Bank of Japan facts for kids

|

|

|

|

| Headquarters | Chūō, Tokyo, Japan |

|---|---|

| Coordinates | 35°41′10″N 139°46′17″E / 35.6861°N 139.7715°E |

| Established | 27 June/10 October 1882 |

| Ownership | At least 55% of all capital must be owned by the Government of Japan |

| Governor | Kazuo Ueda (9 April 2023 – present) |

| Central bank of | |

| Currency | Yen JPY (ISO 4217) |

| Reserves | US$1.12 trillion (October 2023) |

| Bank rate | +0.50% |

The Bank of Japan (日本銀行, Nippon Ginkō, BOJ) is Japan's central bank. Think of it as the "bank for banks" in Japan. Its main job is to keep Japan's money system stable. People often call it Nichigin (日銀) for short. Its main office is in Nihonbashi, Chūō, Tokyo.

The BOJ works independently from the Japanese government. This independence helps it make decisions about money that are best for the country in the long run. It focuses on keeping prices stable and the economy healthy.

Contents

History of the Bank of Japan

How the Bank Started

The Bank of Japan was created after the Meiji Restoration. Before this, different parts of Japan used their own money. In 1871, the yen became Japan's new official money. At first, many private banks could print money. But soon, the Bank of Japan became the only one allowed to do this.

Building the Bank

Matsukata Masayoshi, a finance minister, suggested creating the Bank of Japan in 1882. It officially opened on October 10, 1882. The idea for the bank came from the National Bank of Belgium. The Bank of Japan is partly owned by private investors, but the government owns most of it.

In 1885, the Bank of Japan printed its first banknotes. Japan joined the gold standard in 1897. This meant that the value of the yen was linked to gold. By 1899, the old banknotes from other banks were no longer used.

In the early 1900s, the Bank of Japan worked closely with the government. Its leader was seen as a very important person in Japan's business world.

World War II and Beyond

The Bank of Japan was reorganized in 1942 during World War II. After the war, its operations were briefly paused. It was restructured again in 1949.

In the 1970s, Japan's economy changed a lot. It became more open to the world. The Bank of Japan also changed how it managed money. For many years, the BOJ used a method called 'window guidance'. This meant it set limits on how much commercial banks could lend. This method played a role in the "bubble economy" of the 1980s.

In 1997, a new law gave the Bank of Japan more independence. This meant it could make decisions without as much government influence. The law said the bank should work closely with the government, but still be independent.

Economic Ups and Downs

In 1971, the "Nixon shock" happened. This caused inflation in Japan. The BOJ tried to control it by raising interest rates. In 1979, during an energy crisis, the BOJ quickly raised interest rates again. This helped Japan's economy recover fast.

In 1985, the Plaza Accord made the Japanese yen much stronger against the US dollar. To prevent the economy from slowing down, the BOJ lowered interest rates. This, along with other policies, led to a "bubble" in real estate and investments.

After 1990, the bubble burst, and stock and property markets fell. The BOJ worked to fix this. In 1995, after the Great Hanshin earthquake, the yen became very strong. The BOJ lowered interest rates to 0.5% to help. This period marked the start of deflation (when prices generally fall).

In 1999, the BOJ started a zero-interest-rate policy (ZIRP). This meant borrowing money was very cheap. They ended it briefly but restarted a similar policy in 2001. During the 2008 financial crisis, the BOJ lowered interest rates again and bought government bonds to support the economy.

In 2013, the BOJ started a new program called quantitative easing (QE). This involved buying many different types of assets, including stocks. In 2016, they introduced yield curve control (YCC) and a negative interest rate policy (NIRP). This meant banks had to pay to keep money at the BOJ. In 2024, the BOJ ended its negative interest rate policy.

Fighting Deflation

After Shinzō Abe became Prime Minister in 2012, the Bank of Japan took strong steps to fight deflation. Deflation means prices keep falling, which can hurt the economy. The BOJ aimed to double Japan's money supply in two years by buying lots of securities and bonds. However, by 2016, it was clear that more work was needed to achieve stable prices.

