. She believes the government has a duty to help reduce poverty and inequality.

Honors and Awards

Janet Yellen has received many awards and honors for her work in economics and public service.

Academic Honors

She has been a fellow at the John Simon Guggenheim Memorial Foundation and a president of the Western Economic Association International. She was also president of the American Economic Association from 2020 to 2021.

Honorary Degrees

Yellen has received honorary degrees from many universities, including Brown University, New York University, London School of Economics, and Yale University.

Memberships and Fellowships

She is a member of the American Academy of Arts and Sciences and the Council on Foreign Relations. She is also a senior member of the Group of Thirty, an international group of financial leaders.

Awards

Some of her awards include the Wilbur Cross Medal from Yale Graduate School, the Adam Smith Award from the National Association for Business Economics, and the Radcliffe Medal. In 2023, she received The Paul A. Volcker Lifetime Achievement Award for Economic Policy.

Other Recognition

- In 2018, Yale School of Management created The Janet L. Yellen Chair in her honor.

- The Federal Reserve Board also created the Janet L. Yellen Award for Excellence in Community Development to recognize public service.

- Time magazine has named her one of the 100 most influential people in the world four times (2014, 2015, 2017, and 2023).

- Forbes magazine has ranked her among the world's most powerful women and most powerful people.

Personal Life

Yellen is married to George Akerlof, who is also a Nobel Prize-winning economist. They met in 1977 and married in 1978. Their son, Robert Akerlof, is also an economist and teaches at the University of Warwick.

Janet Yellen and George Akerlof have often worked together on research, including topics like poverty and unemployment. Yellen says her husband has been her biggest intellectual influence.

She has an estimated net worth of $20 million, earned from her various government and academic roles. When she became Treasury Secretary, she sold her shares in many companies to avoid conflicts of interest.

Images for kids

See also

In Spanish: Janet Yellen para niños

In Spanish: Janet Yellen para niños

| Aurelia Browder |

| Nannie Helen Burroughs |

| Michelle Alexander |