Monetary policy facts for kids

Monetary policy is how a country's main bank, often called a central bank, manages the money supply and interest rates. Their main goal is to keep prices stable and make sure people trust the country's money.

This policy also aims to help the economy grow steadily, keep unemployment low, and make exchange rates predictable. Think of it as the central bank's way of steering the country's economic ship.

Contents

What is Monetary Policy?

Monetary policy is a set of actions taken by a country's monetary authority (usually its central bank). These actions control either the amount of money in circulation or the cost of borrowing money. The central bank can change how much money banks have to lend. They can also change the interest rate that banks pay to borrow from them.

Who Makes These Decisions?

In many countries, a special group within the central bank makes these important decisions. For example, in the United States, the Federal Open Market Committee (FOMC) decides on monetary policy. These groups meet regularly to discuss the economy. They then decide what steps to take.

Why Do We Need Monetary Policy?

Monetary policy has several important goals. These goals help keep a country's economy healthy and strong.

Keeping Prices Steady

One of the most important goals is to keep price stability. This means making sure that prices for goods and services do not go up too quickly. When prices rise too fast, it's called inflation. Inflation makes your money buy less than it used to. The central bank tries to control inflation so that your money keeps its value.

Helping the Economy Grow

Monetary policy also tries to help the gross domestic product (GDP) grow steadily. GDP is the total value of everything a country produces. When the economy grows, there are more jobs and more opportunities for everyone. The central bank tries to find a balance. They want growth without causing too much inflation.

Keeping People Employed

Another key goal is to achieve and keep low unemployment. This means making sure that most people who want a job can find one. When the economy is doing well, businesses hire more people. Monetary policy can help create conditions where businesses feel confident to expand and hire.

Stable Exchange Rates

Monetary policy also aims for predictable exchange rates. An exchange rate tells you how much one country's money is worth compared to another's. Stable exchange rates help businesses that trade with other countries. They make it easier to plan and do business internationally.

How Does it Work?

Central banks use different tools to achieve their goals. The two main tools are controlling interest rates and managing the money supply.

Controlling Interest Rates

The central bank can set a special interest rate for banks. This is the rate at which banks can borrow money from the central bank. When this rate goes up, it usually means other interest rates in the economy also go up. This makes it more expensive for people and businesses to borrow money. When borrowing is expensive, people might spend less. This can help slow down inflation. If the central bank lowers this rate, borrowing becomes cheaper. This can encourage spending and help the economy grow.

Managing the Money Supply

The central bank can also control how much money is available in the economy. They can buy or sell government bonds. When they buy bonds, they put more money into the economy. When they sell bonds, they take money out. More money in circulation can make borrowing cheaper and encourage spending. Less money can make borrowing more expensive and slow down spending.

History of Monetary Policy

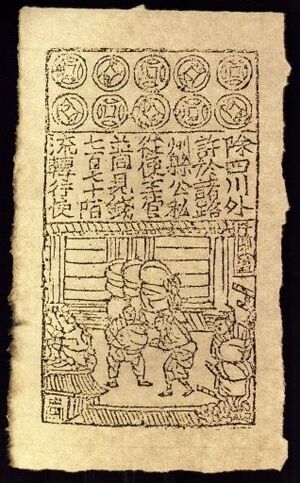

The idea of a central bank managing a country's money is quite old. Many countries have had central banks for hundreds of years. These banks have evolved over time. They started by simply printing money and managing government finances. Now, they play a much bigger role in guiding the economy.

In the past, some countries used a gold standard. This meant their money was directly linked to a certain amount of gold. Today, most countries use "fiat money." This means the money's value comes from government trust and policy, not from a physical commodity like gold.

Images for kids

-

Clockwise from top-left: Federal Reserve, Bank of England, European Central Bank, Bank of Canada

-

Banknotes with a face value of 5000 in different currencies. (United States dollar, Central African CFA franc, Japanese yen, Italian lira, and French franc)

-

The Bank of Japan, in Tokyo, established in 1882.

-

The Bank of Finland, in Helsinki, established in 1812.

-

The headquarters of the Bank for International Settlements, in Basel (Switzerland).

-

The Reserve Bank of India (established in 1935) Headquarters in Mumbai.

-

The Central Bank of Brazil (established in 1964) in Brasília.

-

The Bank of Spain (established in 1782) in Madrid.

See also

In Spanish: Política monetaria para niños

In Spanish: Política monetaria para niños