How the Bank Works

Main Goals

The Bank of Japan has two main goals:

- Price Stability: This means keeping prices from rising or falling too much. The BOJ aims for a 2% inflation target. Inflation is when prices go up over time. Japan has struggled with deflation (falling prices) for a long time.

- Financial System Stability: This means making sure the system for handling money (like banks and payments) works smoothly. People need to trust the system.

The BOJ's policies are decided at Monetary Policy Meetings (MPM). These meetings happen every other month.

What the Bank Does

The Bank of Japan has several important jobs:

- Issuing Banknotes: It is the only organization in Japan that can print and manage Japanese yen banknotes.

- Setting Monetary Policy: It adjusts the amount of money in circulation to keep prices stable. It does this by changing interest rates and other financial tools.

- Bank for Banks: It helps financial institutions make transactions. Banks have accounts with the BOJ, but regular people and businesses do not.

- Government's Bank: It handles money for the Japanese government, like collecting and paying out public funds.

- Lender of Last Resort: If a bank is in trouble, the BOJ can lend it money to prevent a financial crisis. This helps keep the financial system stable.

- International Relations: It works with other central banks around the world and helps manage Japan's foreign exchange.

- Research and Statistics: It collects information about the economy and publishes economic reports.

Money the Bank Holds

The Bank of Japan owns a large amount of Japanese public stocks. Since 2020, it has owned more domestic stocks than any other organization in Japan.

Headquarters

| Bank of Japan Headquarters | |

|---|---|

|

日本銀行本店

|

|

|

|

| General information | |

| Architectural style | Neoclassical |

| Town or city | Chuo, Tokyo |

| Country | Japan |

| Coordinates | 35°41′12.6″N 139°46′17.1″E / 35.686833°N 139.771417°E |

| Completed | 1896 |

| Owner | Bank of Japan |

| Technical details | |

| Floor count | 10 |

| Design and construction | |

| Architect | Tatsuno Kingo |

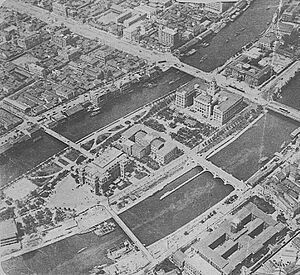

The Bank of Japan Headquarters (日本銀行本店, Nippon Ginkō Honten) is the main office of the BOJ. It is located in Nihonbashi, Chuo, Tokyo, Japan. The building is considered an important architectural site in Tokyo. It stands on the spot where a gold mint used to be. It is also near the famous Ginza district, which means "silver mint."

The main building was designed by Tatsuno Kingo in 1896. He was inspired by the Bank of England and the National Bank of Belgium's buildings. The building is in a style called neo-baroque. It became an Important Cultural Property in 1974. The new building, completed in 1973, has 10 floors above ground and 5 underground. The south annex building houses the Currency Museum of the Bank of Japan.

Branches

-

The Bank of Japan Otaru Museum in Otaru, Hokkaido

Leadership

| Governor of the Bank of Japan | |

|---|---|

| Style | His Excellency |

| Appointer | The Prime Minister |

| Term length | Five years |

| Inaugural holder | Yoshihara Shigetoshi |

| Formation | 6 October 1882 |

The governor of the Bank of Japan (総裁, sōsai) is a very important person. They have a lot of influence on Japan's economic policies.

List of Governors

| # | Governor | Took office | Left office | Previous jobs | Alma Mater |

|---|---|---|---|---|---|

| 1 | Yoshihara Shigetoshi | 6 October 1882 | 19 December 1887 | bureaucrat, diplomat | Yale University |

| 2 | Tomita Tetsunosuke | 21 February 1888 | 3 September 1889 | bureaucrat, diplomat | Whitney Business College, Newark |

| 3 | Kawada Koichiro | 3 September 1889 | 7 November 1896 | Senior member of Mitsubishi | |

| 4 | Iwasaki Yanosuke | 11 November 1896 | 20 October 1898 | Head of Mitsubishi | Edward Hall's Family School for Boys |

| 5 | Tatsuo Yamamoto | 20 October 1898 | 19 October 1903 | central banker | Mitsubishi School of Commerce |

| 6 | Shigeyoshi Matsuo | 20 October 1903 | 1 June 1911 | bureaucrat | |

| 7 | Korekiyo Takahashi | 1 June 1911 | 20 February 1913 | bureaucrat | Meiji Gakuin |

| 8 | Yatarō Mishima | 28 February 1913 | 7 March 1919 | banker | University of Massachusetts Amherst |

| 9 | Junnosuke Inoue (First) | 13 March 1919 | 2 September 1923 | central banker | University of Tokyo |

| 10 | Otohiko Ichiki | 5 September 1923 | 10 May 1927 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 11 | Junnosuke Inoue (Second) | 10 May 1927 | 12 June 1928 | ||

| 12 | Hisaakira Hijikata | 12 June 1928 | 4 June 1935 | central banker | University of Tokyo |

| 13 | Eigo Fukai | 4 June 1935 | 9 February 1937 | businessman

central banker |

Doshisha |

| 14 | Seihin Ikeda | 9 February 1937 | 27 July 1937 | Head of Mitsui | Keio Gijuku |

| 15 | Toyotaro Yuki | 27 July 1937 | 18 March 1944 | central banker | University of Tokyo |

| 16 | Keizo Shibusawa | 18 March 1944 | 9 October 1945 | banker | University of Tokyo |

| 17 | Eikichi Araki (First) | 9 October 1945 | 1 June 1946 | central banker | University of Tokyo |

| 18 | Hisato Ichimada | 1 June 1946 | 10 December 1954 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 19 | Eikichi Araki (Second) | 11 December 1954 | 30 November 1956 | ||

| 20 | Masamichi Yamagiwa | 30 November 1956 | 17 December 1964 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 21 | Makoto Usami | 17 December 1964 | 16 December 1969 | banker (Mitsubishi bank) | Keio University |

| 22 | Tadashi Sasaki | 17 December 1969 | 16 December 1974 | central banker | University of Tokyo |

| 23 | Teiichiro Morinaga | 17 December 1974 | 16 December 1979 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 24 | Haruo Maekawa | 17 December 1979 | 16 December 1984 | central banker | University of Tokyo |

| 25 | Satoshi Sumita | 17 December 1984 | 16 December 1989 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 26 | Yasushi Mieno | 17 December 1989 | 16 December 1994 | central banker | University of Tokyo |

| 27 | Yasuo Matsushita | 17 December 1994 | 20 March 1998 | bureaucrat

(Ministry of Finance) |

University of Tokyo |

| 28 | Masaru Hayami | 20 March 1998 | 19 March 2003 | central banker | Hitotsubashi University |

| 29 | Toshihiko Fukui | 20 March 2003 | 19 March 2008 | central banker | University of Tokyo |

| 30 | Masaaki Shirakawa | 9 April 2008 | 19 March 2013 | central banker | University of Tokyo (B.A.)

University of Chicago (M.A.) |

| 31 | Haruhiko Kuroda | 20 March 2013 | 9 April 2023 | bureaucrat

(Ministry of Finance) President of ADB |

University of Tokyo (B.A.)

University of Oxford (MPhil) |

| 32 | Kazuo Ueda | 9 April 2023 | Incumbent | Economist at the University of Tokyo | University of Tokyo (B.S., B.A.) |

Monetary Policy Board Members

As of April 9, 2023, nine people make up the board that sets the Bank of Japan's money policies:

- Kazuo Ueda, the Governor of the BOJ

- Uchida Shinichi, Deputy Governor

- Himino Ryozo, Deputy Governor

- Adachi Seiji

- Nakamura Toyoaki

- Noguchi Asahi

- Nakagawa Junko

- Takata Hajime

- Tamura Naoki

See also

In Spanish: Banco de Japón para niños

In Spanish: Banco de Japón para niños

- Japanese yen

- Economy of Japan

- National Printing Bureau

- Japan Mint

- List of central banks

| Misty Copeland |

| Raven Wilkinson |

| Debra Austin |

| Aesha Ash |